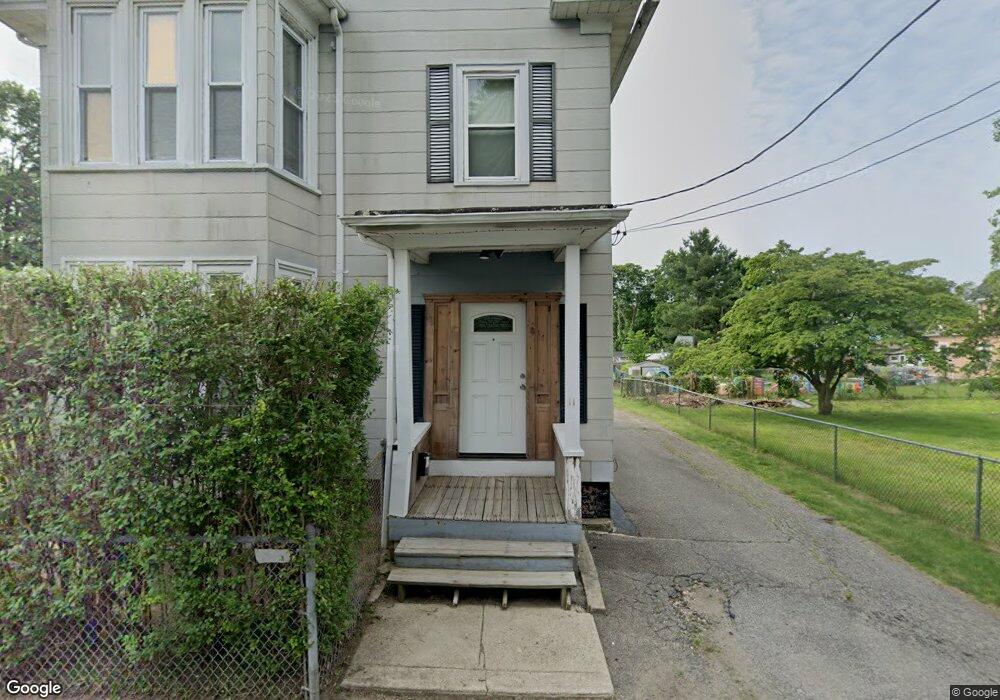

11 Hemlock St Brockton, MA 02302

Clifton Heights NeighborhoodEstimated Value: $619,000 - $767,000

5

Beds

3

Baths

2,807

Sq Ft

$248/Sq Ft

Est. Value

About This Home

This home is located at 11 Hemlock St, Brockton, MA 02302 and is currently estimated at $696,873, approximately $248 per square foot. 11 Hemlock St is a home located in Plymouth County with nearby schools including Gilmore Elementary School, John F. Kennedy Elementary School, and Davis K-8 School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 6, 2011

Sold by

Fhlmc

Bought by

Jardine Erikka R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$156,559

Outstanding Balance

$107,411

Interest Rate

4.99%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$589,462

Purchase Details

Closed on

Jan 19, 2010

Sold by

Winston Kyle T

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Mar 1, 2004

Sold by

William William F and William Margaret B

Bought by

Winston Kyle T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$330,600

Interest Rate

5.65%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jardine Erikka R | $145,000 | -- | |

| Federal National Mortgage Association | $342,100 | -- | |

| Winston Kyle T | $348,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jardine Erikka R | $156,559 | |

| Previous Owner | Winston Kyle T | $313,600 | |

| Previous Owner | Winston Kyle T | $330,600 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,381 | $609,500 | $140,500 | $469,000 |

| 2024 | $7,331 | $609,900 | $140,500 | $469,400 |

| 2023 | $6,917 | $532,900 | $106,500 | $426,400 |

| 2022 | $6,549 | $468,800 | $96,800 | $372,000 |

| 2021 | $5,406 | $372,800 | $80,900 | $291,900 |

| 2020 | $5,775 | $381,200 | $75,300 | $305,900 |

| 2019 | $5,579 | $359,000 | $73,300 | $285,700 |

| 2018 | $5,165 | $321,600 | $73,300 | $248,300 |

| 2017 | $4,914 | $305,200 | $73,300 | $231,900 |

| 2016 | $4,435 | $255,500 | $71,200 | $184,300 |

| 2015 | $3,334 | $183,700 | $71,200 | $112,500 |

| 2014 | $3,327 | $183,500 | $71,200 | $112,300 |

Source: Public Records

Map

Nearby Homes

- 103 Clinton St

- 936 Warren Ave

- 25 Tremont St

- 223 Clinton St Unit 16

- 18 Florence St

- 99 Tribou St Unit 6

- 65 Tremont St

- 21 Forest Ave

- 41 Riverview St

- 33 Menlo St

- 34 Hillberg Ave

- 15 1st St

- 111 Riverview St

- 115 Market St

- 18 Lawrence St

- 20 Custer St

- 23 Ridgeway Ct Unit 23

- 127 Hillberg Ave

- 112 Hillside Ave

- 78 Summer St