1101 E Division St Unit ST2D Lockport, IL 60441

Estimated Value: $179,370 - $227,000

Studio

1

Bath

--

Sq Ft

0.97

Acres

About This Home

This home is located at 1101 E Division St Unit ST2D, Lockport, IL 60441 and is currently estimated at $208,593. 1101 E Division St Unit ST2D is a home located in Will County with nearby schools including Fairmont School, Lockport Township High School East, and Saint Dennis School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 1, 2020

Sold by

Erp Investments Llc

Bought by

1101 Division Llc

Current Estimated Value

Purchase Details

Closed on

Jun 1, 2015

Sold by

Sheehan Christine A

Bought by

Erp Investments Llc

Purchase Details

Closed on

Apr 30, 2015

Sold by

Sheehan Christine A

Bought by

Erp Investments Llc

Purchase Details

Closed on

Sep 6, 2000

Sold by

Robb Michael P

Bought by

Sheehan John W and Sheehan Christine A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$48,000

Interest Rate

7.99%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 30, 1999

Sold by

Knippenburg Julie A and Drake Julie A

Bought by

Robb Michael F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$83,600

Interest Rate

8.25%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 15, 1994

Sold by

First National Bank Of Lockport

Bought by

Knippenberg Julie A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$64,900

Interest Rate

7.5%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| 1101 Division Llc | -- | None Available | |

| Erp Investments Llc | $49,000 | None Available | |

| Erp Investments Llc | $49,000 | None Available | |

| Sheehan John W | $85,500 | First American Title | |

| Robb Michael F | $88,000 | -- | |

| Knippenberg Julie A | $77,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sheehan John W | $48,000 | |

| Previous Owner | Robb Michael F | $83,600 | |

| Previous Owner | Knippenberg Julie A | $64,900 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,246 | $46,587 | $10,474 | $36,113 |

| 2023 | $4,246 | $44,986 | $9,403 | $35,583 |

| 2022 | $4,165 | $42,380 | $8,859 | $33,521 |

| 2021 | $4,042 | $39,827 | $8,325 | $31,502 |

| 2020 | $3,962 | $38,517 | $8,051 | $30,466 |

| 2019 | $3,823 | $36,509 | $7,631 | $28,878 |

| 2018 | $3,883 | $36,509 | $7,631 | $28,878 |

| 2017 | $3,289 | $38,057 | $7,204 | $30,853 |

| 2016 | $3,188 | $36,138 | $7,222 | $28,916 |

| 2015 | $2,359 | $31,838 | $6,363 | $25,475 |

| 2014 | $2,359 | $30,613 | $6,118 | $24,495 |

| 2013 | $2,359 | $33,641 | $6,723 | $26,918 |

Source: Public Records

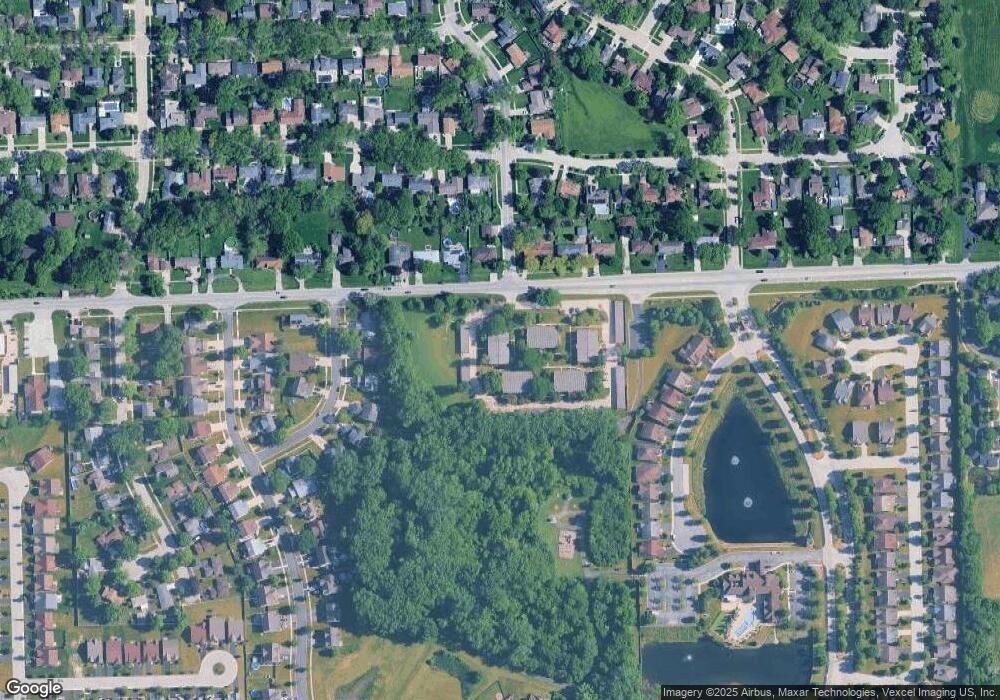

Map

Nearby Homes

- 16901 Ennerdale Ave

- 17221 Fontana Ln

- 827 Read St

- 17009 Mendota Dr

- 17053 Mendota Dr

- 17120 Carlislie Ln

- 17113 Manitoba

- 1015 Grandview Ave

- 17213 Mendota Dr

- 17228 Como Ave

- 1513 Connor Ave

- 1623 East St

- 1330 Lacoma Ct

- 1914 S Austrian Pine St Unit 2

- 605 Gloria St

- 17045 Sterling Dr

- 2005 Princess Ct

- 2009 Princess Ct

- 2021 Princess Ct

- 516 Whelan St

- 1101 E Division St Unit 1D

- 1101 E Division St Unit 2A

- 1101 E Division St Unit ST1A

- 1101 E Division St Unit ST2C

- 1101 E Division St Unit ST2B

- 1101 E Division St Unit ST1C

- 1101 E Division St Unit 1B

- 1101 E Division St Unit 1C

- 1101 E Division St Unit 2D

- 1105 E Division St Unit ST1B

- 1105 E Division St Unit 2B

- 1105 E Division St Unit 3C

- 1105 E Division St Unit 1A

- 1105 E Division St Unit ST3A

- 1105 E Division St Unit 1D

- 1105 E Division St Unit ST1C

- 1105 E Division St Unit ST3D

- 1105 E Division St Unit 2D

- 1105 E Division St Unit ST3B

- 1105 E Division St Unit 2C