1056 Fallaw Rd Gaston, SC 29053

Estimated Value: $180,000 - $221,786

3

Beds

2

Baths

1,736

Sq Ft

$116/Sq Ft

Est. Value

About This Home

This home is located at 1056 Fallaw Rd, Gaston, SC 29053 and is currently estimated at $201,197, approximately $115 per square foot. 1056 Fallaw Rd is a home located in Lexington County with nearby schools including Sandhills Primary School, Sandhills Elementary School, and Sandhills Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 22, 2021

Sold by

Hopkins Jennifer

Bought by

Dita Catherine W

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,546

Outstanding Balance

$114,871

Interest Rate

2.98%

Mortgage Type

FHA

Estimated Equity

$86,326

Purchase Details

Closed on

Feb 17, 2010

Sold by

Hopkins Christopher

Bought by

Hopkins Jennifer

Purchase Details

Closed on

Oct 17, 2005

Sold by

Rural Land Development Llc

Bought by

Hopkins Christopher and Hopkins Jennifer

Purchase Details

Closed on

Apr 14, 2005

Sold by

Foster Clifton and Prochaska Crystal U

Bought by

Us Bank Na and Bank One

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dita Catherine W | $129,900 | Southeastern Title Company | |

| Hopkins Jennifer | -- | -- | |

| Hopkins Christopher | $1,200 | -- | |

| Us Bank Na | $20,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dita Catherine W | $127,546 | |

| Closed | Dita Catherine W | $127,546 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $607 | $6,600 | $548 | $6,052 |

| 2023 | $601 | $7,450 | $548 | $6,902 |

| 2022 | $3,181 | $7,450 | $548 | $6,902 |

| 2020 | $365 | $786 | $618 | $168 |

| 2019 | $378 | $786 | $618 | $168 |

| 2018 | $366 | $786 | $618 | $168 |

| 2017 | $360 | $786 | $618 | $168 |

| 2016 | $327 | $786 | $618 | $168 |

| 2014 | $310 | $735 | $615 | $120 |

| 2013 | -- | $740 | $620 | $120 |

Source: Public Records

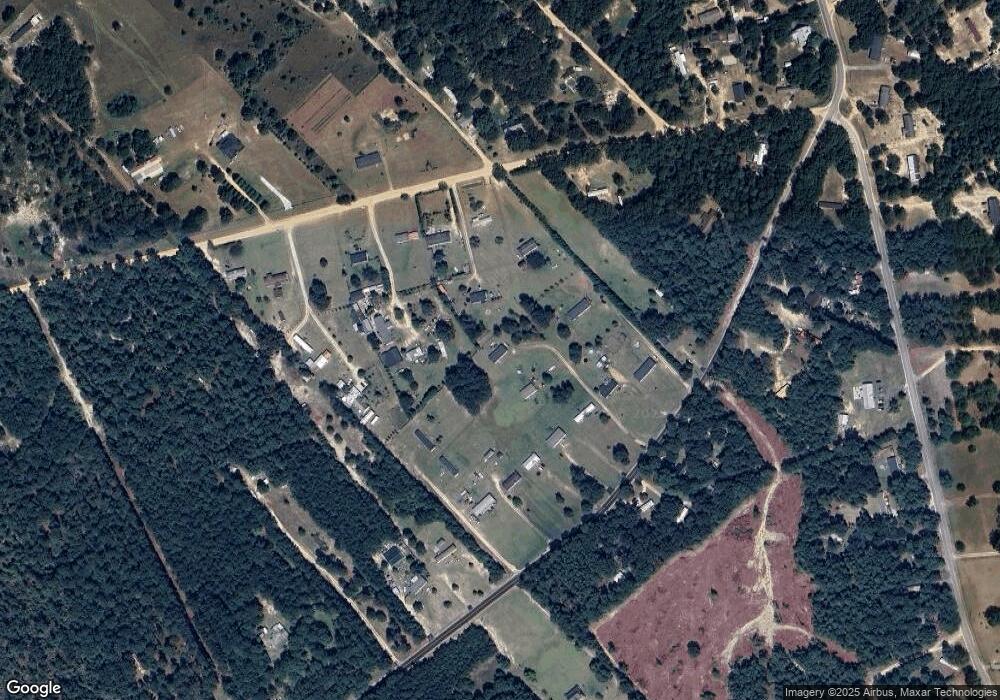

Map

Nearby Homes

- Harper II Plan at Ashrei

- Bentcreek II Plan at Ashrei

- Courtland II Plan at Ashrei

- Driftwood II Plan at Ashrei

- P/O 1375 Fallaw Rd

- 0 Forestbrook Ln

- 177 Glencrest Dr

- 148 Glencrest Dr

- 145 Glencrest Dr

- 0 Sharpes Hill Rd

- 1040 Cassidy Rd

- 438 Meadowfield Rd

- 423 Olive Grouse Ln

- 418 Olive Grouse Ln

- 422 Olive Grouse Ln

- 427 Olive Grouse Ln

- 315 Silver Spur Way

- 410 Olive Grouse Ln

- 405 Olive Grouse Ln

- 2465 Sharpes Hill Rd