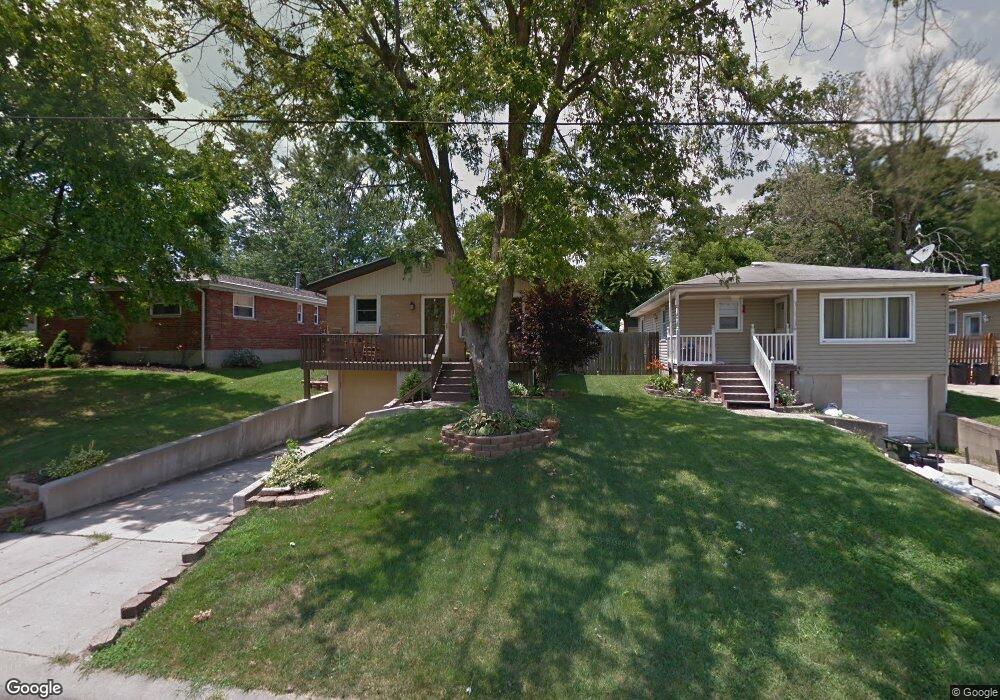

1021 Westview Ave Hamilton, OH 45013

Estimated Value: $158,000 - $195,000

2

Beds

1

Bath

984

Sq Ft

$185/Sq Ft

Est. Value

About This Home

This home is located at 1021 Westview Ave, Hamilton, OH 45013 and is currently estimated at $181,630, approximately $184 per square foot. 1021 Westview Ave is a home located in Butler County with nearby schools including Brookwood Elementary School, Wilson Middle School, and Hamilton High School Main Campus.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 18, 2003

Sold by

Hornsby James and Hornsby Kyra

Bought by

Gabbard Daniel E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$89,760

Outstanding Balance

$42,212

Interest Rate

6.44%

Mortgage Type

VA

Estimated Equity

$139,418

Purchase Details

Closed on

Jul 2, 2003

Sold by

Stapleton Rita M and Stapleton Fredrick E

Bought by

Hornsby James

Purchase Details

Closed on

Mar 20, 1998

Sold by

Vii Drake John H and Vii Diane M

Bought by

Stapleton Fredrick E and Stapleton Rita M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$77,214

Interest Rate

7.09%

Mortgage Type

VA

Purchase Details

Closed on

Mar 1, 1990

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gabbard Daniel E | -- | -- | |

| Hornsby James | $70,000 | -- | |

| Stapleton Fredrick E | $75,700 | First Title Ins Agency Inc | |

| -- | $55,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gabbard Daniel E | $89,760 | |

| Previous Owner | Stapleton Fredrick E | $77,214 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,705 | $40,400 | $12,260 | $28,140 |

| 2023 | $1,697 | $40,400 | $12,260 | $28,140 |

| 2022 | $1,748 | $35,500 | $12,260 | $23,240 |

| 2021 | $1,563 | $34,520 | $12,260 | $22,260 |

| 2020 | $1,839 | $34,520 | $12,260 | $22,260 |

| 2019 | $2,279 | $31,120 | $12,240 | $18,880 |

| 2018 | $1,677 | $31,120 | $12,240 | $18,880 |

| 2017 | $1,700 | $31,120 | $12,240 | $18,880 |

| 2016 | $1,678 | $29,010 | $12,240 | $16,770 |

| 2015 | $1,419 | $29,010 | $12,240 | $16,770 |

| 2014 | $1,888 | $29,010 | $12,240 | $16,770 |

| 2013 | $1,888 | $34,770 | $12,240 | $22,530 |

Source: Public Records

Map

Nearby Homes

- 1063 Westview Ave

- 15 Ohio Ave

- 1241 Millville Ave

- 732 Millville Ave

- 65 W Persimmon Dr

- 1281 Millville Ave

- 2073 Sunset Dr

- 1317 Goodman Ave

- 16 Rockford Dr

- 1231 Franklin St

- 560 Springvale Dr

- 997 Millikin St

- 781 Springvale Dr

- 1278 Elizabeth Dr

- 1280 Elizabeth Dr

- 1150 Franklin St

- 672 Glenway Dr

- 885 Carlisle Ave

- 570 Harrison Ave

- 238 Twinbrook Dr

- 1025 Westview Ave

- 215 N Gersam Ave

- 1005 Westview Ave

- 227 N Gersam Ave

- 1031 Westview Ave

- 241 N Gersam Ave

- 253 N Gersam Ave

- 1020 Westview Ave

- 1008 Westview Ave

- 1039 Westview Ave

- 275 N Gersam Ave

- 1002 Westview Ave

- 1034 Westview Ave

- 1034 Westview Ave

- 1040 Westview Ave

- 994 Westview Ave

- 1025 Timberman Ave

- 1015 Timberman Ave

- 1009 Timberman Ave

- 1046 Westview Ave