1062 Crestview Cir Baraboo, WI 53913

Estimated Value: $271,000 - $374,000

3

Beds

3

Baths

2,895

Sq Ft

$119/Sq Ft

Est. Value

About This Home

This home is located at 1062 Crestview Cir, Baraboo, WI 53913 and is currently estimated at $343,111, approximately $118 per square foot. 1062 Crestview Cir is a home located in Sauk County with nearby schools including Baraboo High School, St. Joseph Catholic School, and St. John's Lutheran School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 30, 2012

Sold by

Rod Ronald F and Rod Patricia J

Bought by

Parsons Dennis B and Gruhn Mary A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Outstanding Balance

$101,952

Interest Rate

3.65%

Mortgage Type

New Conventional

Estimated Equity

$241,159

Purchase Details

Closed on

May 19, 2005

Sold by

Luger Timothy J and Luger Kathleen

Bought by

Rod Ronald F and Rod Patricia J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,000

Interest Rate

5.91%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Parsons Dennis B | $224,000 | None Available | |

| Rod Ronald F | $201,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Parsons Dennis B | $150,000 | |

| Previous Owner | Rod Ronald F | $160,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,849 | $229,100 | $45,500 | $183,600 |

| 2024 | $44 | $229,100 | $45,500 | $183,600 |

| 2023 | $2,339 | $229,100 | $45,500 | $183,600 |

| 2022 | $4,457 | $229,100 | $45,500 | $183,600 |

| 2021 | $4,280 | $229,100 | $45,500 | $183,600 |

| 2020 | $4,407 | $195,300 | $40,400 | $154,900 |

| 2019 | $4,957 | $195,300 | $40,400 | $154,900 |

| 2018 | $4,633 | $195,300 | $40,400 | $154,900 |

| 2017 | $4,519 | $195,300 | $40,400 | $154,900 |

| 2016 | $4,277 | $195,300 | $40,400 | $154,900 |

| 2015 | $4,300 | $195,300 | $40,400 | $154,900 |

| 2014 | $4,368 | $195,300 | $40,400 | $154,900 |

Source: Public Records

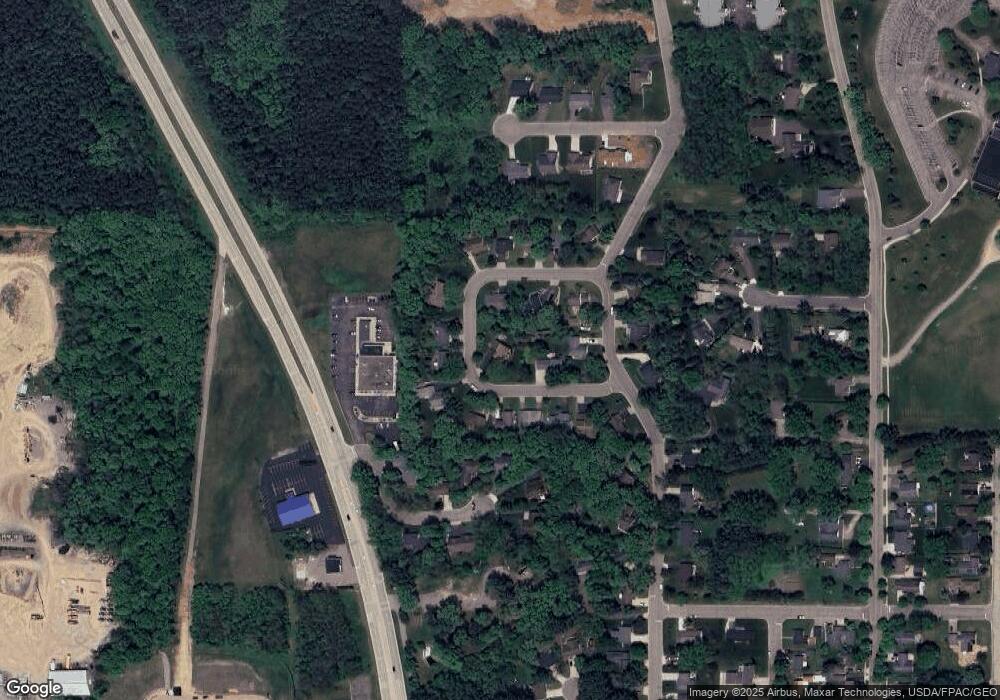

Map

Nearby Homes

- 674 W Mulberry St

- E11220 Birnam Woods Rd

- S4362 Fox Hill Cir

- 831 Island Ct

- S4166 Whispering Pines Dr

- 509 Ernstmeyer Dr

- 604 9th Ave

- 1735 Crawford St Unit 8

- 435 14th Ave

- 515 8th Ave

- E11086 Hatchery Rd

- 602 Eisenhower St

- E10919 Hatchery Rd

- 326 7th Ave

- 616 West St

- 59.04 County Rd W

- 415 2nd Ave

- 405 2nd Ave

- S4166 Crawford St

- 128 Monroe St

- 1060 Crestview Cir

- Lot 8 Crestview Cir

- 1064 Crestview Cir

- 1066 Crestview Cir

- 925 Rosemary Ln

- 1018 Crestview Cir

- 1026 Crestview Cir

- 925 Rosemary Ln

- 1015 Crestview Cir Unit 1016

- 1028 Crestview Cir

- 1020 Crestview Cir

- 949 Rosemary Ln

- 1014 Crestview Cir

- 1022 Crestview Cir

- 1032 Crestview Cir

- 1012 Crestview Cir

- L12 Rosemary Ln

- L10 Rosemary Ln

- 842 Log Lodge Ct

- 1038 Crestview Cir

Your Personal Tour Guide

Ask me questions while you tour the home.