110 Sampson Ct Unit 9 Covington, GA 30016

Estimated Value: $287,273 - $329,000

Studio

--

Bath

1,858

Sq Ft

$164/Sq Ft

Est. Value

About This Home

This home is located at 110 Sampson Ct Unit 9, Covington, GA 30016 and is currently estimated at $304,818, approximately $164 per square foot. 110 Sampson Ct Unit 9 is a home located in Newton County with nearby schools including Oak Hill Elementary School, Veterans Memorial Middle School, and Alcovy High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 14, 2025

Sold by

Brown Gloria G

Bought by

Sabatino Sherry G

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,000

Outstanding Balance

$218,672

Interest Rate

6.83%

Mortgage Type

New Conventional

Estimated Equity

$86,146

Purchase Details

Closed on

Apr 19, 2021

Sold by

Craft Home Builders Llc

Bought by

Brown Gloria G

Purchase Details

Closed on

Nov 24, 2017

Sold by

Hard Labor Real Estate Inv

Bought by

Craft Home Builders Llc

Purchase Details

Closed on

Aug 11, 2009

Sold by

Homemax Of Georgia Llc

Bought by

First Piedmont Bank

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sabatino Sherry G | $300,000 | -- | |

| Sabatino Sherry G | $300,000 | -- | |

| Brown Gloria G | $209,900 | -- | |

| Brown Gloria G | $209,900 | -- | |

| Craft Home Builders Llc | $9,000 | -- | |

| Craft Home Builders Llc | $9,000 | -- | |

| First Piedmont Bank | $48,887 | -- | |

| First Piedmont Bank | $48,887 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sabatino Sherry G | $220,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,230 | $132,320 | $15,200 | $117,120 |

| 2024 | $2,092 | $121,840 | $15,200 | $106,640 |

| 2023 | $2,365 | $114,000 | $8,000 | $106,000 |

| 2022 | $1,514 | $82,600 | $8,000 | $74,600 |

| 2021 | $2,394 | $76,960 | $8,000 | $68,960 |

| 2020 | $188 | $5,600 | $5,600 | $0 |

| 2019 | $191 | $5,600 | $5,600 | $0 |

| 2018 | $144 | $4,200 | $4,200 | $0 |

| 2017 | $133 | $3,880 | $3,880 | $0 |

| 2016 | $161 | $4,680 | $4,680 | $0 |

| 2015 | $89 | $960 | $960 | $0 |

| 2014 | $89 | $960 | $0 | $0 |

Source: Public Records

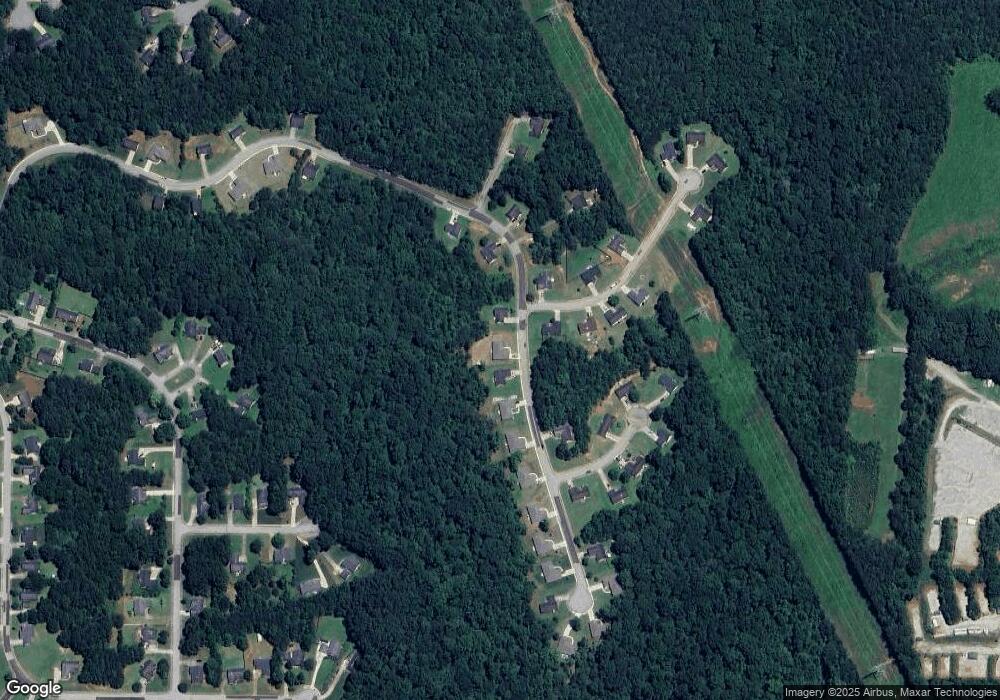

Map

Nearby Homes

- 30 Amber Way

- 125 Sampson Ct

- 195 Sampson Ct

- 20 Clarion Ct

- 45 Saratoga Way

- 45 Edinburgh Ln Unit 2

- 145 Providence Dr

- 768 Wehunt Rd

- 55 the Falls Blvd

- 20 N River Rd

- 1462 Bethany Rd

- 4627 Highway 212

- 255 Hugh Dr

- 50 Butler Bridge Cir

- 31 Butler Bridge Dr

- 110 Chapel Heights Way

- 1024 Bethany Rd

- 1824 Smith Store Rd

- 458 Trousseau Ln

- 130 Goldfinch Dr