10412 SE Leatherback Terrace Jupiter, FL 33469

Estimated Value: $769,346 - $1,128,000

3

Beds

3

Baths

2,169

Sq Ft

$424/Sq Ft

Est. Value

About This Home

This home is located at 10412 SE Leatherback Terrace, Jupiter, FL 33469 and is currently estimated at $919,087, approximately $423 per square foot. 10412 SE Leatherback Terrace is a home located in Martin County with nearby schools including Hobe Sound Elementary School, Murray Middle School, and South Fork High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 26, 2007

Sold by

Elias Joan D

Bought by

Richard J Elias Jr Revocable Living Tr

Current Estimated Value

Purchase Details

Closed on

Sep 29, 2005

Sold by

Elias Joan D

Bought by

The Joan D Elias Revocable Living Trust

Purchase Details

Closed on

Apr 8, 2002

Sold by

Mccranor Charles E

Bought by

Elias Joan D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$263,700

Interest Rate

7.16%

Mortgage Type

Balloon

Purchase Details

Closed on

Nov 22, 1994

Sold by

Mccranor Charles E and Mccranor Catherine

Bought by

Mccranor Charles E and Mccranor Catherine

Purchase Details

Closed on

Feb 21, 1994

Sold by

Beckwith & Assoc Inc

Bought by

Mccranor Charles E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Richard J Elias Jr Revocable Living Tr | -- | None Available | |

| The Joan D Elias Revocable Living Trust | -- | -- | |

| Elias Joan D | $293,000 | -- | |

| Mccranor Charles E | -- | -- | |

| Mccranor Charles E | $50,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Elias Joan D | $263,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,138 | $555,566 | -- | -- |

| 2024 | $8,983 | $505,060 | -- | -- |

| 2023 | $8,983 | $459,146 | $0 | $0 |

| 2022 | $7,901 | $417,406 | $0 | $0 |

| 2021 | $6,954 | $379,460 | $170,000 | $209,460 |

| 2020 | $6,659 | $363,660 | $160,000 | $203,660 |

| 2019 | $6,389 | $343,910 | $155,000 | $188,910 |

| 2018 | $6,107 | $332,030 | $130,000 | $202,030 |

| 2017 | $5,035 | $298,690 | $150,000 | $148,690 |

| 2016 | $5,482 | $304,620 | $150,000 | $154,620 |

| 2015 | $4,933 | $288,680 | $125,000 | $163,680 |

| 2014 | $4,933 | $283,000 | $125,000 | $158,000 |

Source: Public Records

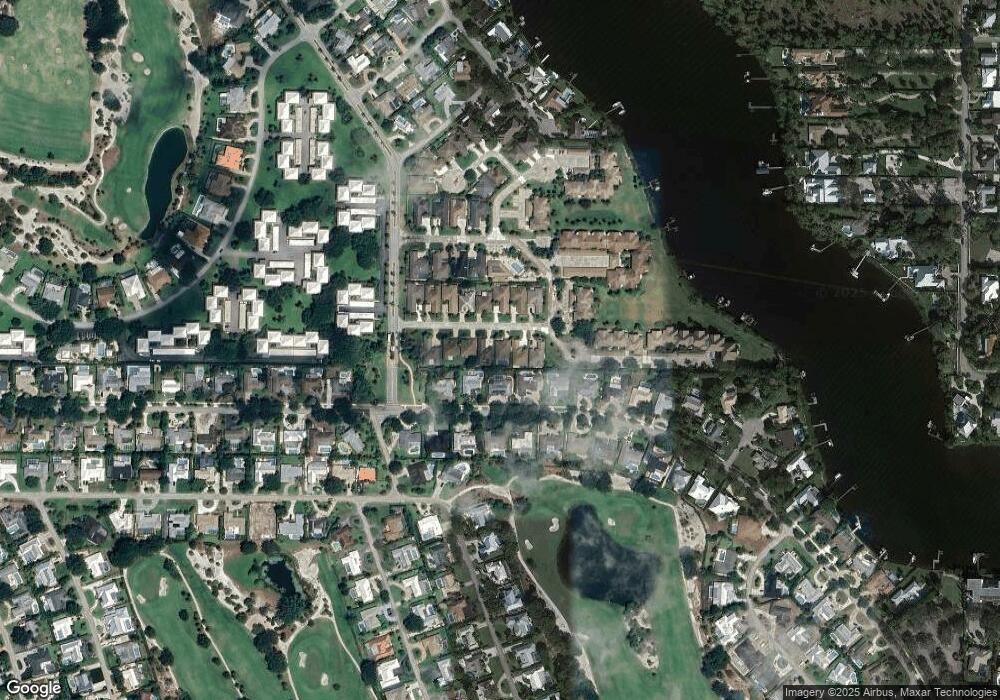

Map

Nearby Homes

- 10459 SE Terrapin Place Unit 101D

- 11 Concourse Dr Unit B

- 10555 SE Terrapin Place Unit F-206

- 19148 SE Sea Turtle Ct

- 16 SE Turtle Creek Dr Unit E

- 325 Fairway N

- 196 SE Turtle Creek Dr

- 351 Country Club Dr

- 10841 SE Arielle Terrace

- 18670 SE Lakeside Way

- 1 SE Turtle Creek Dr Unit A

- 18647 SE Lakeside Way

- 20 SE Turtle Creek Dr Unit F

- 20 Tradewinds Cir

- 18289 SE Heritage Dr

- 24 SE Turtle Creek Dr Unit F

- 18240 SE Heritage Dr

- 8 Leeward Cir

- 19 Leeward Cir

- 18360 SE Lakeside Dr

- 10424 SE Leatherback Terrace

- 10400 SE Leatherback Terrace

- 10435 SE Leatherback Terrace

- 10436 SE Leatherback Terrace

- 294 Country Club Dr

- 10388 SE Leatherback Terrace

- 290 Country Club Dr

- 298 Country Club Dr

- 10387 SE Leatherback Terrace

- 10411 SE Leatherback Terrace

- 10376 SE Leatherback Terrace

- 10423 SE Leatherback Terrace

- 10399 SE Leatherback Terrace

- 286 Country Club Dr

- 10507 SE Terrapin Place Unit E-202

- 10507 SE Terrapin Place Unit E 101

- 10507 SE Terrapin Place Unit E-103

- 10507 SE Terrapin Place Unit E-201

- 10507 SE Terrapin Place Unit 203E

- 10507 SE Terrapin Place Unit 102E