10330 New Ave Gilroy, CA 95020

Estimated Value: $1,473,000 - $1,773,000

4

Beds

3

Baths

1,732

Sq Ft

$934/Sq Ft

Est. Value

About This Home

This home is located at 10330 New Ave, Gilroy, CA 95020 and is currently estimated at $1,618,479, approximately $934 per square foot. 10330 New Ave is a home located in Santa Clara County with nearby schools including Rucker Elementary School, Solorsano Middle School, and Christopher High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 21, 2004

Sold by

Garza Kevin and Garza Adrienne

Bought by

Lustre Augustin and Lustre Socorro

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$538,900

Outstanding Balance

$248,104

Interest Rate

5.35%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$1,370,375

Purchase Details

Closed on

Mar 21, 2000

Sold by

Gorman James R and Gorman Juliet M

Bought by

Garza Kevin and Garza Adrienne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$503,200

Interest Rate

8.38%

Mortgage Type

Stand Alone First

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lustre Augustin | $895,000 | First American Title Company | |

| Garza Kevin | $629,000 | Financial Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lustre Augustin | $538,900 | |

| Previous Owner | Garza Kevin | $503,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $14,905 | $1,247,535 | $627,253 | $620,282 |

| 2024 | $14,905 | $1,223,074 | $614,954 | $608,120 |

| 2023 | $14,796 | $1,199,094 | $602,897 | $596,197 |

| 2022 | $14,531 | $1,175,583 | $591,076 | $584,507 |

| 2021 | $14,465 | $1,152,534 | $579,487 | $573,047 |

| 2020 | $14,289 | $1,140,718 | $573,546 | $567,172 |

| 2019 | $14,146 | $1,118,351 | $562,300 | $556,051 |

| 2018 | $13,140 | $1,096,424 | $551,275 | $545,149 |

| 2017 | $13,420 | $1,074,926 | $540,466 | $534,460 |

| 2016 | $13,147 | $1,053,850 | $529,869 | $523,981 |

| 2015 | $11,517 | $965,900 | $485,600 | $480,300 |

| 2014 | $11,267 | $937,800 | $471,500 | $466,300 |

Source: Public Records

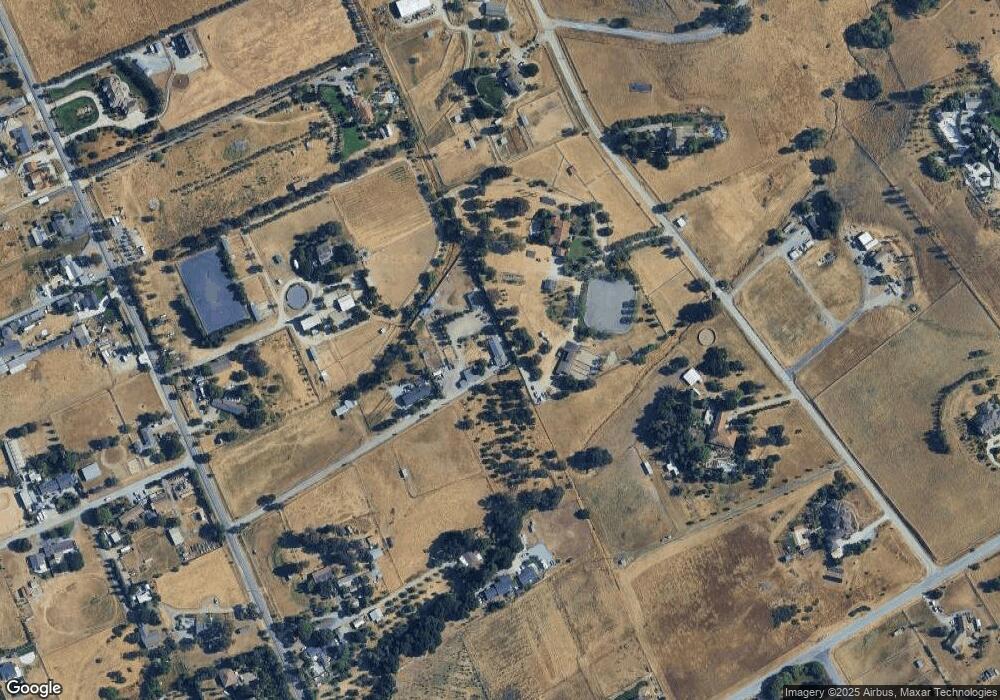

Map

Nearby Homes

- 9560 Via Del Oro

- 2525 Bridle Path Dr

- 10055 Foothill Ave

- 10980 New Ave

- 2055 Rucker Ave

- 0002 Buena Vista Ave

- 11840 Foothill Ave

- 145 Masten Ave

- 1925 Church Ave

- 0 Buena Vista Ave

- 700 Las Animas Ave

- 0 Crews Rd

- 12467 Creekview Ct

- 310 Lena Ave

- 2115 Gwinn Ave

- 12550 Center Ave

- 119 Farrell Ave

- 103 Farrell Ave

- 111 Farrell Ave

- 264 Windsong Way

- 10340 New Ave

- 10357 Duke Dr

- 10357 Duke Dr

- 10390 New Ave

- 10230 New Ave Unit E

- 10230 New Ave Unit B

- 10346 New Ave

- 10265 Duke Dr

- 0 Duke Dr

- 0 New Ave Unit ML80902036

- 0 New Ave Unit ML81947545

- 0 New Ave Unit ML81835523

- 0 New Ave Unit ML81799425

- 0 New Ave Unit ML81774384

- 0 New Ave Unit ML81784278

- 0 New Ave Unit ML81733831

- 10400 New Ave

- 10433 Duke Dr

- 10358 Duke Dr

- 10345 New Ave