104 Middleton Dr Peachtree City, GA 30269

Estimated Value: $820,061 - $896,000

--

Bed

--

Bath

3,258

Sq Ft

$265/Sq Ft

Est. Value

About This Home

This home is located at 104 Middleton Dr, Peachtree City, GA 30269 and is currently estimated at $863,265, approximately $264 per square foot. 104 Middleton Dr is a home located in Fayette County with nearby schools including Crabapple Lane Elementary School, Booth Middle School, and McIntosh High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 2, 2015

Sold by

Johnston Mark

Bought by

Johnston Mark A and Johnston Angela M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,650

Interest Rate

3.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 9, 2005

Sold by

Hms John Wieland

Bought by

Johnston Mark A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,200

Interest Rate

5.6%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johnston Mark A | -- | -- | |

| Johnston Mark A | $448,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Johnston Mark A | $384,000 | |

| Closed | Johnston Mark A | $70,650 | |

| Closed | Johnston Mark A | $353,250 | |

| Previous Owner | Johnston Mark A | $80,000 | |

| Previous Owner | Johnston Mark A | $67,200 | |

| Previous Owner | Johnston Mark A | $358,786 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,448 | $311,656 | $58,000 | $253,656 |

| 2023 | $6,544 | $264,480 | $58,000 | $206,480 |

| 2022 | $6,807 | $252,360 | $58,000 | $194,360 |

| 2021 | $6,553 | $231,600 | $58,000 | $173,600 |

| 2020 | $6,555 | $213,080 | $38,000 | $175,080 |

| 2019 | $6,454 | $207,800 | $38,000 | $169,800 |

| 2018 | $6,156 | $195,160 | $38,000 | $157,160 |

| 2017 | $6,191 | $194,960 | $38,000 | $156,960 |

| 2016 | $5,757 | $174,880 | $38,000 | $136,880 |

| 2015 | $5,394 | $161,320 | $38,000 | $123,320 |

| 2014 | $5,185 | $152,520 | $38,000 | $114,520 |

| 2013 | -- | $148,920 | $0 | $0 |

Source: Public Records

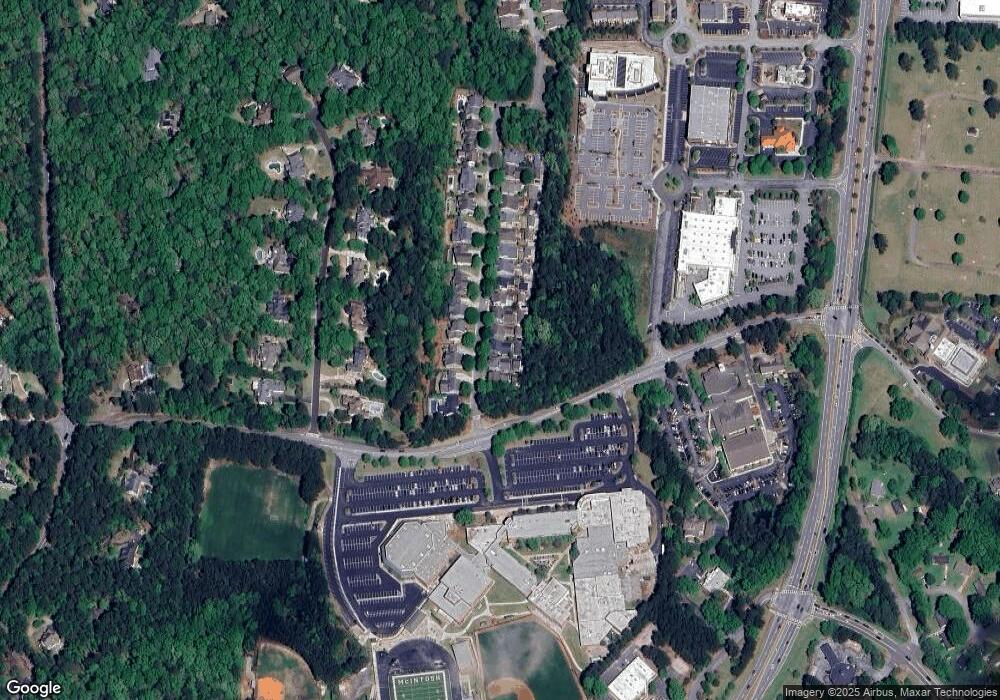

Map

Nearby Homes

- 124 Middleton Dr

- 226 Collierstown Way

- 235 Collierstown Way

- 168 Maple Grove Terrace

- 905 Lexington Village

- 164 Maple Grove Terrace

- 330 N Peachtree Pkwy

- 101 Parkway Dr

- 527 Hazelnut Dr

- 115 Seymour Place

- 940 Laurel Brooke Ave

- Level Three Plan at Laurel Brooke - The Enclave at Laurel Brooke

- Level Two Plan at Laurel Brooke - The Enclave at Laurel Brooke

- Level One Plan at Laurel Brooke - The Enclave at Laurel Brooke

- 221 N Cove Dr

- 125 Seymour Place

- 103 Greensway

- 1000 Blair Ln

- 930 Laurel Brooke Ave

- 106 Sandtrap Ridge

- 106 Middleton Dr

- 102 Middleton Dr

- 108 Middleton Dr

- 100 Middleton Dr

- 110 Middleton Dr

- 107 Middleton Dr

- 105 Middleton Dr

- 112 Middleton Dr

- 103 Middleton Dr

- 109 Middleton Dr

- 0 Middleton Dr Unit 7494280

- 0 Middleton Dr Unit 7440906

- 0 Middleton Dr Unit 7407057

- 0 Middleton Dr Unit 7406432

- 0 Middleton Dr Unit 7394132

- 0 Middleton Dr Unit 7125699

- 0 Middleton Dr Unit 7118362

- 0 Middleton Dr Unit 7069348

- 0 Middleton Dr Unit 3223903

- 0 Middleton Dr Unit 3213701