1033 Agate Dr Edgewood, MD 21040

Estimated Value: $243,978 - $292,000

--

Bed

2

Baths

1,296

Sq Ft

$207/Sq Ft

Est. Value

About This Home

This home is located at 1033 Agate Dr, Edgewood, MD 21040 and is currently estimated at $268,245, approximately $206 per square foot. 1033 Agate Dr is a home located in Harford County with nearby schools including Deerfield Elementary School, Edgewood Middle School, and Edgewood High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 20, 2005

Sold by

Smith Linda M

Bought by

Batres Miguel A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$158,746

Outstanding Balance

$83,885

Interest Rate

6.05%

Mortgage Type

FHA

Estimated Equity

$184,360

Purchase Details

Closed on

Jun 5, 2001

Sold by

Batson Elizabeth Kay

Bought by

Smith Linda M

Purchase Details

Closed on

May 15, 1991

Sold by

Associates Relocation Management

Bought by

Batson Elizabeth Kay

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$59,500

Interest Rate

9.47%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Batres Miguel A | $160,000 | -- | |

| Smith Linda M | $89,500 | -- | |

| Batson Elizabeth Kay | $74,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Batres Miguel A | $158,746 | |

| Previous Owner | Batson Elizabeth Kay | $59,500 | |

| Closed | Smith Linda M | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,796 | $177,533 | $0 | $0 |

| 2024 | $1,796 | $164,767 | $0 | $0 |

| 2023 | $1,657 | $152,000 | $40,000 | $112,000 |

| 2022 | $1,611 | $147,800 | $0 | $0 |

| 2021 | $1,609 | $143,600 | $0 | $0 |

| 2020 | $1,609 | $139,400 | $40,000 | $99,400 |

| 2019 | $1,586 | $137,467 | $0 | $0 |

| 2018 | $1,550 | $135,533 | $0 | $0 |

| 2017 | $1,528 | $133,600 | $0 | $0 |

| 2016 | -- | $133,600 | $0 | $0 |

| 2015 | $1,754 | $133,600 | $0 | $0 |

| 2014 | $1,754 | $157,000 | $0 | $0 |

Source: Public Records

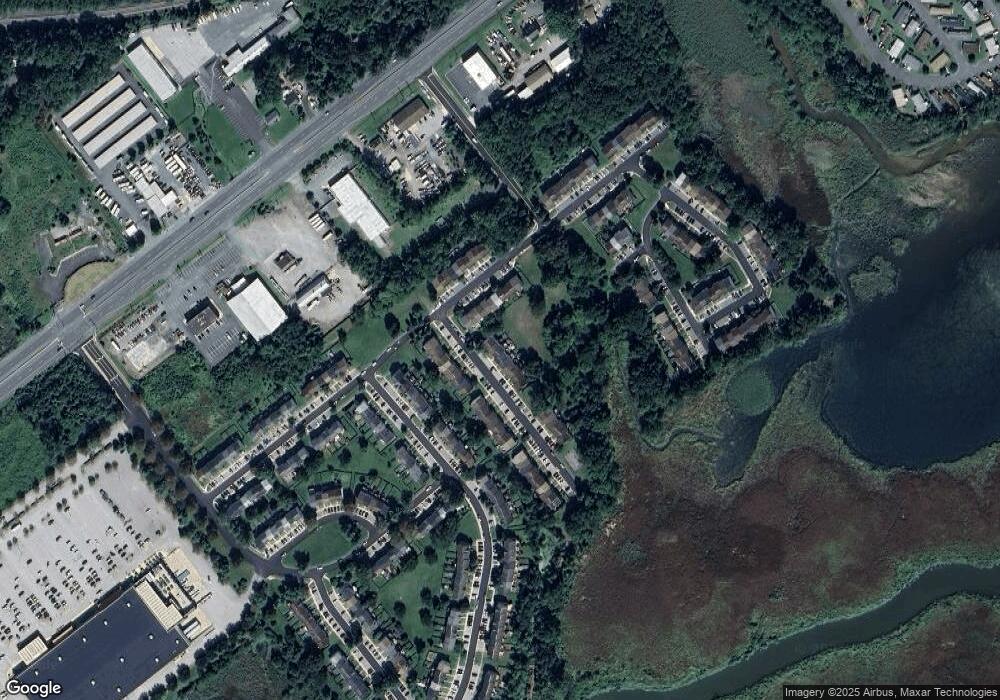

Map

Nearby Homes

- 2805 Beckon Dr

- 2809 Beckon Dr

- 2828 Beckon Dr

- 1071 Sand Pebble Dr

- 1024 Westshore Dr

- 2707 Pulaski Hwy

- 2912 Philadelphia Rd

- 1203 Van Bibber Rd

- 1205 Van Bibber Rd

- 1207 Van Bibber Rd

- 619 Aspen Ln

- 730 Sequoia Dr

- 1211 Van Bibber Rd

- 3109 Raking Leaf Dr

- 3106 Raking Leaf Dr

- 2945 Raking Leaf Dr

- 2909 Willoughby Beach Rd

- 2313 Hanson Rd

- 2204 Blevins Rd

- 508 Scholar Ct