1016 West Rd Ashfield, MA 01330

Ashfield NeighborhoodEstimated Value: $414,000 - $563,000

3

Beds

2

Baths

2,246

Sq Ft

$217/Sq Ft

Est. Value

About This Home

This home is located at 1016 West Rd, Ashfield, MA 01330 and is currently estimated at $487,439, approximately $217 per square foot. 1016 West Rd is a home located in Franklin County with nearby schools including Mohawk Trail Regional High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 27, 2010

Sold by

Jekanowski Leonard C

Bought by

Moore Thomas F and Summers Mandi E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$30,000

Outstanding Balance

$19,914

Interest Rate

4.39%

Estimated Equity

$467,525

Purchase Details

Closed on

Oct 14, 2003

Sold by

Gray Brister S

Bought by

Summers Mandi E and Moore Thomas F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$158,650

Interest Rate

6.35%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 29, 2002

Sold by

Gray Brister S

Bought by

Gray Raymond M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Moore Thomas F | -- | -- | |

| Jekanowski Leonard C | -- | -- | |

| Summers Mandi E | $167,000 | -- | |

| Gray Raymond M | $19,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gray Raymond M | $30,000 | |

| Open | Jekanowski Leonard C | $144,000 | |

| Closed | Moore Thomas F | $144,000 | |

| Previous Owner | Gray Raymond M | $158,650 | |

| Previous Owner | Gray Raymond M | $25,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,171 | $384,200 | $111,200 | $273,000 |

| 2024 | $5,255 | $359,700 | $111,200 | $248,500 |

| 2023 | $5,360 | $304,400 | $91,000 | $213,400 |

| 2022 | $5,171 | $297,500 | $87,500 | $210,000 |

| 2021 | $4,644 | $280,600 | $87,500 | $193,100 |

| 2020 | $4,675 | $280,600 | $87,500 | $193,100 |

| 2019 | $4,741 | $276,300 | $83,200 | $193,100 |

| 2018 | $4,747 | $276,300 | $83,200 | $193,100 |

| 2017 | $4,185 | $258,000 | $82,300 | $175,700 |

| 2016 | $3,490 | $212,300 | $82,300 | $130,000 |

| 2015 | $3,390 | $212,300 | $82,300 | $130,000 |

| 2014 | $3,318 | $205,300 | $77,000 | $128,300 |

Source: Public Records

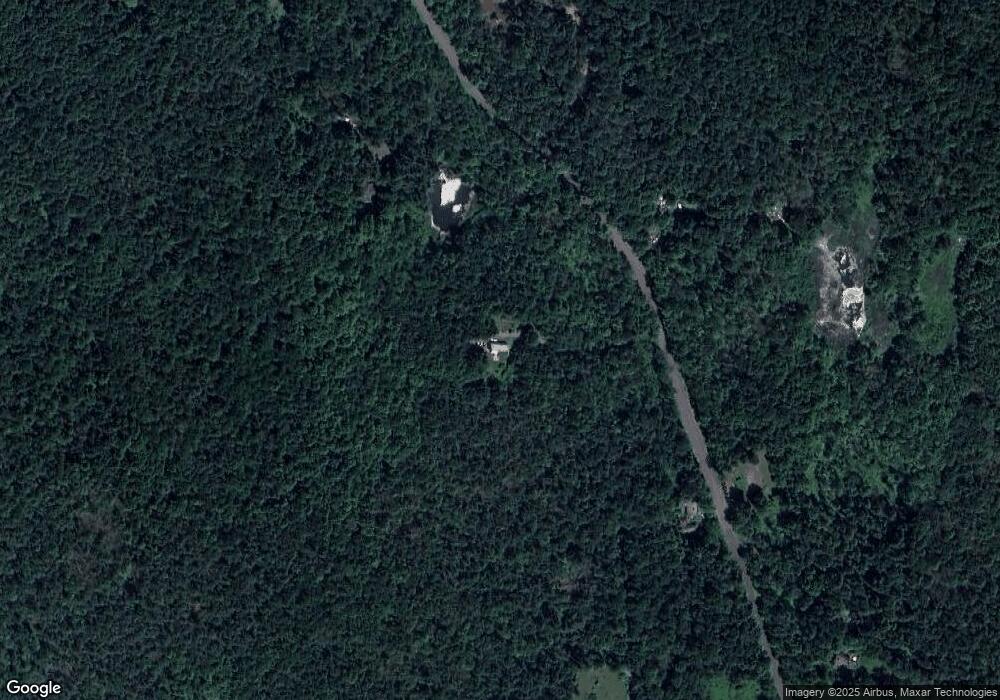

Map

Nearby Homes

- 0 Sears Rd Unit 73373850

- 1531 Williamsburg Rd

- 473 N Poland Rd

- 230 S Ashfield Rd

- 0 Spruce Corner Rd Unit 73244975

- 146 Berkshire Trail W

- 0 John Ford Rd Unit 73403157

- 0 John Ford Rd Unit 73403156

- 374 Watson Spruce Corner Rd

- 220 Hawley Rd

- 240 Beldingville Rd

- 333 Ranney Corner Rd

- 820 E Guinea Rd

- 0 Fuller Rd

- 0 Old Stage Rd Unit 73326639

- 0 Pleasant St

- 7 Sundown Dr

- lot 1 Shelburne Falls Rd

- 14 River St

- 85 Dacey Rd