10896 Kristiridge Dr Cincinnati, OH 45252

Estimated Value: $507,000 - $630,000

5

Beds

4

Baths

3,476

Sq Ft

$160/Sq Ft

Est. Value

About This Home

This home is located at 10896 Kristiridge Dr, Cincinnati, OH 45252 and is currently estimated at $555,231, approximately $159 per square foot. 10896 Kristiridge Dr is a home located in Hamilton County with nearby schools including Colerain Elementary School, Colerain Middle School, and Colerain High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 26, 2015

Sold by

Jenkins Kerri A

Bought by

Jenkins Tim C

Current Estimated Value

Purchase Details

Closed on

May 11, 2001

Sold by

Spampinato Mark J and Spampinato Alisa M

Bought by

Jenkins Tim C and Jenkins Kerri A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Interest Rate

6.99%

Mortgage Type

Balloon

Purchase Details

Closed on

Nov 22, 1996

Sold by

Benz Steven A and Benz Marianne B

Bought by

Spampinato Mark J and Spampinato Alisa M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$164,000

Interest Rate

7.94%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jenkins Tim C | -- | Attorney | |

| Jenkins Tim C | $300,000 | -- | |

| Spampinato Mark J | $317,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Jenkins Tim C | $240,000 | |

| Previous Owner | Spampinato Mark J | $164,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,523 | $159,870 | $16,034 | $143,836 |

| 2023 | $8,575 | $159,870 | $16,034 | $143,836 |

| 2022 | $6,724 | $102,215 | $15,278 | $86,937 |

| 2021 | $6,666 | $102,215 | $15,278 | $86,937 |

| 2020 | $6,736 | $102,215 | $15,278 | $86,937 |

| 2019 | $7,213 | $102,215 | $15,278 | $86,937 |

| 2018 | $6,468 | $102,215 | $15,278 | $86,937 |

| 2017 | $6,127 | $102,215 | $15,278 | $86,937 |

| 2016 | $6,066 | $99,880 | $14,077 | $85,803 |

| 2015 | $6,126 | $99,880 | $14,077 | $85,803 |

| 2014 | $6,136 | $99,880 | $14,077 | $85,803 |

| 2013 | $6,146 | $105,137 | $14,819 | $90,318 |

Source: Public Records

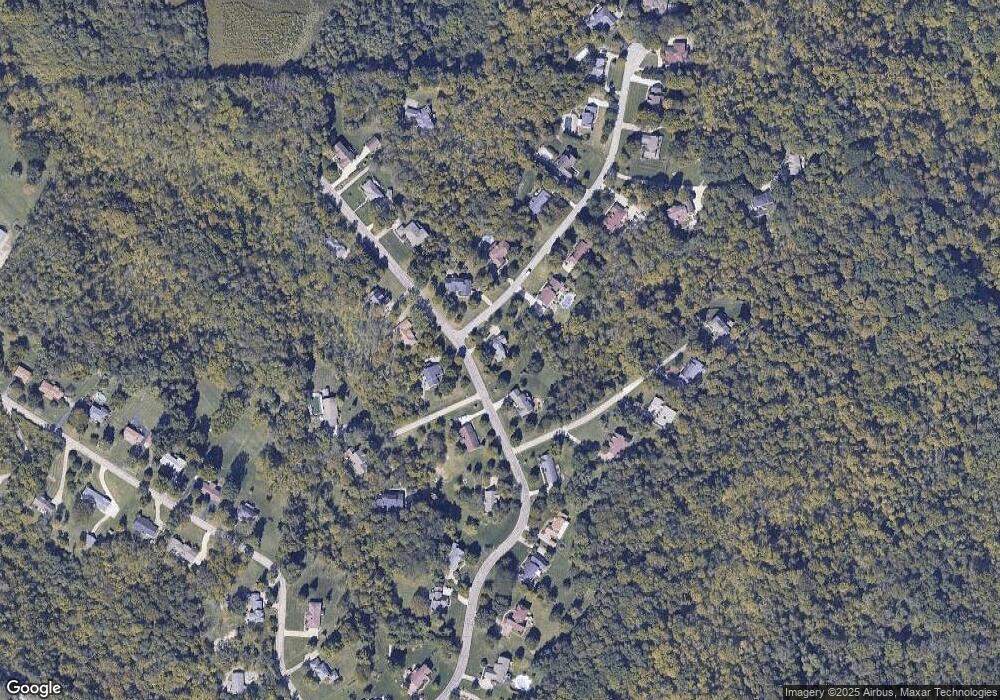

Map

Nearby Homes

- 5567 Day Rd

- 11115 Colerain Ave

- 6037 Dunlap Rd

- 5285 Yeatman Rd

- 10660 Colerain Ave

- 10232 Roppelt Rd

- 0 Miamitrail Ln Unit 1852362

- 10046 Brehm Rd

- 10034 Brehm Rd

- 26 Rylan Dr

- 10391 E Miami River Rd

- 11881 Stone Mill Rd

- 0 Stone Mill Rd Unit 1846428

- 9897 Skyridge Dr

- 10054 Prechtel Rd

- 5077 Pebblevalley Dr

- 10263 Colerain Ave

- 1 Stone Mill Rd

- 9908 Pebbleknoll Dr

- 11970 Stone Mill Rd

- 10880 Kristiridge Dr

- 5689 Krystal Ct

- 5696 Krystal Ct

- 10891 Kristiridge Dr

- 10905 Kristiridge Dr

- 5688 Krystal Ct

- 5681 Krystal Ct

- 10865 Kristiridge Dr

- 10858 Kristiridge Dr

- 5680 Krystal Ct

- 10919 Kristiridge Dr

- 10860 Kristiridge Dr

- 10922 Kristiridge Dr

- 5673 Krystal Ct

- 10862 Kristiridge Dr

- 10845 Kristiridge Dr

- 10864 Kristiridge Dr

- 5672 Krystal Ct

- 10871 Kristiridge Dr

- 10869 Kristiridge Dr