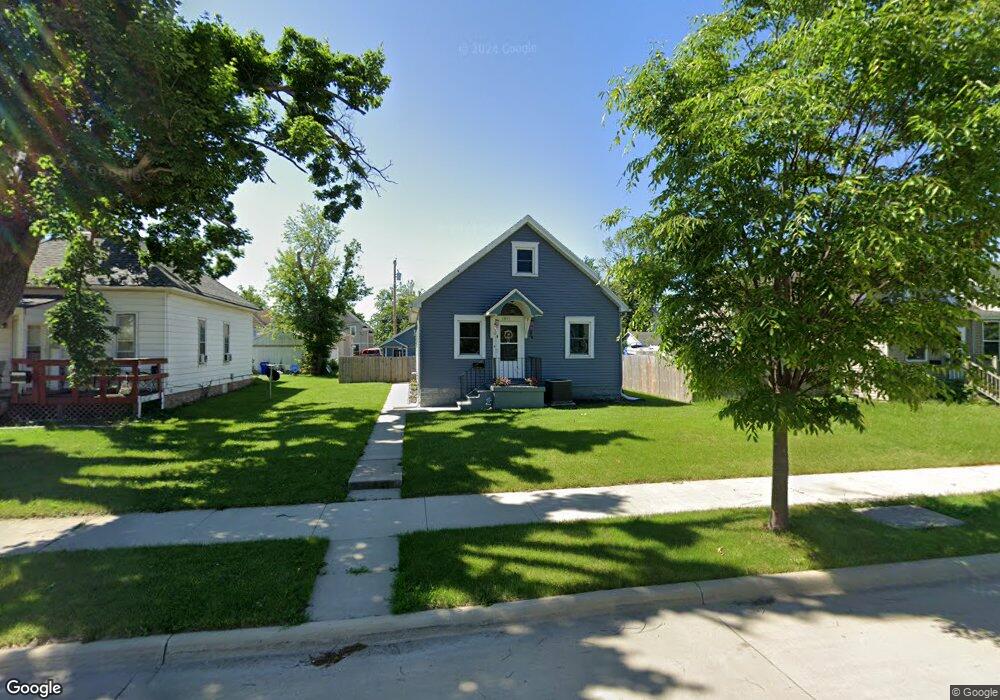

1011 E Ave NW Cedar Rapids, IA 52405

Northwest Area NeighborhoodEstimated Value: $144,000 - $159,000

2

Beds

2

Baths

1,106

Sq Ft

$138/Sq Ft

Est. Value

About This Home

This home is located at 1011 E Ave NW, Cedar Rapids, IA 52405 and is currently estimated at $152,648, approximately $138 per square foot. 1011 E Ave NW is a home located in Linn County with nearby schools including Junction City Elementary School, Harrison Elementary School, and Kentucky Tech - Ashland Reg Tech Center.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 29, 2006

Sold by

Schoner Tina R and Schoner Kevin T

Bought by

Stangland Marsha L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,290

Outstanding Balance

$41,033

Interest Rate

6.34%

Mortgage Type

FHA

Estimated Equity

$111,615

Purchase Details

Closed on

Jan 10, 2005

Sold by

Lathrop Minnie A and Cutler Carol S

Bought by

Schoner Tina R and Schoner Kevin T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$57,150

Interest Rate

5.83%

Mortgage Type

Credit Line Revolving

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stangland Marsha L | $72,500 | None Available | |

| Schoner Tina R | $63,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stangland Marsha L | $72,290 | |

| Previous Owner | Schoner Tina R | $57,150 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,074 | $145,300 | $33,800 | $111,500 |

| 2024 | $2,044 | $136,100 | $31,300 | $104,800 |

| 2023 | $2,044 | $127,700 | $27,500 | $100,200 |

| 2022 | $1,782 | $105,800 | $27,500 | $78,300 |

| 2021 | $1,890 | $95,000 | $27,500 | $67,500 |

| 2020 | $1,890 | $94,300 | $25,000 | $69,300 |

| 2019 | $1,660 | $85,500 | $20,000 | $65,500 |

Source: Public Records

Map

Nearby Homes

- 819 G Ave NW

- 816 9th St NW

- 716 F Ave NW

- 1073 G Ave NW

- 1016 H Ave NW

- 1128 B Ave NW

- 1413 Seminole Ave NW

- 1020 A Ave NW

- 319 5th St NW

- 1015 Pawnee Dr NW

- 1338 Hinkley Ave NW

- 718 4th St NW

- 1155 A Ave NW

- 1130 13th St NW

- 1311 Burch Ave NW

- 1118 2nd Ave SW

- 1238 Ellis Blvd NW

- 235 Highland Dr NW

- 820 M Ave NW

- 531 10th St SW