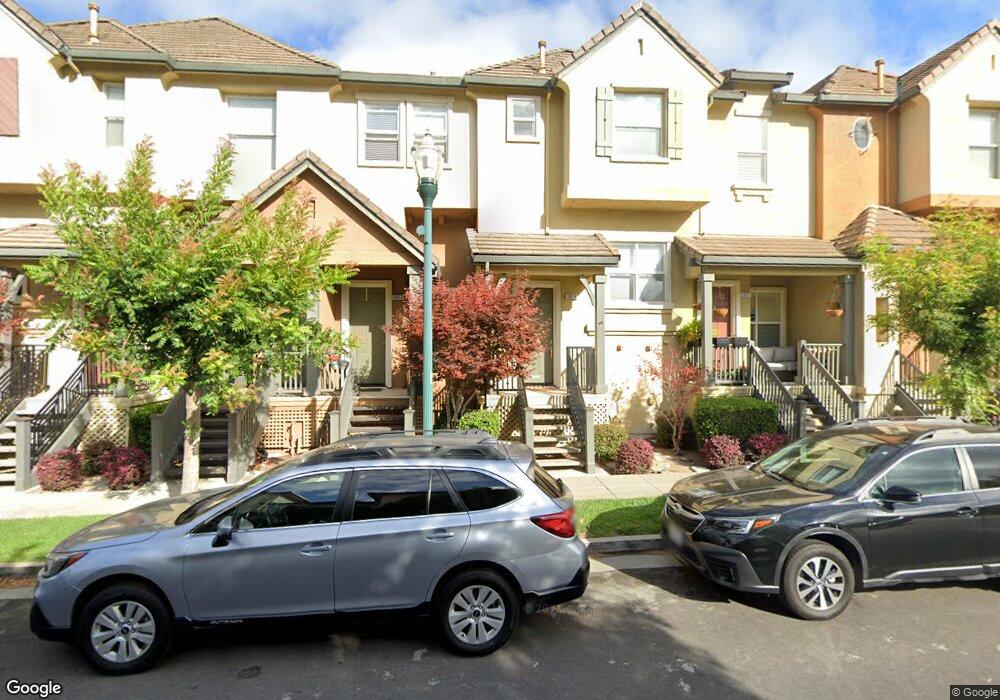

1019 Yates Way Unit 1027 San Mateo, CA 94403

Hillsdale NeighborhoodEstimated Value: $597,000 - $1,413,000

2

Beds

3

Baths

1,254

Sq Ft

$761/Sq Ft

Est. Value

About This Home

This home is located at 1019 Yates Way Unit 1027, San Mateo, CA 94403 and is currently estimated at $954,359, approximately $761 per square foot. 1019 Yates Way Unit 1027 is a home located in San Mateo County with nearby schools including George Hall Elementary School, Abbott Middle School, and Hillsdale High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 19, 2004

Sold by

Potter Joseph Edward and Potter Patricia Ann

Bought by

Potter Joseph Edward and Potter Patricia Ann

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,000

Outstanding Balance

$84,123

Interest Rate

5.86%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Estimated Equity

$870,236

Purchase Details

Closed on

Mar 22, 2001

Sold by

Ryland Homes Of California Inc

Bought by

Potter Joseph Edward and Potter Patricia Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,200

Interest Rate

7.06%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Potter Joseph Edward | -- | Fidelity National Title Comp | |

| Potter Joseph Edward | $197,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Potter Joseph Edward | $175,000 | |

| Closed | Potter Joseph Edward | $157,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,805 | $296,222 | $88,862 | $207,360 |

| 2023 | $5,805 | $284,721 | $85,412 | $199,309 |

| 2022 | $5,724 | $279,139 | $83,738 | $195,401 |

| 2021 | $5,562 | $273,667 | $82,097 | $191,570 |

| 2020 | $5,131 | $270,862 | $81,256 | $189,606 |

| 2019 | $4,937 | $265,552 | $79,663 | $185,889 |

| 2018 | $4,390 | $260,346 | $78,101 | $182,245 |

| 2017 | $4,545 | $255,242 | $76,570 | $178,672 |

| 2016 | $4,233 | $250,238 | $75,069 | $175,169 |

| 2015 | $4,123 | $246,480 | $73,942 | $172,538 |

| 2014 | $3,986 | $241,653 | $72,494 | $169,159 |

Source: Public Records

Map

Nearby Homes

- 2835 Alvarado Ave

- 475 Landeros Dr

- 406 E 28th Ave

- 2868 Baze Rd

- 367 Derby Ave

- 2736 Foster St

- 133 Waters Park Cir

- 413 Franklin Pkwy

- 2009 Trinity St

- 1573 Marina Ct Unit A

- 3513 Casanova Dr

- 1640 Marina Ct Unit F

- 3015 Los Prados St Unit 114

- 3001 Los Prados St Unit 104

- 35 28th Ave Unit 106B

- 3045 Los Prados St Unit 218

- 740 Promontory Point Ln Unit 3109

- 3605 Pacific Blvd

- 345 E 39th Ave

- 739 Aries Ln

- 1017 Yates Way Unit 1027

- 1013 Yates Way Unit 1027

- 1009 Yates Way Unit 1027

- 1015 Yates Way Unit 5608

- 1025 Yates Way

- 1015 Yates Way Unit 1027

- 1011 Yates Way Unit 1027

- 1005 Yates Way Unit 1027

- 1003 Yates Way Unit 1027

- 1001 Yates Way Unit 1027

- 1027 Yates Way

- 1023 Yates Way Unit 1027

- 1021 Yates Way Unit 1027

- 1007 Yates Way

- 1008 Wayne Way

- 1012 Wayne Way

- 1004 Wayne Way

- 1016 Wayne Way

- 1000 Wayne Way

- 1020 Wayne Way