10415 W Briar Oaks Dr Unit A Stanton, CA 90680

West Anaheim NeighborhoodEstimated Value: $541,289 - $574,000

2

Beds

2

Baths

961

Sq Ft

$586/Sq Ft

Est. Value

About This Home

This home is located at 10415 W Briar Oaks Dr Unit A, Stanton, CA 90680 and is currently estimated at $563,322, approximately $586 per square foot. 10415 W Briar Oaks Dr Unit A is a home located in Orange County with nearby schools including Hansen Elementary School, Orangeview Junior High, and Western High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 21, 2017

Sold by

Lee Sang Hee

Bought by

Lee Sang Hee and The Sang Hee Lee Living Trust

Current Estimated Value

Purchase Details

Closed on

Mar 5, 2016

Sold by

Lee Sang Hee

Bought by

Lee Sang Hee and Woman Somin Kim A Single

Purchase Details

Closed on

Mar 13, 2003

Sold by

Wilson Susan F

Bought by

Lee Carl Kwanghyo and Lee Sang Hee

Purchase Details

Closed on

Nov 2, 2000

Sold by

Litchfield Vance and Litchfield Kelly A

Bought by

Wilson Susan F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,710

Interest Rate

7.86%

Mortgage Type

FHA

Purchase Details

Closed on

Apr 28, 1999

Sold by

Kenneth Woods

Bought by

Litchfield Kelly A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lee Sang Hee | -- | None Available | |

| Lee Sang Hee | -- | None Available | |

| Lee Sang Hee | -- | Accommodation | |

| Lee Carl Kwanghyo | $223,000 | Security Union | |

| Wilson Susan F | $143,000 | Benefit Land Title Company | |

| Litchfield Kelly A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wilson Susan F | $138,710 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,013 | $322,967 | $204,763 | $118,204 |

| 2024 | $4,013 | $316,635 | $200,748 | $115,887 |

| 2023 | $3,912 | $310,427 | $196,812 | $113,615 |

| 2022 | $3,836 | $304,341 | $192,953 | $111,388 |

| 2021 | $3,870 | $298,374 | $189,170 | $109,204 |

| 2020 | $3,817 | $295,315 | $187,230 | $108,085 |

| 2019 | $3,716 | $289,525 | $183,559 | $105,966 |

| 2018 | $3,664 | $283,849 | $179,960 | $103,889 |

| 2017 | $3,464 | $278,284 | $176,432 | $101,852 |

| 2016 | $3,448 | $272,828 | $172,973 | $99,855 |

| 2015 | $3,406 | $268,730 | $170,374 | $98,356 |

| 2014 | $3,240 | $263,466 | $167,036 | $96,430 |

Source: Public Records

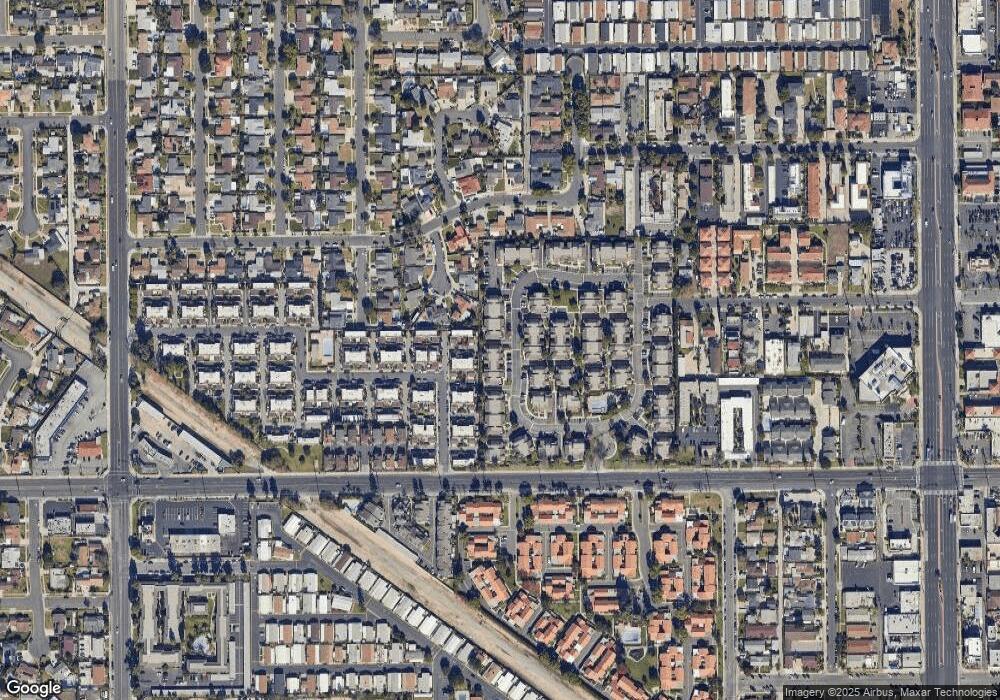

Map

Nearby Homes

- 10393 E Briar Oaks Dr Unit D

- 10420 Vassar Way

- 7850 2nd St

- 10552 Royal Oak Way

- 10626 Braeswood Way

- 10531 Western Ave

- 10550 Western Ave Unit 43

- 10550 Western Ave Unit 56

- 10550 Western Ave Unit 85

- 10550 Western Ave Unit 98

- 3050 W Ball Rd Unit 171

- 3050 W Ball Rd Unit 115B

- 3050 W Ball Rd Unit 127

- 3050 W Ball Rd Unit 132

- 3050 W Ball Rd Unit 82

- 3050 W Ball Rd Unit 200

- 3050 W Ball Rd Unit 152

- 3050 W Ball Rd Unit 88

- 3213 W Sunview Dr

- 10786 Mitchell Dr

- 10415 W Briar Oaks Dr Unit E

- 10415 W Briar Oaks Dr Unit 167

- 10415 W Briar Oaks Dr Unit B

- 10415 W Briar Oaks Dr Unit C

- 10396 W Briar Oaks Dr Unit C

- 10435 W Briar Oaks Dr Unit E

- 10435 W Briar Oaks Dr Unit 173

- 10435 W Briar Oaks Dr Unit 174

- 10396 W Briar Oaks Dr Unit 137

- 10396 W Briar Oaks Dr Unit 139

- 10435 W Briar Oaks Dr Unit B

- 10396 W Briar Oaks Dr Unit E

- 10435 W Briar Oaks Dr Unit 175

- 10396 W Briar Oaks Dr Unit B

- 10435 W Briar Oaks Dr Unit D

- 10396 W Briar Oaks Dr Unit A

- 7710 Wabash Way

- 7711 Purdue Way

- 10416 W Briar Oaks Dr Unit 153

- 10416 W Briar Oaks Dr Unit D