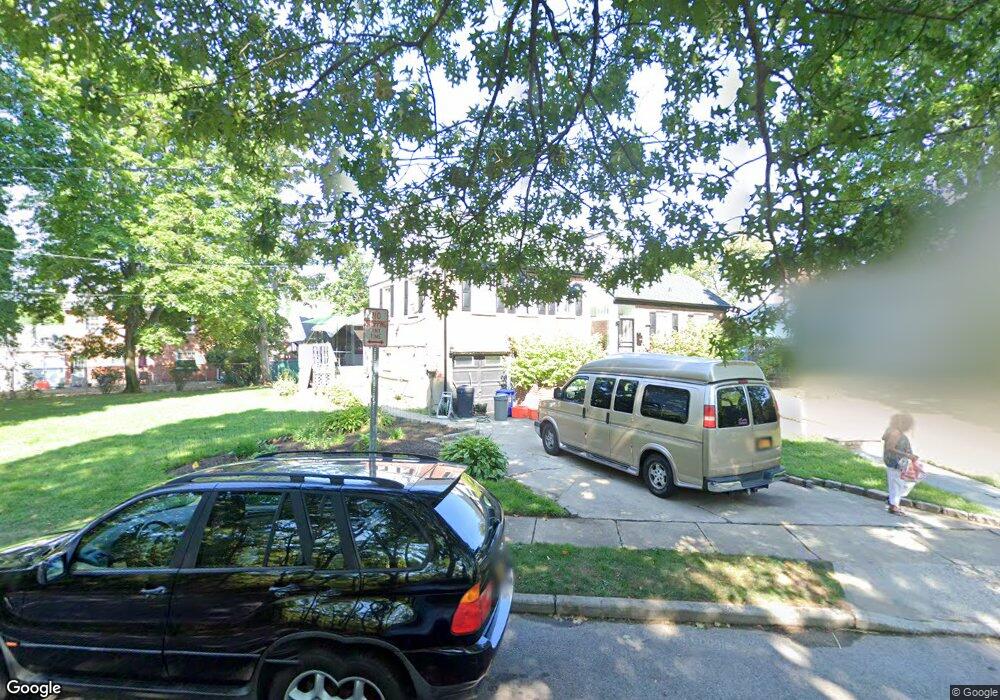

1014 Hillman St West Hempstead, NY 11552

Estimated Value: $712,000 - $728,990

--

Bed

2

Baths

1,458

Sq Ft

$494/Sq Ft

Est. Value

About This Home

This home is located at 1014 Hillman St, West Hempstead, NY 11552 and is currently estimated at $720,495, approximately $494 per square foot. 1014 Hillman St is a home located in Nassau County with nearby schools including Davison Avenue Intermediate School, Maurice W. Downing Primary K-2 School, and Howard T Herber Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 23, 2022

Sold by

Franklin Robert J and Franklin Robert

Bought by

Franklin Robert I and Franklin Annie Lee

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$508,750

Outstanding Balance

$492,418

Interest Rate

6.76%

Mortgage Type

FHA

Estimated Equity

$228,077

Purchase Details

Closed on

Jan 1, 2013

Sold by

Franklin Jr. Robert J

Bought by

Rjrm Enterprises Llc

Purchase Details

Closed on

Mar 21, 1997

Sold by

Alves John

Bought by

Franklin Robert

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Franklin Robert I | -- | All Counyt Abstract Inc | |

| Franklin Robert J | $39,500 | Judicial Title | |

| Franklin Robert J | $39,500 | Judicial Title | |

| Franklin Robert J | $39,500 | Judicial Title | |

| Rjrm Enterprises Llc | -- | -- | |

| Rjrm Enterprises Llc | -- | -- | |

| Rjrm Enterprises Llc | -- | -- | |

| Franklin Robert | $141,000 | -- | |

| Franklin Robert | $141,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Franklin Robert I | $508,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $14,162 | $474 | $210 | $264 |

| 2024 | $4,760 | $474 | $210 | $264 |

| 2023 | $13,552 | $474 | $210 | $264 |

| 2022 | $13,552 | $473 | $210 | $263 |

| 2021 | $18,192 | $447 | $198 | $249 |

| 2020 | $13,425 | $660 | $380 | $280 |

| 2019 | $13,163 | $660 | $380 | $280 |

| 2018 | $12,430 | $660 | $0 | $0 |

| 2017 | $7,375 | $660 | $380 | $280 |

| 2016 | $11,257 | $660 | $380 | $280 |

| 2015 | $3,633 | $660 | $380 | $280 |

| 2014 | $3,633 | $660 | $380 | $280 |

| 2013 | $3,421 | $660 | $380 | $280 |

Source: Public Records

Map

Nearby Homes

- 5 Juliette Rd

- 394 Pinebrook Ave

- 49 Carol St

- 312 Coventry Rd S

- 10 Pinebrook Ave

- 301 Coventry Rd N

- 1024 Mahopac Rd

- 1070 Mahopac Rd

- 461 Pinebrook Ave

- 55 Melvin Ave

- 486 Champlain Ave

- 7 Hopatcong Ave

- 841 Woodfield Rd

- 1095 Pinebrook Ct

- 1090 Pinebrook Ct

- 402 Clinton Ave

- 450 Rhodes Ln

- 0 Rhodes Ln

- 362 Langdon Blvd

- 1025 Ontario Rd