105 157th St Basehor, KS 66007

Estimated Value: $619,000 - $811,000

4

Beds

4

Baths

2,144

Sq Ft

$337/Sq Ft

Est. Value

About This Home

This home is located at 105 157th St, Basehor, KS 66007 and is currently estimated at $723,089, approximately $337 per square foot. 105 157th St is a home located in Leavenworth County with nearby schools including Glenwood Ridge Elementary School, Basehor-Linwood Middle School, and Basehor-Linwood High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 17, 2019

Sold by

Davis Jeff C and Davis Jeffrey C

Bought by

Davis Jeffrey C and Davis Christy L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$469,999

Outstanding Balance

$413,244

Interest Rate

4.1%

Mortgage Type

VA

Estimated Equity

$309,845

Purchase Details

Closed on

May 14, 2018

Sold by

Vontersch James P and Vontersch Jennifer M

Bought by

Davis Jeffrey C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$418,966

Interest Rate

4.4%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Davis Jeffrey C | -- | None Listed On Document | |

| Davis Jeffrey C | $410,586 | Continental Title Co | |

| Davis Jeffrey C | $410,586 | Continental Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Davis Jeffrey C | $469,999 | |

| Previous Owner | Davis Jeffrey C | $418,966 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,273 | $82,931 | $14,784 | $68,147 |

| 2024 | $10,591 | $78,483 | $12,881 | $65,602 |

| 2023 | $10,591 | $76,944 | $11,478 | $65,466 |

| 2022 | $9,885 | $68,575 | $10,264 | $58,311 |

| 2021 | $8,515 | $59,306 | $8,824 | $50,482 |

| 2020 | $7,641 | $52,332 | $8,824 | $43,508 |

| 2019 | $7,556 | $52,332 | $8,831 | $43,501 |

| 2018 | $7,127 | $48,921 | $7,948 | $40,973 |

| 2017 | $7,013 | $47,875 | $7,948 | $39,927 |

| 2016 | $6,908 | $47,369 | $7,948 | $39,421 |

| 2015 | -- | $33,385 | $7,948 | $25,437 |

| 2014 | -- | $10,248 | $7,948 | $2,300 |

Source: Public Records

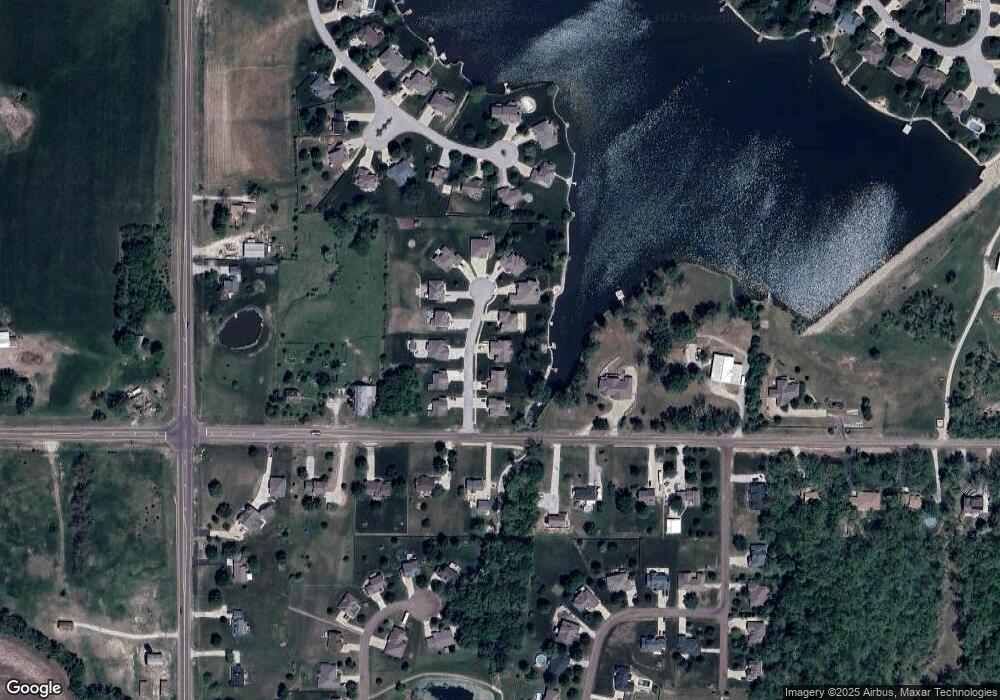

Map

Nearby Homes

- 15733 Evans Rd

- 17891 158th St

- 15471 Cedar Ln

- 15526 Evans Rd

- 15733 Pine Cir

- 15373 Bradfort Ct

- 00000 N 158th St

- 15423 Juniper Ln

- 0000 Knight Rd

- 18625 158th St

- 18650 153rd St

- 0 Kansas Ave

- 18429 166th St

- Lot 15 166th St

- Lot 5 166th St

- Lot 2 166th St

- 15595 Sheridan Ct

- 15601 Sheridan Ct

- 15619 Sheridan Ct

- 15645 Sheridan Ct