10450 E Briar Oaks Dr Unit C Stanton, CA 90680

West Anaheim NeighborhoodEstimated Value: $564,000 - $711,000

2

Beds

2

Baths

1,073

Sq Ft

$564/Sq Ft

Est. Value

About This Home

This home is located at 10450 E Briar Oaks Dr Unit C, Stanton, CA 90680 and is currently estimated at $605,073, approximately $563 per square foot. 10450 E Briar Oaks Dr Unit C is a home located in Orange County with nearby schools including Hansen Elementary School, Orangeview Junior High, and Western High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 21, 2013

Sold by

Deanda Javier S and Deanda Javier

Bought by

Deanda Javier S

Current Estimated Value

Purchase Details

Closed on

Mar 1, 2011

Sold by

Tyma Steven M

Bought by

Deanda Javier

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$193,500

Outstanding Balance

$133,204

Interest Rate

4.83%

Mortgage Type

New Conventional

Estimated Equity

$471,869

Purchase Details

Closed on

Jan 8, 2007

Sold by

Cartus Relocation Corp

Bought by

Tyma Steven M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$292,000

Interest Rate

6.62%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 11, 2006

Sold by

Kelly Michael J and Kelly Deborah E

Bought by

Cartus Relocation Corp

Purchase Details

Closed on

Nov 21, 2001

Sold by

Kelly Michael J

Bought by

Kelly Michael J and Kelly Deborah E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,000

Interest Rate

7.01%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Deanda Javier S | -- | Wfg Title | |

| Deanda Javier | $215,000 | Western Resources Title | |

| Tyma Steven M | $365,000 | Equity Title Company | |

| Cartus Relocation Corp | -- | Equity Title Company | |

| Kelly Michael J | -- | American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Deanda Javier | $193,500 | |

| Previous Owner | Tyma Steven M | $292,000 | |

| Previous Owner | Kelly Michael J | $110,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,494 | $275,447 | $168,481 | $106,966 |

| 2024 | $3,494 | $270,047 | $165,178 | $104,869 |

| 2023 | $3,406 | $264,752 | $161,939 | $102,813 |

| 2022 | $3,339 | $259,561 | $158,763 | $100,798 |

| 2021 | $3,368 | $254,472 | $155,650 | $98,822 |

| 2020 | $3,321 | $251,863 | $154,054 | $97,809 |

| 2019 | $3,235 | $246,925 | $151,033 | $95,892 |

| 2018 | $3,190 | $242,084 | $148,072 | $94,012 |

| 2017 | $3,085 | $237,338 | $145,169 | $92,169 |

| 2016 | $3,072 | $232,685 | $142,323 | $90,362 |

| 2015 | $3,036 | $229,190 | $140,185 | $89,005 |

| 2014 | $2,891 | $224,701 | $137,439 | $87,262 |

Source: Public Records

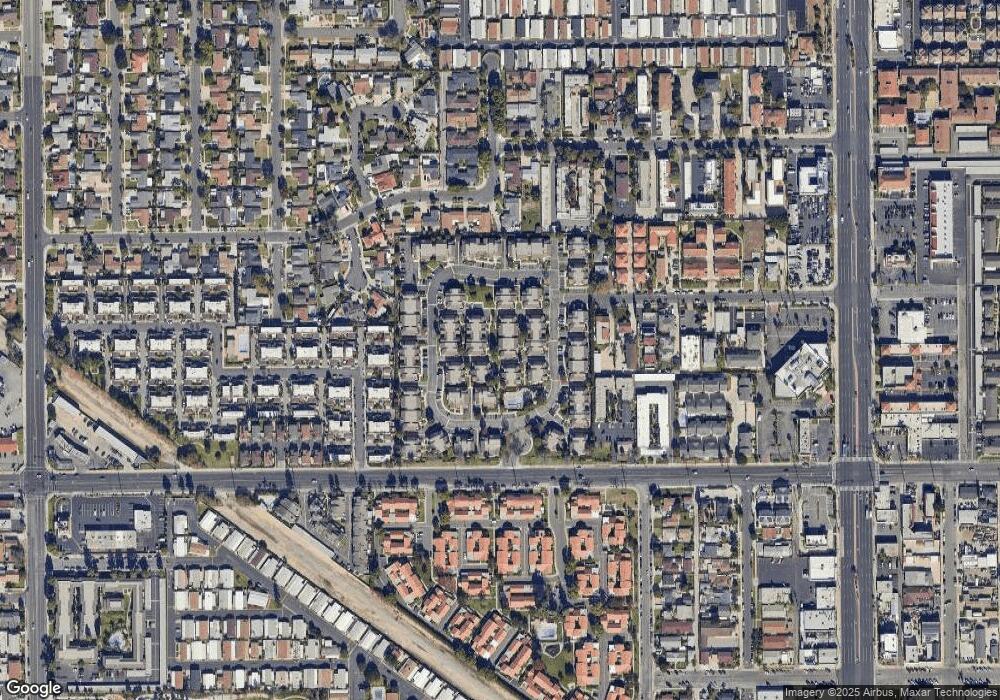

Map

Nearby Homes

- 10393 E Briar Oaks Dr Unit D

- 10526 Carrotwood Way

- 10552 Royal Oak Way

- 7931 1st St

- 7652 Cerritos Ave Unit E

- 7658 Cerritos Ave Unit B

- 10550 Western Ave Unit 86

- 10550 Western Ave Unit 98

- 10550 Western Ave Unit 33

- 10550 Western Ave Unit 32

- 10550 Western Ave

- 10550 Western Ave Unit 128

- 10550 Western Ave Unit 43

- 10550 Western Ave Unit 29

- 3050 W Ball Rd

- 3050 W Ball Rd Unit 88

- 3050 W Ball Rd Unit 58

- 3050 W Ball Rd Unit 132

- 3050 W Ball Rd Unit 82

- 3050 W Ball Rd Unit 195

- 10450 E Briar Oaks Dr Unit A

- 10450 E Briar Oaks Dr Unit D

- 10450 E Briar Oaks Dr Unit E

- 10450 E Briar Oaks Dr Unit B

- 10480 E Briar Oaks Dr

- 10480 E Briar Oaks Dr Unit A

- 10480 E Briar Oaks Dr Unit E

- 10497 W Briar Oaks Dr Unit 4

- 10497 W Briar Oaks Dr Unit D

- 10480 E Briar Oaks Dr Unit B

- 10497 W Briar Oaks Dr Unit A

- 10480 E Briar Oaks Dr Unit C

- 10497 W Briar Oaks Dr Unit B

- 10480 E Briar Oaks Dr Unit D

- 10497 W Briar Oaks Dr Unit E

- 10460 E Briar Oaks Dr

- 10460 E Briar Oaks Dr Unit E

- 10460 E Briar Oaks Dr Unit B

- 10460 E Briar Oaks Dr Unit D

- 10460 E Briar Oaks Dr Unit C