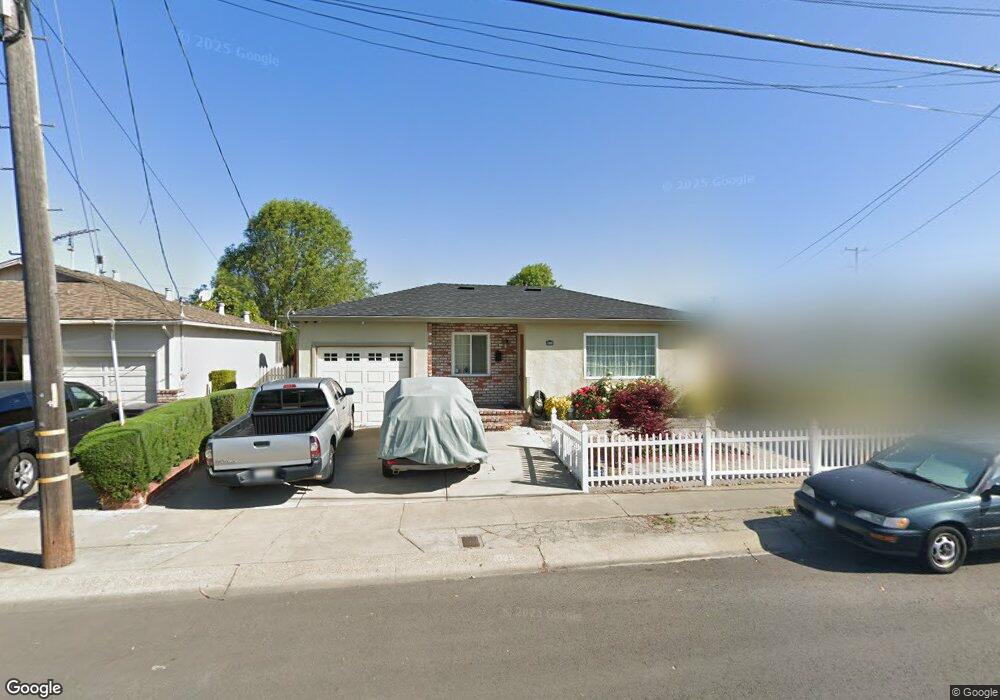

1025 Burkhart Ave San Leandro, CA 94579

Washington Manor-Bonaire NeighborhoodEstimated Value: $771,000 - $828,000

2

Beds

1

Bath

1,244

Sq Ft

$644/Sq Ft

Est. Value

About This Home

This home is located at 1025 Burkhart Ave, San Leandro, CA 94579 and is currently estimated at $801,510, approximately $644 per square foot. 1025 Burkhart Ave is a home located in Alameda County with nearby schools including Dayton Elementary School, Washington Manor Middle School, and Arroyo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 15, 2005

Sold by

Cass Richard L and Peggy J Cornelius Living Trust

Bought by

Sonza Carlos C and Sonza Macrina L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$399,950

Outstanding Balance

$210,274

Interest Rate

5.87%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$591,236

Purchase Details

Closed on

Jan 9, 1996

Sold by

Cornelius Peggy J

Bought by

Cornelius Peggy J

Purchase Details

Closed on

Apr 13, 1994

Sold by

Cornelius Peggy J

Bought by

Cornelius Peggy J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,000

Interest Rate

7.67%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sonza Carlos C | $500,000 | Financial Title Company | |

| Cornelius Peggy J | -- | -- | |

| Cornelius Peggy J | -- | American Title Insurance |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sonza Carlos C | $399,950 | |

| Previous Owner | Cornelius Peggy J | $84,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,596 | $689,750 | $208,927 | $487,823 |

| 2024 | $8,596 | $676,093 | $204,832 | $478,261 |

| 2023 | $8,549 | $669,700 | $200,816 | $468,884 |

| 2022 | $8,429 | $649,573 | $196,880 | $459,693 |

| 2021 | $8,200 | $636,701 | $193,020 | $450,681 |

| 2020 | $8,027 | $637,102 | $191,041 | $446,061 |

| 2019 | $7,945 | $616,000 | $184,800 | $431,200 |

| 2018 | $7,162 | $573,000 | $171,900 | $401,100 |

| 2017 | $6,320 | $517,000 | $155,100 | $361,900 |

| 2016 | $5,597 | $456,000 | $136,800 | $319,200 |

Source: Public Records

Map

Nearby Homes

- 15535 Sedgeman St

- 840 Woodgate Dr

- 15596 Tilden St

- 720 Fargo Ave Unit 14

- 747 Lewelling Blvd

- 747 Lewelling Blvd Unit SPC 22

- 670 Fargo Ave Unit 5

- 15106 Edgemoor St

- 700 Fargo Ave Unit 2

- 700 Fargo Ave Unit 12

- 650 Fargo Ave Unit 4

- 15049 Kesterson St

- 15102 Chapel Ct

- 15009 Kesterson St

- 15373 Inverness St

- 15512 Farnsworth St

- 1311 Hubbard Ave

- 1950 Randy St

- 15822 Devonwood Way

- 1786 Via Chorro

- 1033 Burkhart Ave

- 1017 Burkhart Ave

- 1041 Burkhart Ave

- 1009 Burkhart Ave

- 1034 Trojan Ave

- 1026 Trojan Ave

- 1018 Trojan Ave

- 1049 Burkhart Ave

- 1042 Trojan Ave

- 1010 Trojan Ave

- 1024 Burkhart Ave

- 1016 Burkhart Ave

- 1040 Burkhart Ave

- 1008 Burkhart Ave

- 1050 Trojan Ave

- 1057 Burkhart Ave

- 995 Burkhart Ave

- 998 Trojan Ave

- 1058 Trojan Ave

- 15319 Norton St