Estimated Value: $251,636 - $379,000

Studio

--

Bath

1,194

Sq Ft

$247/Sq Ft

Est. Value

About This Home

This home is located at 1054 E Richton Rd, Crete, IL 60417 and is currently estimated at $294,659, approximately $246 per square foot. 1054 E Richton Rd is a home located in Will County with nearby schools including Crete Elementary School, Crete-Monee Middle School, and Crete-Monee High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 21, 2003

Sold by

Guadagno Robert J and Guadagno Mary A

Bought by

Wiater Scott N and Wiater Jan M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$149,000

Outstanding Balance

$69,007

Interest Rate

6.1%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$225,652

Purchase Details

Closed on

Nov 18, 1997

Sold by

Johnson Harold T V and Johnson Hazel Jeannette

Bought by

Guadagno Robert J and Guadagno Mary A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,600

Interest Rate

7.38%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wiater Scott N | $239,000 | Multiple | |

| Guadagno Robert J | $182,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wiater Scott N | $149,000 | |

| Previous Owner | Guadagno Robert J | $145,600 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,617 | $76,845 | $23,833 | $53,012 |

| 2023 | $6,617 | $68,617 | $21,281 | $47,336 |

| 2022 | $5,702 | $60,982 | $18,913 | $42,069 |

| 2021 | $5,587 | $55,834 | $17,316 | $38,518 |

| 2020 | $5,389 | $52,328 | $16,229 | $36,099 |

| 2019 | $5,189 | $49,181 | $15,253 | $33,928 |

| 2018 | $5,112 | $48,123 | $14,925 | $33,198 |

| 2017 | $4,813 | $44,332 | $13,749 | $30,583 |

| 2016 | $4,798 | $44,045 | $13,660 | $30,385 |

| 2015 | $4,721 | $42,866 | $13,294 | $29,572 |

| 2014 | $4,721 | $43,299 | $13,428 | $29,871 |

| 2013 | $4,721 | $45,373 | $14,071 | $31,302 |

Source: Public Records

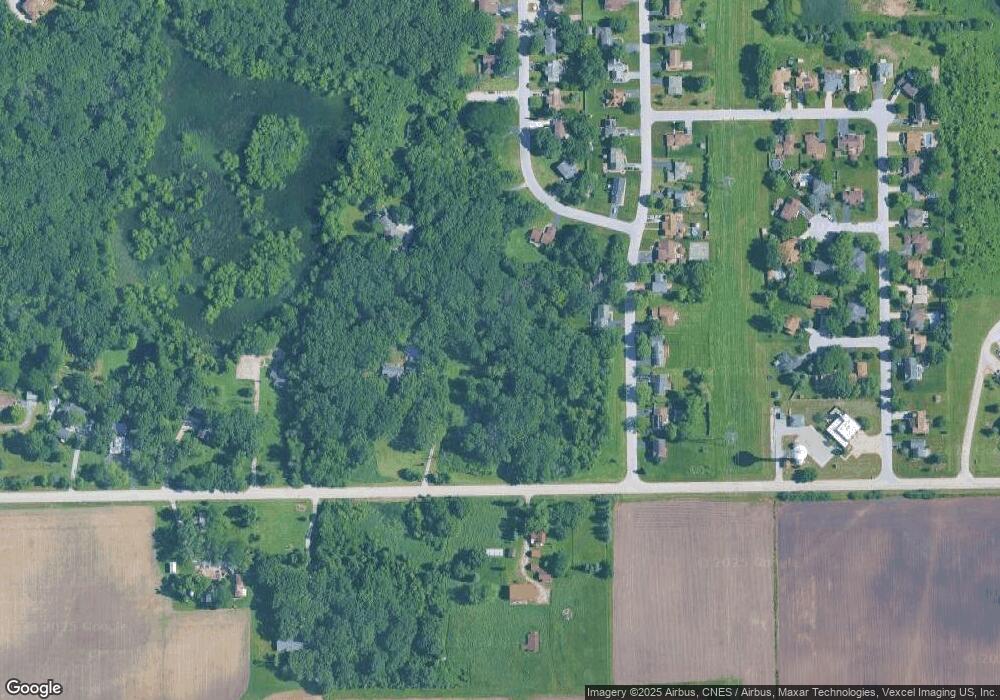

Map

Nearby Homes

- 3618 Ronald Rd

- 944 Carol Ln

- 2701 E Richton Rd

- 25 W Donovan Ct

- 3542 Ronald Rd

- 3685 Ayr Ct

- LOT 1 Beckwith Ln

- 1173 Robert Ln

- 3505 Lyle Ln

- 3518 Jacqueline Dr

- 883 Honey Ln

- 1010 Patricia Ln

- 917 Patricia Ln Unit 89058

- 3433 Huntley Terrace

- Lot# 8 Saint Andrews Dr

- Lot# 10 Saint Andrews Dr

- Lot# 9 Saint Andrews Dr

- Lot#s 8, 9, 10 Saint Andrews Dr

- 621 Huntley Terrace

- 3412 Donovan Dr Unit 1

- 1024 E Richton Rd

- 3714 Ronald Rd

- 3698 Edward Dr

- 3706 Ronald Rd

- 3694 Edward Dr

- 3723 Ronald Rd

- 3715 Ronald Rd

- 3695 Edward Dr

- 3731 Ronald Rd

- 3707 Ronald Rd

- 3694 Ronald Rd

- 3739 Ronald Rd

- 1065 E Richton Rd

- 3703 Ronald Rd

- 3745 Ronald Rd

- 870 Sussex Terrace

- 3690 Ronald Rd

- 3689 Edward Dr

- 3686 Edward Dr

- 3699 Ronald Rd

Your Personal Tour Guide

Ask me questions while you tour the home.