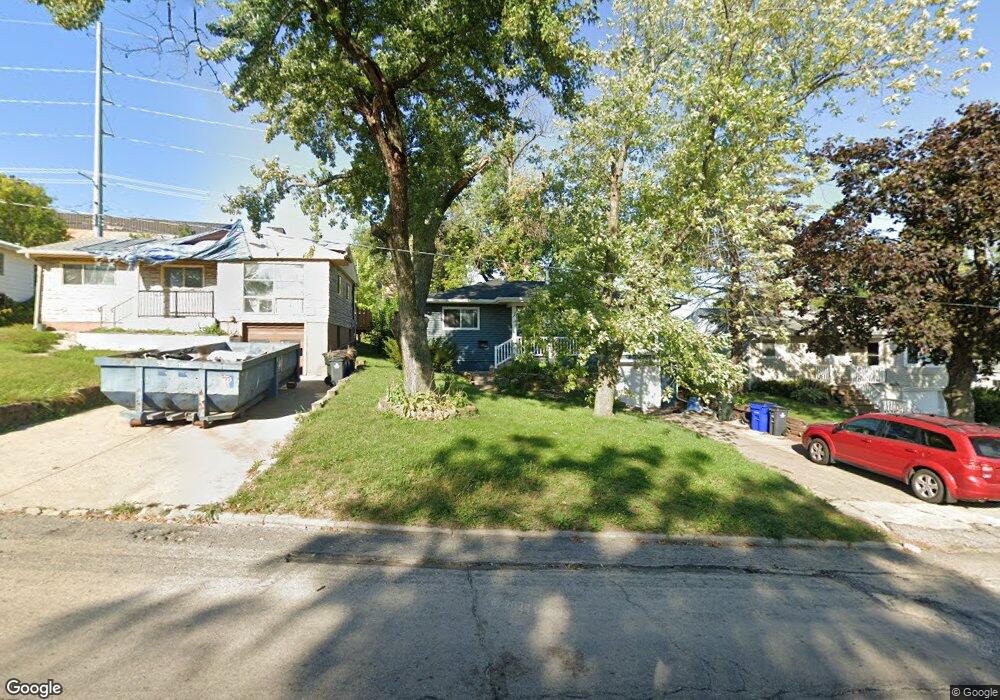

1102 18th St SW Cedar Rapids, IA 52404

Cleveland Area NeighborhoodEstimated Value: $159,000 - $187,000

3

Beds

1

Bath

1,382

Sq Ft

$126/Sq Ft

Est. Value

About This Home

This home is located at 1102 18th St SW, Cedar Rapids, IA 52404 and is currently estimated at $173,912, approximately $125 per square foot. 1102 18th St SW is a home located in Linn County with nearby schools including Junction City Elementary School, Cleveland Elementary School, and Kentucky Tech - Ashland Reg Tech Center.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 23, 2010

Sold by

Shannon Lance D and Shannon Lynn A

Bought by

Drzycimski Andrew J and Drzycimski Melissa J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$87,465

Outstanding Balance

$59,793

Interest Rate

5.62%

Mortgage Type

New Conventional

Estimated Equity

$114,119

Purchase Details

Closed on

Mar 25, 2002

Sold by

Meyer Jerry D and Gilloon Meyer Mary R

Bought by

Shannon Lance D and Shannon Lynn A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$83,194

Interest Rate

6.93%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Drzycimski Andrew J | $102,500 | None Available | |

| Shannon Lance D | $84,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Drzycimski Andrew J | $87,465 | |

| Previous Owner | Shannon Lance D | $83,194 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,540 | $162,200 | $26,700 | $135,500 |

| 2024 | $2,754 | $151,900 | $24,300 | $127,600 |

| 2023 | $2,754 | $143,500 | $24,300 | $119,200 |

| 2022 | $2,426 | $130,600 | $20,600 | $110,000 |

| 2021 | $2,478 | $117,100 | $20,600 | $96,500 |

| 2020 | $2,478 | $112,300 | $19,400 | $92,900 |

| 2019 | $2,214 | $102,700 | $19,400 | $83,300 |

| 2018 | $2,030 | $102,700 | $19,400 | $83,300 |

| 2017 | $1,926 | $92,900 | $19,400 | $73,500 |

| 2016 | $1,926 | $90,600 | $19,400 | $71,200 |

| 2015 | $1,904 | $89,485 | $19,400 | $70,085 |

| 2014 | $1,904 | $92,436 | $19,400 | $73,036 |

| 2013 | $1,924 | $92,436 | $19,400 | $73,036 |

Source: Public Records

Map

Nearby Homes

- 1206 18th St SW

- 1253 20th St SW

- 1818 Holly Meadow Ave SW

- 1812 Holly Meadow Ave SW

- 1807 9th Ave SW

- 1824 Holly Meadow Ave SW

- 1806 Holly Meadow Ave SW

- 1913 Holly Meadow Ave SW

- 1801 Shady Grove Rd SW

- 1832 8th Ave SW

- 1960 Rockford Rd SW Unit 45

- 2178 Chandler St SW

- Remington - Cedar Rapids Plan at Whispering Pines

- Copeland Plan at Whispering Pines

- Meadowbrook - Cedar Rapids Plan at Stags Leap Estates

- Caldwell Plan at Stags Leap Estates

- Concord - Cedar Rapids Plan at Stags Leap Estates

- Yuma Expanded Plan at Whispering Pines

- Becker II Plan at Kirkwood Village - Kirk Wood Village

- Meadowbrook - Cedar Rapids Plan at Whispering Pines

- 1104 18th St SW

- 1106 18th St SW

- 1108 18th St SW

- 1034 18th St SW

- 1719 11th Ave SW

- 1103 18th St SW

- 1716 12th Ave SW

- 1200 18th St SW

- 1030 18th St SW

- 1204 18th St SW

- 1715 11th Ave SW

- 1718 11th Ave SW

- 1712 12th Ave SW

- 1026 18th St SW

- 1721 12th Ave SW

- 1711 11th Ave SW

- 1027 18th St SW

- 1710 12th Ave SW

- 1714 11th Ave SW

- 1022 18th St SW