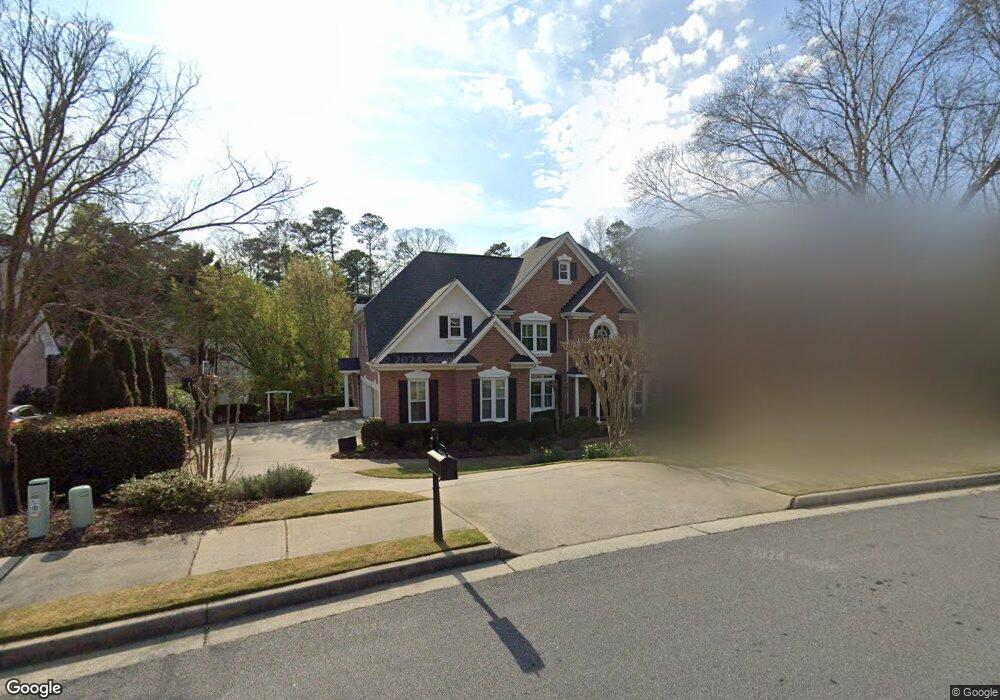

10500 Stanyan St Unit 2 Alpharetta, GA 30022

Estimated Value: $817,000 - $1,247,000

5

Beds

5

Baths

3,939

Sq Ft

$269/Sq Ft

Est. Value

About This Home

This home is located at 10500 Stanyan St Unit 2, Alpharetta, GA 30022 and is currently estimated at $1,058,972, approximately $268 per square foot. 10500 Stanyan St Unit 2 is a home located in Fulton County with nearby schools including Northwood Elementary School, Haynes Bridge Middle School, and Centennial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 18, 2024

Sold by

Trute Matthew A

Bought by

Jenkins Janelle Maree Trust and Matthew Trute

Current Estimated Value

Purchase Details

Closed on

Nov 4, 2013

Sold by

Decouto John A

Bought by

Trute Matthew A and Jenkins Janelle M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$394,500

Interest Rate

3.32%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 15, 1997

Sold by

Osley Bldrs Inc

Bought by

Decouto John A and Decouto Sheree

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$214,600

Interest Rate

6.75%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jenkins Janelle Maree Trust | -- | -- | |

| Trute Matthew A | $577,500 | -- | |

| Decouto John A | $410,300 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Trute Matthew A | $394,500 | |

| Previous Owner | Decouto John A | $214,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,138 | $348,480 | $55,440 | $293,040 |

| 2023 | $8,225 | $291,400 | $80,320 | $211,080 |

| 2022 | $5,140 | $285,520 | $41,800 | $243,720 |

| 2021 | $6,095 | $248,600 | $31,920 | $216,680 |

| 2020 | $6,128 | $239,840 | $34,960 | $204,880 |

| 2019 | $943 | $213,400 | $30,080 | $183,320 |

| 2018 | $5,348 | $208,400 | $29,360 | $179,040 |

| 2017 | $5,085 | $186,560 | $22,640 | $163,920 |

| 2016 | $5,059 | $186,560 | $22,640 | $163,920 |

| 2015 | $5,950 | $186,560 | $22,640 | $163,920 |

| 2014 | $5,132 | $180,160 | $16,920 | $163,240 |

Source: Public Records

Map

Nearby Homes

- 530 Kearny St

- 10530 Haynes Forest Dr

- 225 Wentworth Terrace

- 3195 Waters Mill Dr

- 10421 Park Walk Point

- 3273 Long Indian Creek Ct

- 10280 Crescent Ridge Dr

- 3077 Haynes Trail

- 105 May Glen Way

- 385 Birch Rill Dr

- 3040 Roxburgh Dr

- 305 Birch Rill Dr

- 130 Forrest View Terrace

- 10085 Old Woodland Entry

- 3430 Waters Mill Dr

- 3396 Carverton Ln

- 201 Downing Dr Unit 76

- 10490 Stanyan St

- 10510 Stanyan St

- 575 Kearny St

- 580 Kearny St

- 10525 Stanyan St

- 10515 Stanyan St

- 565 Kearny St

- 565 Kearny St Unit 1

- 10520 Stanyan St

- 300 Stanyan Place

- 570 Kearny St Unit 1

- 10470 Stanyan St

- 10470 Stanyan St

- 340 Stanyan Place

- 10530 Stanyan St

- 560 Kearny St

- 555 Kearny St

- 310 Stanyan Place Unit 2

- 10535 Stanyan St

- 330 Stanyan Place