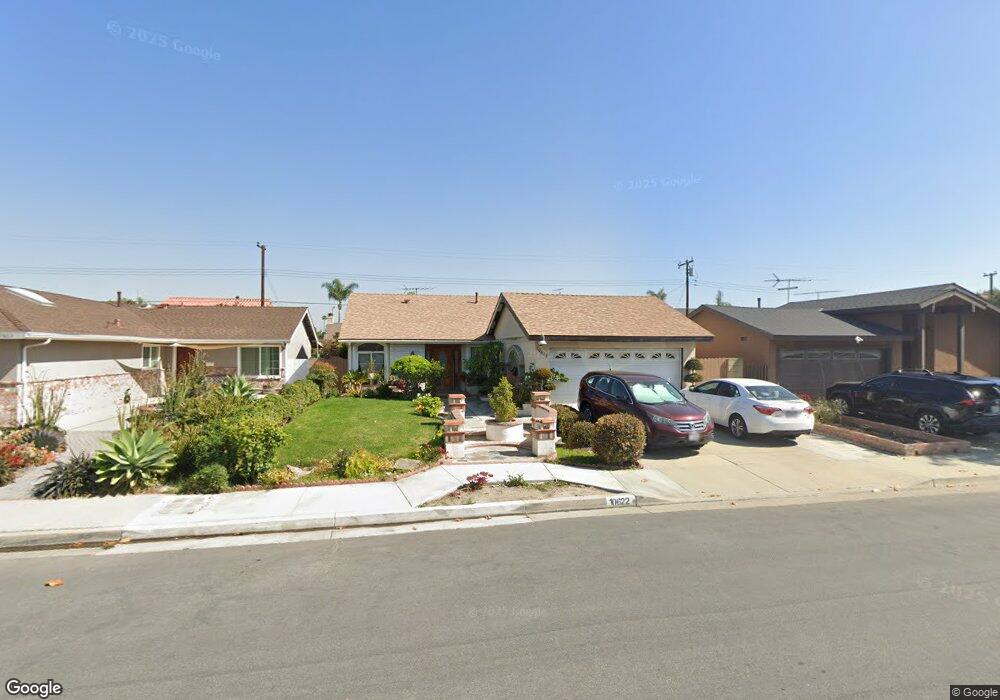

10622 Chestnut St Cypress, CA 90630

Estimated Value: $964,845 - $1,023,000

3

Beds

2

Baths

1,480

Sq Ft

$668/Sq Ft

Est. Value

About This Home

This home is located at 10622 Chestnut St, Cypress, CA 90630 and is currently estimated at $989,211, approximately $668 per square foot. 10622 Chestnut St is a home located in Orange County with nearby schools including Cerritos Elementary School, Orangeview Junior High, and Western High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 27, 2004

Sold by

Zaragosa Chona C and Amolenda Corazon P

Bought by

Zaragosa Chona C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Outstanding Balance

$140,010

Interest Rate

5.65%

Mortgage Type

New Conventional

Estimated Equity

$849,201

Purchase Details

Closed on

Jul 17, 2001

Sold by

Macalalad Benjamin B and Macalalad Perla T

Bought by

Zaragoza Chona C and Amolenda Corazon P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$274,000

Interest Rate

7.09%

Purchase Details

Closed on

Jan 9, 1999

Sold by

Macalalad Benjamin B and Macalalad Perla T

Bought by

Macalalad Benjamin B and Macalalad Perla T

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Zaragosa Chona C | -- | First American Title Co | |

| Zaragoza Chona C | $289,000 | Chicago Title Co | |

| Macalalad Benjamin B | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Zaragosa Chona C | $300,000 | |

| Closed | Zaragoza Chona C | $274,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,945 | $515,587 | $411,633 | $103,954 |

| 2024 | $5,945 | $505,478 | $403,562 | $101,916 |

| 2023 | $5,792 | $495,567 | $395,649 | $99,918 |

| 2022 | $5,677 | $485,850 | $387,891 | $97,959 |

| 2021 | $5,731 | $476,324 | $380,285 | $96,039 |

| 2020 | $5,653 | $471,440 | $376,385 | $95,055 |

| 2019 | $8,187 | $462,197 | $369,005 | $93,192 |

| 2018 | $8,104 | $453,135 | $361,770 | $91,365 |

| 2017 | $5,230 | $444,250 | $354,676 | $89,574 |

| 2016 | $5,207 | $435,540 | $347,722 | $87,818 |

| 2015 | $5,144 | $428,998 | $342,499 | $86,499 |

| 2014 | $4,879 | $420,595 | $335,790 | $84,805 |

Source: Public Records

Map

Nearby Homes

- 10700 Knott Ave

- 10720 Knott Ave

- 3582 W Stonepine Ln Unit 157

- 10684 Bell St

- 10860 Jasmine Ln

- 7160 Cerritos Ave

- 3532 W Stonepine Ln Unit B

- 3583 W Greentree Cir Unit C

- 3512 W Stonepine Ln Unit D

- 3573 W Greentree Cir Unit C

- 11058 Grant Way

- 10410 Hester Ave

- 6837 Amelia Way

- 6657 Lassen Cir

- 7271 Katella Ave Unit 58

- 7271 Katella Ave Unit 101

- 7271 Katella Ave Unit 99

- 11390 Nantucket Ct

- 7336 Ewell Way

- 3213 W Sunview Dr

- 10632 Chestnut St

- 10602 Chestnut St

- 10642 Chestnut St

- 10582 Chestnut St

- 10591 Ritter St

- 10601 Ritter St

- 10581 Ritter St

- 6704 Teakwood St

- 10652 Chestnut St

- 10552 Chestnut St

- 10631 Chestnut St

- 10561 Ritter St

- 10641 Chestnut St

- 6694 Teakwood St

- 10631 Ritter St

- 10662 Chestnut St

- 10532 Chestnut St

- 10651 Chestnut St

- 10551 Ritter St

- 6703 Teakwood St