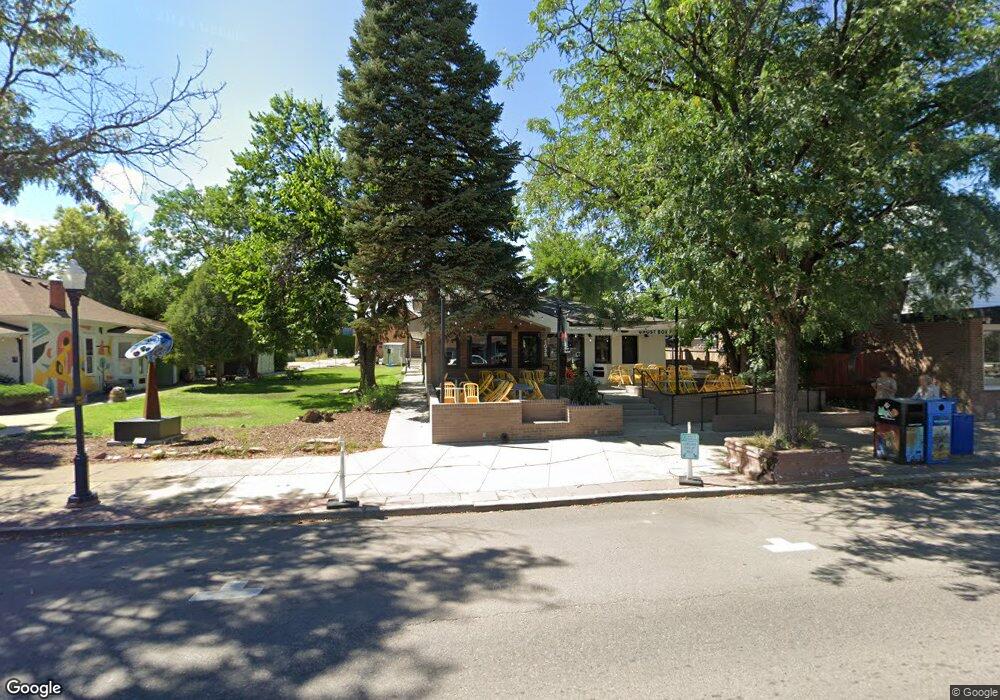

103 S Public Rd Lafayette, CO 80026

Estimated Value: $2,277,836

--

Bed

--

Bath

6,533

Sq Ft

$349/Sq Ft

Est. Value

About This Home

This home is located at 103 S Public Rd, Lafayette, CO 80026 and is currently estimated at $2,277,836, approximately $348 per square foot. 103 S Public Rd is a home located in Boulder County with nearby schools including Lafayette Elementary School, Angevine Middle School, and Centaurus High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 21, 2018

Sold by

Tebo Stephen D

Bought by

103 South Public Road Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,130,816

Interest Rate

4.9%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

Jun 23, 2006

Sold by

Mcfarland Kathryn T

Bought by

Tebo Stephen D

Purchase Details

Closed on

Jan 24, 2005

Sold by

Deferred Exchange B Llc

Bought by

Mcfarland Kathryn T

Purchase Details

Closed on

Aug 6, 2004

Sold by

Eldridge Thomas E and Eldridge Betty L

Bought by

The Deferred Exhange B Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$192,500

Interest Rate

12%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jan 28, 1972

Bought by

Tebo Stephen D

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| 103 South Public Road Llc | $1,605,000 | Fntg Ncs Colorado | |

| Tebo Stephen D | $489,000 | First Colorado Title | |

| Mcfarland Kathryn T | $252,000 | -- | |

| The Deferred Exhange B Llc | $212,500 | -- | |

| Tebo Stephen D | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | 103 South Public Road Llc | $1,130,816 | |

| Previous Owner | The Deferred Exhange B Llc | $192,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $35,298 | $404,487 | $96,849 | $307,638 |

| 2024 | $35,298 | $404,487 | $96,849 | $307,638 |

| 2023 | $34,694 | $398,356 | $91,735 | $314,991 |

| 2022 | $36,774 | $391,500 | $116,000 | $275,500 |

| 2021 | $23,648 | $261,870 | $116,000 | $145,870 |

| 2020 | $26,504 | $290,000 | $116,000 | $174,000 |

| 2019 | $26,138 | $290,000 | $116,000 | $174,000 |

| 2018 | $23,165 | $253,750 | $50,750 | $203,000 |

| 2017 | $22,555 | $314,650 | $56,086 | $258,564 |

| 2016 | $20,635 | $224,750 | $50,156 | $174,594 |

| 2015 | $19,335 | $144,217 | $26,651 | $117,566 |

| 2014 | $12,470 | $144,217 | $26,651 | $117,566 |

Source: Public Records

Map

Nearby Homes

- 201 E Cleveland St

- 303 E Geneseo St

- 403 W Cannon St

- 306 E Cannon St

- 511 S Roosevelt Ave

- 406 E Cleveland St

- 200 S Carr Ave

- 304 Skylark Cir

- 511 E Emma St

- 715 Bunting Dr

- 712 Bunting Dr

- 709 Cardinal Dr

- 285 Skylark Cir

- 409 N Finch Ave

- 351 S Foote Ave

- 713 Flamingo Dr

- 801 E Geneseo St

- 490 E Sutton Cir

- 921 Latigo Loop

- 917 Latigo Loop

- 107 S Public Rd

- 107 W Cleveland St

- 109 S Public Rd

- 110 W Simpson St

- 109 W Cleveland St Unit 109 A

- 109 W Cleveland St

- 107 W Simpson St

- 111 W Cleveland St

- 116 S Roosevelt Ave Unit A & B

- 116 S Roosevelt Ave Unit A & B

- 116 S Roosevelt Ave

- 105 N Public Rd Unit 107

- 105 N Public Rd Unit C

- 109 W Simpson St Unit A & B

- 104 E Simpson St

- 101 S Roosevelt Ave

- 105 E Cleveland St

- 106 E Simpson St

- 105 E Simpson St

- 200 W Simpson St Unit 1