10856 Lydia Estates Dr E Jacksonville, FL 32218

College Park NeighborhoodEstimated Value: $289,000 - $352,000

4

Beds

2

Baths

2,289

Sq Ft

$139/Sq Ft

Est. Value

About This Home

This home is located at 10856 Lydia Estates Dr E, Jacksonville, FL 32218 and is currently estimated at $317,612, approximately $138 per square foot. 10856 Lydia Estates Dr E is a home located in Duval County with nearby schools including Garden City Elementary School, Highlands Middle School, and Jean Ribault High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 6, 2015

Sold by

American Homes 4 Rent Properties Six Llc

Bought by

Amh 2015-1 Borrower Llc

Current Estimated Value

Purchase Details

Closed on

Dec 4, 2013

Sold by

Dacres Samuel D and Dacres Christine B

Bought by

American Homes 4 Rent Properties Llc

Purchase Details

Closed on

Aug 14, 2013

Sold by

Dacres Samuel D and Dacres Christine B

Bought by

American Homes 4 Rent Properties Six Llc

Purchase Details

Closed on

Nov 29, 2012

Sold by

Dacres Samuel D and Dacres Christine B

Bought by

Shoreline Hoas Llc

Purchase Details

Closed on

Nov 15, 2012

Sold by

Dacres Samuel D and Dacres Christine B

Bought by

Terra Mar Property Management Llc

Purchase Details

Closed on

Apr 23, 2007

Sold by

Smith Antwann D

Bought by

Dacres Samuel D and Dacres Christine B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$245,000

Interest Rate

6.1%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 25, 2000

Sold by

D S Ware Homes Llc

Bought by

Smith Antwann D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,104

Interest Rate

7.91%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Amh 2015-1 Borrower Llc | -- | None Available | |

| American Homes 4 Rent Properties Llc | $106,300 | None Available | |

| American Homes 4 Rent Properties Six Llc | $106,300 | Attorney | |

| Shoreline Hoas Llc | $5,200 | None Available | |

| Terra Mar Property Management Llc | $5,200 | None Available | |

| Dacres Samuel D | $245,000 | Gibraltar Title Services | |

| Smith Antwann D | $164,600 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Dacres Samuel D | $245,000 | |

| Previous Owner | Smith Antwann D | $148,104 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,826 | $270,696 | $53,415 | $217,281 |

| 2024 | $4,738 | $259,287 | $50,000 | $209,287 |

| 2023 | $4,738 | $269,961 | $50,000 | $219,961 |

| 2022 | $4,176 | $259,755 | $50,000 | $209,755 |

| 2021 | $3,718 | $201,361 | $40,000 | $161,361 |

| 2020 | $3,462 | $185,598 | $30,000 | $155,598 |

| 2019 | $3,471 | $185,346 | $30,000 | $155,346 |

| 2018 | $3,182 | $165,830 | $30,000 | $135,830 |

| 2017 | $2,942 | $150,746 | $25,000 | $125,746 |

| 2016 | $2,987 | $150,435 | $0 | $0 |

| 2015 | $2,809 | $138,442 | $0 | $0 |

| 2014 | $2,684 | $130,390 | $0 | $0 |

Source: Public Records

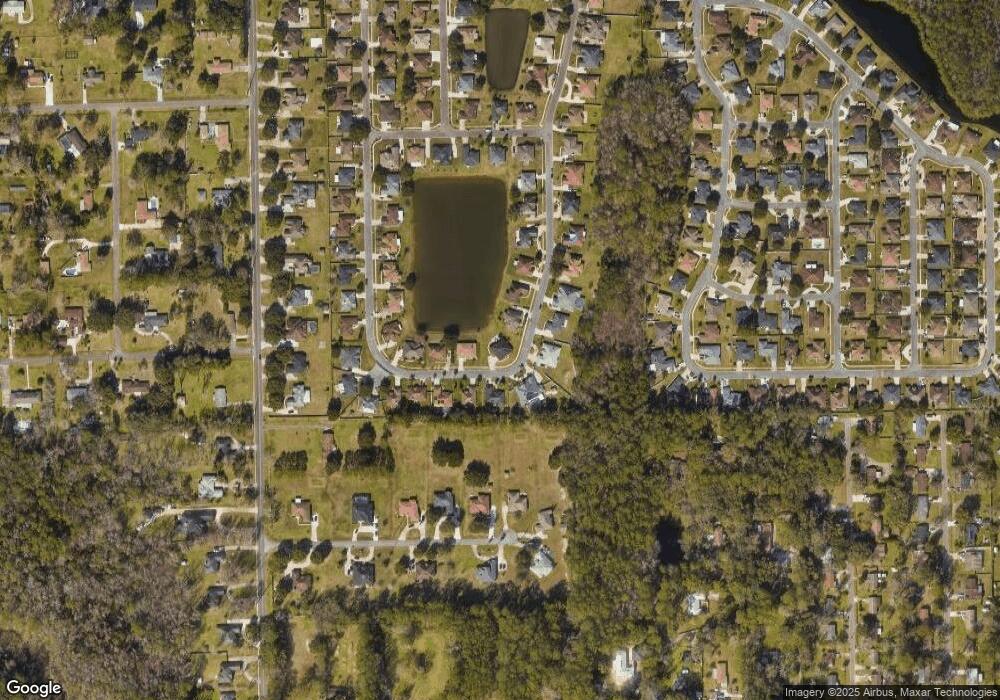

Map

Nearby Homes

- 3620 Antar Ridge Ln

- 3656 Capper Rd

- 10718 Meadow Lea Dr

- 10660 Northwyck Dr

- 10623 Meadowlea Dr

- 3829 Dexter Dr N

- 3269 Penny Cove Ln

- 3843 Bessent Rd

- 11101 Campus Heights Ln

- 11040 Campus Heights Ln

- 3233 Penny Cove Ln

- 3215 Penny Cove Ln

- 10560 Madrone Cove Ct

- 3210 Brookasher Dr

- 3137 Blake Ave

- 3364 Penny Cove Ln

- 3133 Blake Ave

- 10553 Madrone Cove Ct Unit 46

- 10581 Maidstone Cove Dr

- 4266 Key Adam Dr

- 10838 Lydia Estates Dr E

- 10868 Lydia Estates Dr E Unit 3

- 10849 Lydia Estates Dr E

- 10876 Lydia Estates Dr E

- 10830 Lydia Estates Dr E Unit 3

- 10841 Lydia Estates Dr E Unit 3

- 10873 Lydia Estates Dr E

- 10857 Lydia Estates Dr E

- 10833 Lydia Estates Dr E

- 10820 Lydia Estates Dr E

- 10888 Lydia Estates Dr E Unit 3

- 10881 Lydia Estates Dr E

- 10825 Lydia Estates Dr E

- 10833 Lydia Estates Dr

- 10825 Lydia Estates Dr

- 10896 Lydia Estates Dr E

- 10889 Lydia Estates Dr E

- 10817 Lydia Estates Dr E

- 10841 Lydia Estates Dr

- 10849 Lydia Estates Dr