1027F Saint George Ln Unit F-27 Myrtle Beach, SC 29588

Burgess NeighborhoodEstimated Value: $145,000 - $157,000

2

Beds

2

Baths

1,156

Sq Ft

$132/Sq Ft

Est. Value

About This Home

This home is located at 1027F Saint George Ln Unit F-27, Myrtle Beach, SC 29588 and is currently estimated at $152,938, approximately $132 per square foot. 1027F Saint George Ln Unit F-27 is a home located in Horry County with nearby schools including St. James Elementary School, St. James Middle School, and St. James Intermediate.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 19, 2021

Sold by

Hope Edward M

Bought by

Sabbatino Pamela S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Outstanding Balance

$44,720

Interest Rate

2.7%

Mortgage Type

New Conventional

Estimated Equity

$108,219

Purchase Details

Closed on

May 5, 2017

Sold by

Livid Ii Llc

Bought by

Hope Edward M and Hope Millicent

Purchase Details

Closed on

Sep 26, 2007

Sold by

Davis Richard Gordon and Davis Mary Lou

Bought by

Livid Ii Llc

Purchase Details

Closed on

Jun 19, 2002

Sold by

Creamer Robert F and Creamer Janet M

Bought by

Davis Richard Gordon and Davis Mary Lou

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sabbatino Pamela S | $110,000 | -- | |

| Hope Edward M | $80,000 | -- | |

| Livid Ii Llc | $125,000 | Attorney | |

| Davis Richard Gordon | $73,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sabbatino Pamela S | $50,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $357 | $9,000 | $0 | $9,000 |

| 2023 | $357 | $8,190 | $0 | $8,190 |

| 2021 | $493 | $8,190 | $0 | $8,190 |

| 2020 | $1,004 | $8,190 | $0 | $8,190 |

| 2019 | $1,004 | $8,190 | $0 | $8,190 |

| 2018 | $0 | $8,085 | $0 | $8,085 |

| 2017 | $782 | $6,195 | $0 | $6,195 |

| 2016 | $0 | $3,540 | $0 | $3,540 |

| 2015 | -- | $6,195 | $0 | $6,195 |

| 2014 | $757 | $3,540 | $0 | $3,540 |

Source: Public Records

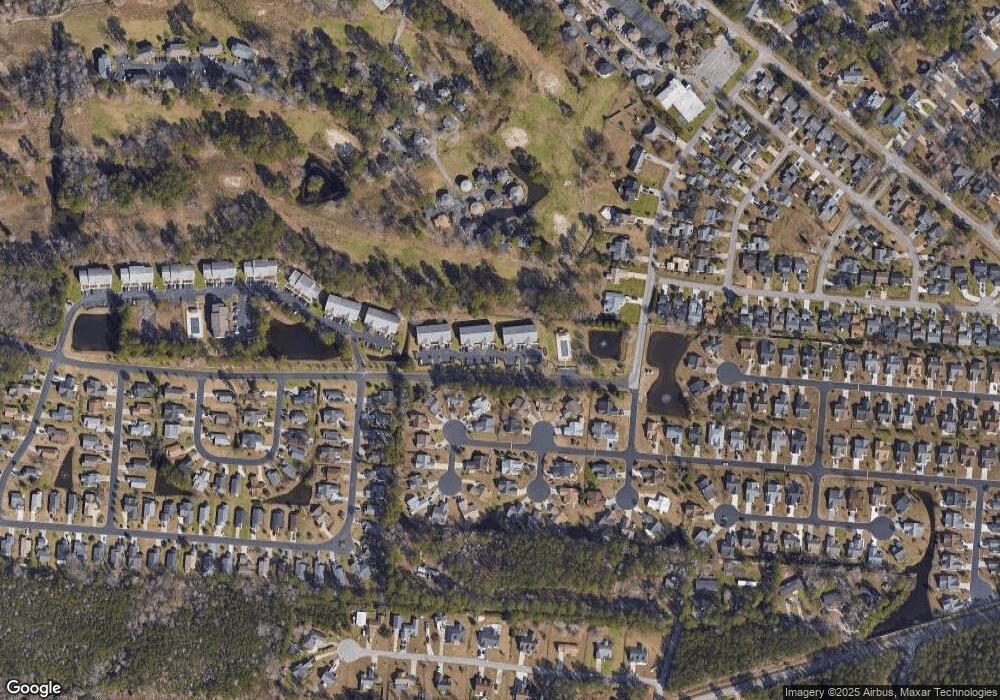

Map

Nearby Homes

- 622 Tall Oaks Ln

- 102 Saint Andrews Ln

- 205 Birkdale Ln

- 742 Tall Oaks Ct

- 740 Tall Oaks Ct

- 1230 White Tree Ln Unit F

- 1240 White Tree Ln Unit G

- 752 Tall Oaks Ct

- 408 Tree Top Ct Unit 8-B

- 408 Tree Top Ct Unit A

- 923 Don Donald Ct

- 512 Tree Top Ln

- 512 Tree Top Ln Unit up/down

- 402 Tree Top Ct Unit B

- 925 Fairwood Lakes Ln Unit 25-J

- 308 Killarney Dr

- 444 Freewoods Park Ct

- ARIA Plan at Island Green

- HAYDEN Plan at Island Green

- CALI Plan at Island Green

- 1027 Saint George Ln Unit J

- 1027 Saint George Ln Unit J-27

- 1027 Saint George Ln Unit B

- 1027 Saint George Ln Unit 1027G

- 1027 Saint George Ln Unit G

- 1027 Saint George Ln Unit I

- 1027 Saint George Ln Unit H

- 1027 Saint George Ln Unit H

- 1027 Saint George Ln Unit j

- 1027 Saint George Ln Unit 1027-G

- 1027 Saint George Ln

- 1027B Saint George Ln

- 1026 Saint George Ln Unit Island Green

- 1026 Saint George Ln Unit J

- 1026G Saint George Ln Unit G-26

- 1026 Saint George Ln Unit 26E

- 1027B Saint George Ln Unit 1027-F

- 1027B Saint George Ln Unit B

- 1027B Saint George Ln Unit G

- 1027F Saint George Ln Unit 1027-F Red Tree Circ