106 The Strand Unit 410 Saint Marys, GA 31558

Estimated Value: $586,000 - $713,000

4

Beds

4

Baths

2,578

Sq Ft

$244/Sq Ft

Est. Value

About This Home

This home is located at 106 The Strand Unit 410, Saint Marys, GA 31558 and is currently estimated at $627,835, approximately $243 per square foot. 106 The Strand Unit 410 is a home located in Camden County with nearby schools including Mary Lee Clark Elementary School, Saint Marys Middle School, and Camden County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 8, 2025

Sold by

Griffin Jerlena

Bought by

Jerlena D Griffin Trust and Griffin Jerlena Tr

Current Estimated Value

Purchase Details

Closed on

Nov 5, 2024

Sold by

Egly Jonathan

Bought by

Griffin Jerlena

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$492,000

Interest Rate

6.44%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 9, 2018

Sold by

Bent Pine Construction Co

Bought by

Egly Jonathan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$328,000

Interest Rate

3.93%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 27, 2006

Sold by

Not Provided

Bought by

Bent Pine Construction Co

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jerlena D Griffin Trust | -- | -- | |

| Griffin Jerlena | $615,000 | -- | |

| Egly Jonathan | $410,000 | -- | |

| Bent Pine Construction Co | $102,510 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Griffin Jerlena | $492,000 | |

| Previous Owner | Egly Jonathan | $328,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,280 | $223,739 | $20,000 | $203,739 |

| 2024 | $5,690 | $219,739 | $16,000 | $203,739 |

| 2023 | $5,768 | $202,048 | $16,000 | $186,048 |

| 2022 | $4,514 | $192,850 | $16,000 | $176,850 |

| 2021 | $4,772 | $160,840 | $16,000 | $144,840 |

| 2020 | $4,906 | $158,320 | $24,000 | $134,320 |

| 2019 | $5,033 | $158,320 | $24,000 | $134,320 |

| 2018 | $988 | $151,960 | $18,000 | $133,960 |

| 2017 | $2,541 | $16,000 | $16,000 | $0 |

| 2016 | $479 | $16,000 | $16,000 | $0 |

| 2015 | $464 | $16,000 | $16,000 | $0 |

| 2014 | $462 | $16,000 | $16,000 | $0 |

Source: Public Records

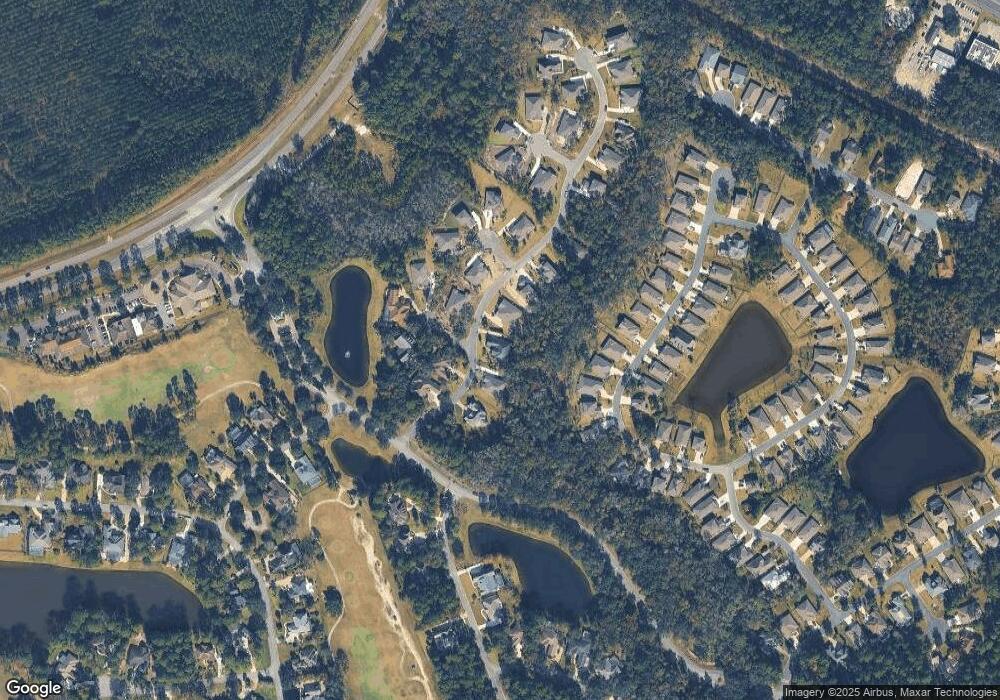

Map

Nearby Homes

- 111 Chinquapin Dr

- 114 Chinquapin Dr

- 202 The Strand

- 101 Encina Ct

- 104 Encina Ct

- 0 Fairways Edge Dr Unit 10631637

- 402 The Strand

- 307 Chinquapin Dr

- 313 Chinquapin Dr

- V/L 504 Holm Place

- 206 Holm Place

- 109 Holm Place

- 107 Holm Place

- 110 Nutgall Dr

- 207 Holm Place

- 5 Sandhill Crane Dr

- 308 Nutgall Dr

- 322 Nutgall Dr

- 535 Cardinal Cir E

- 0 Cedar Hill Dr Unit 10407471

- 106 The Strand

- 106 The Strand Unit 410

- 106 The Strand

- 200 The Strand

- 0 The Strand Unit LOT 401 3146414

- 0 The Strand Unit 394 7032125

- 0 The Strand Unit LOT 400 7050965

- 0 The Strand Unit 398 7249932

- 0 The Strand Unit 390 7249921

- 0 The Strand Unit 397 7282468

- 0 The Strand Unit LOT 409 7338216

- 0 The Strand Unit 409 7387998

- 0 The Strand Unit 390 7387983

- 0 The Strand Unit 409 7448302

- 0 The Strand Unit 390 7448298

- LOT 410 the Strand #410

- 0 The Strand Unit Lot 397 8748532

- 105 The Strand

- 202 The Strand

- 105 The Strand