1018 Betterton Rd Walling, TN 38587

Estimated Value: $175,000 - $231,000

Studio

1

Bath

786

Sq Ft

$257/Sq Ft

Est. Value

About This Home

This home is located at 1018 Betterton Rd, Walling, TN 38587 and is currently estimated at $202,000, approximately $256 per square foot. 1018 Betterton Rd is a home located in White County with nearby schools including Central View Elementary School, White County Middle School, and White County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 22, 2025

Sold by

Young David

Bought by

Atwood Jessica and Atwood Josh

Current Estimated Value

Purchase Details

Closed on

May 4, 2023

Sold by

Holliday Paula Betterton and Holliday Paula B

Bought by

Holliday Family Revocable Trust

Purchase Details

Closed on

Apr 22, 2021

Sold by

Humphrey Darry Kevin

Bought by

Sandoval Manuel and Sandoval Carolyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$413,250

Interest Rate

3.05%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 1, 1979

Purchase Details

Closed on

May 18, 1978

Bought by

Young Quentin and Young Marilyn

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Atwood Jessica | -- | None Listed On Document | |

| Holliday Family Revocable Trust | -- | None Listed On Document | |

| Sandoval Manuel | $435,000 | Upper Cumberland T&E Llc | |

| -- | $1,500 | -- | |

| Young Quentin | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sandoval Manuel | $413,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $258 | $22,425 | $0 | $0 |

| 2024 | $258 | $12,575 | $3,950 | $8,625 |

| 2023 | $258 | $12,575 | $3,950 | $8,625 |

| 2022 | $258 | $12,575 | $3,950 | $8,625 |

| 2021 | $258 | $12,575 | $3,950 | $8,625 |

| 2020 | $258 | $12,575 | $3,950 | $8,625 |

| 2019 | $244 | $11,925 | $3,950 | $7,975 |

| 2018 | $244 | $11,925 | $3,950 | $7,975 |

| 2017 | $244 | $11,925 | $3,950 | $7,975 |

| 2016 | $244 | $11,925 | $3,950 | $7,975 |

| 2015 | $221 | $11,925 | $3,950 | $7,975 |

| 2014 | -- | $11,925 | $3,950 | $7,975 |

| 2013 | -- | $11,125 | $3,950 | $7,175 |

Source: Public Records

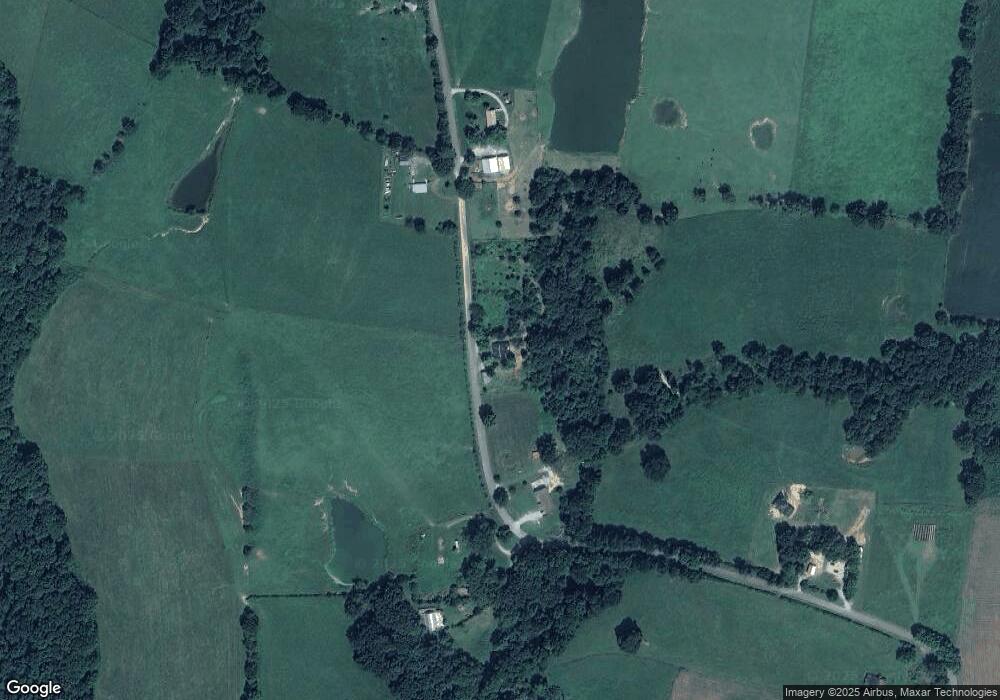

Map

Nearby Homes

- 14193 Old Kentucky Rd

- 14305 Old Kentucky Rd

- 13593 Old Kentucky Rd

- 504 Darkey Springs Rd

- 13723 Old Kentucky Rd

- 13400 Old Kentucky Rd

- 620 Roberts Cemetery Rd

- 00 Roberts Cemetery Rd

- 151 AC. Roberts Cemetery Rd

- 4956 Franks Ferry Rd

- 1295 Darkey Springs Rd

- Lot 6 Franks Ferry Rd

- 265 N Center Point Acres

- 3297 Three Island Rd

- 0 Center Point Acres N Unit 1322803

- 0 Center Point Acres N Unit 240744

- 0 Center Point Acres N Unit RTC3050083

- 2.28 Acres Pates Ford Rd

- 2530 Pollard Rd

- 1476 Conrad Templeton Rd

- LOT 1 Betterton Rd

- . Betterton Rd

- 0 Betterton Rd

- 1787 Betterton Rd

- 1811 Betterton Rd

- 950 Betterton Rd

- 1119 Betterton Rd

- Lot #1 Betterton Rd

- 1152 Betterton Rd

- 758 Betterton Rd

- 1261 Betterton Rd

- 1363 Betterton Rd

- 435 Betterton Rd

- 1456 Betterton Rd

- 1530 Betterton Rd

- 409 Swindell Mill Rd

- Lot #2 Betterton Rd

- 1568 Betterton Rd

- 203 Swindell Mill Rd

- 1667 Betterton Rd