10815 Newcroft Place Helotes, TX 78023

Cedar Creek NeighborhoodEstimated Value: $450,657 - $498,000

4

Beds

3

Baths

2,556

Sq Ft

$189/Sq Ft

Est. Value

About This Home

This home is located at 10815 Newcroft Place, Helotes, TX 78023 and is currently estimated at $482,664, approximately $188 per square foot. 10815 Newcroft Place is a home located in Bexar County with nearby schools including Los Reyes Elementary School, Garcia Middle School, and O'Connor High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 14, 2015

Sold by

Hilton David R

Bought by

Urrutia Daniel D and Urrutia Jenica M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$305,000

Outstanding Balance

$240,693

Interest Rate

4.13%

Mortgage Type

VA

Estimated Equity

$241,971

Purchase Details

Closed on

Jun 19, 2014

Sold by

Hilton Miranda R

Bought by

Hilton David R

Purchase Details

Closed on

Aug 28, 2012

Sold by

Rh Of Texas Limited Partnership

Bought by

Hilton David R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$265,448

Interest Rate

3.56%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Urrutia Daniel D | -- | Platinum Title | |

| Hilton David R | -- | None Available | |

| Hilton David R | -- | Oak Hills Land Title Agency |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Urrutia Daniel D | $305,000 | |

| Previous Owner | Hilton David R | $265,448 | |

| Closed | Hilton David R | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,703 | $463,750 | $96,300 | $367,450 |

| 2024 | $6,703 | $457,470 | $96,300 | $361,170 |

| 2023 | $6,703 | $426,755 | $96,300 | $355,580 |

| 2022 | $7,880 | $387,959 | $78,890 | $360,310 |

| 2021 | $7,425 | $352,690 | $72,980 | $279,710 |

| 2020 | $7,353 | $341,930 | $72,980 | $268,950 |

| 2019 | $7,430 | $334,580 | $72,980 | $261,600 |

| 2018 | $7,194 | $323,720 | $72,980 | $250,740 |

| 2017 | $7,322 | $328,800 | $72,980 | $255,820 |

| 2016 | $6,992 | $313,980 | $72,980 | $241,000 |

| 2015 | $5,946 | $295,330 | $60,990 | $234,340 |

| 2014 | $5,946 | $275,090 | $0 | $0 |

Source: Public Records

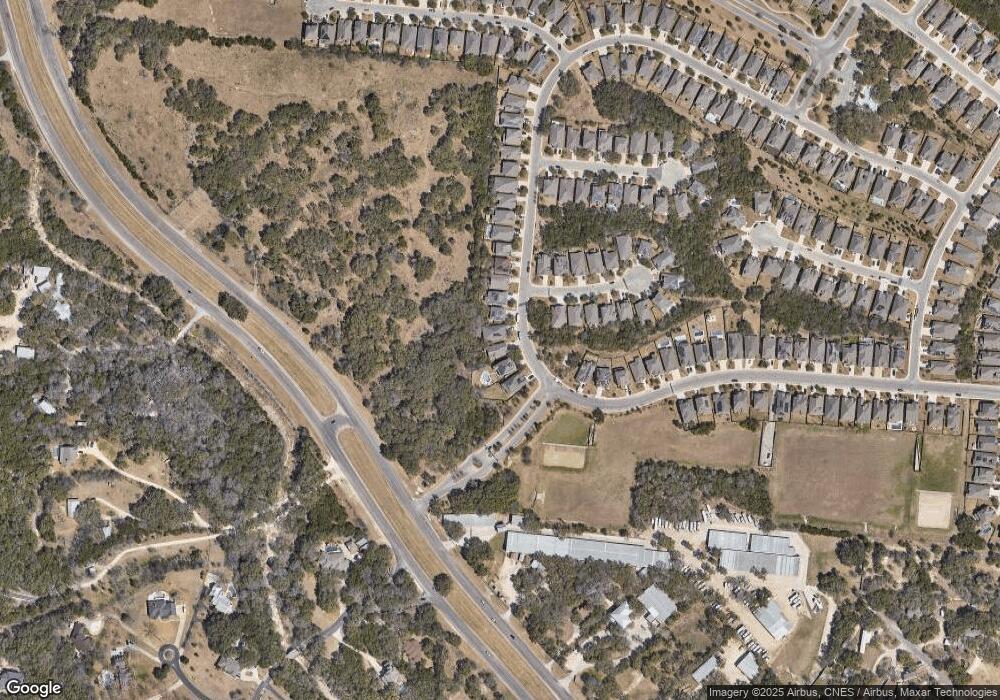

Map

Nearby Homes

- 10811 Newcroft Place

- 10607 Carmona

- 10515 Cima Vista

- 15766 La Subida Trail

- 10330 Salamanca

- 16227 Ondara

- 15921 Reyes Ridge

- 10513 Far Reaches Ln

- 16202 Ondara

- 17132 Bandera Rd

- 10212 Whip o Will Way

- 16812 Fox Ridge

- 0 Bandera Rd

- 15352 Texas Highway 16

- 16523 Loma Landing

- 11215 Indian Caves

- 11228 Cave Creek

- 10096 Whip o Will Way

- 11224 Cave Creek

- 11235 Indian Caves

- 10819 Newcroft Place

- 10823 Newcroft Place

- 10807 Newcroft Place

- 10803 Newcroft Place

- 10755 Newcroft Place

- 10630 Carmona

- 10751 Newcroft Place

- 10626 Carmona

- 10635 Cima Vista

- 10631 Carmona

- 10747 Newcroft Place

- 10622 Carmona

- 10627 Carmona

- 10631 Cima Vista

- 10743 Newcroft Place

- 10623 Carmona

- 10618 Carmona

- 10627 Cima Vista

- 10619 Carmona

- 10739 Newcroft Place