10951 Walmort Rd Wilton, CA 95693

Estimated Value: $619,000 - $1,060,000

4

Beds

2

Baths

2,096

Sq Ft

$410/Sq Ft

Est. Value

About This Home

This home is located at 10951 Walmort Rd, Wilton, CA 95693 and is currently estimated at $860,062, approximately $410 per square foot. 10951 Walmort Rd is a home located in Sacramento County with nearby schools including C.W. Dillard Elementary School, Katherine L. Albiani Middle School, and Pleasant Grove High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 28, 2020

Sold by

Snow Dona E

Bought by

Snow Dona E and The Dona E Snow 2020 Living Tr

Current Estimated Value

Purchase Details

Closed on

Jun 24, 1999

Sold by

Paul Wells Andrew and Wells Carol Wells

Bought by

Snow Richard E and Snow Dona E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$237,500

Outstanding Balance

$63,411

Interest Rate

7.2%

Estimated Equity

$796,651

Purchase Details

Closed on

Jun 17, 1999

Sold by

Paul Wells Andrew

Bought by

Wells Andrew Paul

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$237,500

Outstanding Balance

$63,411

Interest Rate

7.2%

Estimated Equity

$796,651

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Snow Dona E | -- | None Available | |

| Snow Richard E | $250,000 | Fidelity National Title Co | |

| Wells Andrew Paul | -- | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Snow Richard E | $237,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,050 | $388,126 | $230,533 | $157,593 |

| 2024 | $4,050 | $380,516 | $226,013 | $154,503 |

| 2023 | $3,896 | $373,056 | $221,582 | $151,474 |

| 2022 | $3,826 | $365,742 | $217,238 | $148,504 |

| 2021 | $3,795 | $358,572 | $212,979 | $145,593 |

| 2020 | $3,741 | $354,897 | $210,796 | $144,101 |

| 2019 | $3,670 | $347,939 | $206,663 | $141,276 |

| 2018 | $3,530 | $337,686 | $202,611 | $135,075 |

| 2017 | $3,466 | $331,066 | $198,639 | $132,427 |

| 2016 | $3,283 | $324,576 | $194,745 | $129,831 |

| 2015 | $3,218 | $319,701 | $191,820 | $127,881 |

| 2014 | $3,161 | $313,439 | $188,063 | $125,376 |

Source: Public Records

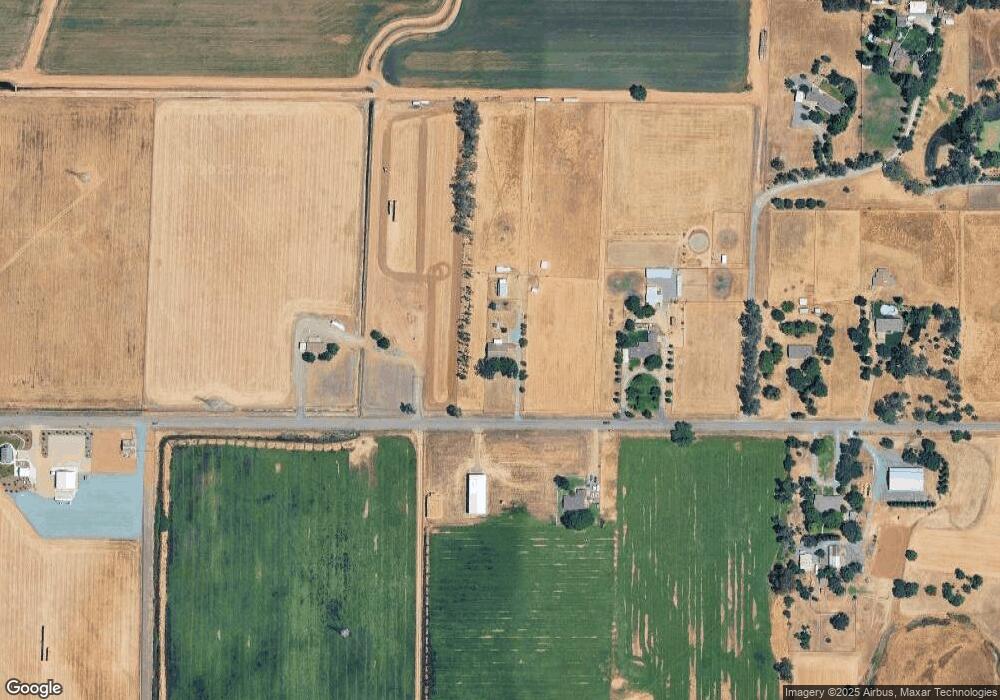

Map

Nearby Homes

- 10600 Colony Rd

- 0 Parcel D Unit 226001796

- 11529 Arno Rd

- 0 Colony Rd Unit 225137072

- 11276 Randolph Rd

- 10307 Alta Mesa Rd

- #1 Alta Mesa Rd

- 0 Blake Rd

- 11835 Hobday Rd

- 9537 Alta Mesa Rd

- 11343-2 Arno Rd

- 11343-4 Arno Rd

- 0 Alta Mesa Rd Unit 224117427

- 10919 Alta Mesa Rd

- 11781 Arno Rd

- 9444 Quintero Ave

- 0 Woods Rd Unit SR25200996

- 12291 Hobday Rd

- 10121 Nebbiolo Ct

- 10112 Nebbiolo Ct

- 10991 Walmort Rd

- 10940 Walmort Rd

- 10861 Walmort Rd

- 11035 Walmort Rd

- 10325 Wilton South Rd

- 11016 Walmort Rd

- 10826 Walmort Rd

- 10315 Wilton South Rd

- 10795 Walmort Rd

- 10341 Wilton South Rd

- 11088 Walmort Rd

- 11109 Walmort Rd

- 11101 Walmort Rd

- 10959 Mann Rd

- 10771 Walmort Rd

- 10974 Mann Rd

- 11133 Walmort Rd

- 11129 Walmort Rd

- 10937 Mann Rd

- 11010 Mann Rd