1102 Cherokee Unit 100 Topanga, CA 90290

Estimated Value: $663,608 - $836,000

2

Beds

2

Baths

1,564

Sq Ft

$477/Sq Ft

Est. Value

About This Home

This home is located at 1102 Cherokee Unit 100, Topanga, CA 90290 and is currently estimated at $745,652, approximately $476 per square foot. 1102 Cherokee Unit 100 is a home located in Los Angeles County with nearby schools including Woodland Hills Academy, Woodland Hills Elementary Charter For Enriched Studies, and Serrania Charter For Enriched Studies.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 22, 2009

Sold by

Federal Deposit Insurance Corporation

Bought by

Jpmorgan Chase Bank National Association

Current Estimated Value

Purchase Details

Closed on

May 21, 2009

Sold by

Jpmorgan Chase Bank Na

Bought by

Ng Keong K

Purchase Details

Closed on

Sep 19, 2008

Sold by

Parker Jennifer

Bought by

Washington Mutual Bank

Purchase Details

Closed on

Apr 19, 2006

Sold by

Ayala Socorro E Lara

Bought by

Parker Jennifer

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$404,550

Interest Rate

8.02%

Mortgage Type

Negative Amortization

Purchase Details

Closed on

Oct 24, 2003

Sold by

Wessler Cindy Lou

Bought by

Ayala Socorro E Lara

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$191,250

Interest Rate

5.37%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 10, 2000

Sold by

Hometown Topanga Lp

Bought by

Schwartz Sally A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jpmorgan Chase Bank National Association | -- | Chicago Title Company | |

| Ng Keong K | $174,000 | Chicago Title Company | |

| Washington Mutual Bank | $258,000 | None Available | |

| Parker Jennifer | $450,000 | Southland Title | |

| Ayala Socorro E Lara | $255,000 | Chicago Title Co | |

| Schwartz Sally A | $63,500 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Parker Jennifer | $404,550 | |

| Previous Owner | Ayala Socorro E Lara | $191,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,069 | $224,052 | $128,767 | $95,285 |

| 2024 | $3,069 | $219,660 | $126,243 | $93,417 |

| 2023 | $2,973 | $215,354 | $123,768 | $91,586 |

| 2022 | $2,788 | $211,133 | $121,342 | $89,791 |

| 2021 | $2,753 | $206,994 | $118,963 | $88,031 |

| 2019 | $2,668 | $200,857 | $115,436 | $85,421 |

| 2018 | $2,575 | $196,920 | $113,173 | $83,747 |

| 2017 | $2,526 | $193,059 | $110,954 | $82,105 |

| 2016 | $2,453 | $189,275 | $108,779 | $80,496 |

| 2015 | $2,416 | $186,433 | $107,146 | $79,287 |

| 2014 | $2,424 | $182,782 | $105,048 | $77,734 |

Source: Public Records

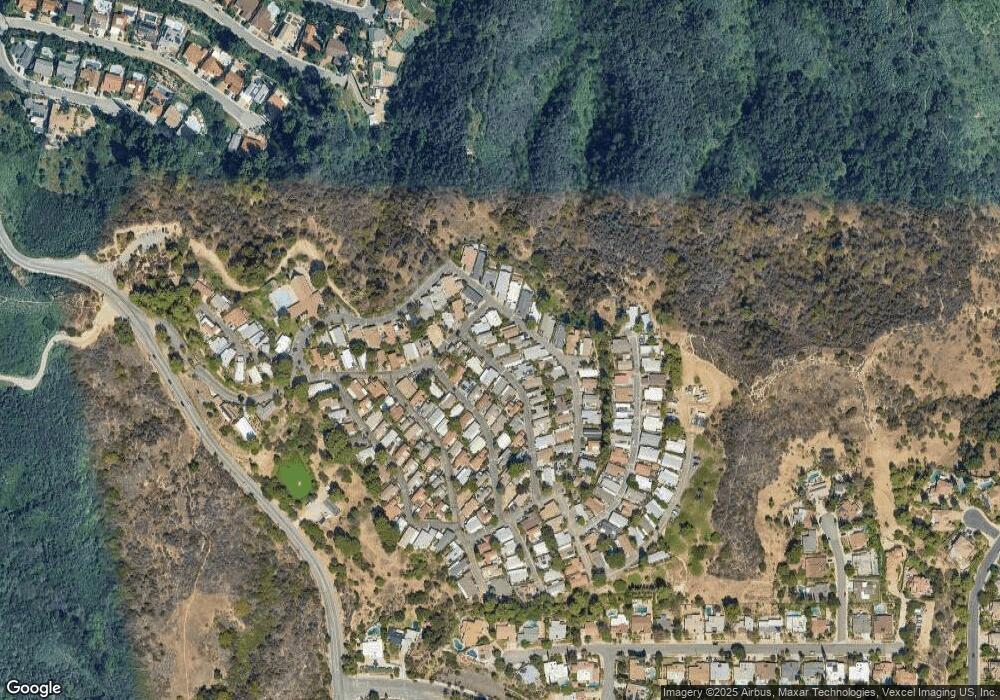

Map

Nearby Homes

- 121 Navajo Ln

- 146 Apache

- 171 Comanche

- 1302 Zuni Ln

- 1165 Cherokee

- 1130 Mohawk

- 120 Navajo Ln

- 1 N Topanga Canyon Blvd

- 3 Ambar Dr

- 21749 Planewood Dr

- 3831 Saint Johnswood Dr

- 3302 Van Allen Place

- 21141 Brunnell Ct

- 21727 Ulmus Dr

- 4120 Carrizal Rd

- 21329 Mulholland Dr

- 4230 Canoga Ave

- 4254 Canoga Ave

- 4260 Canoga Ave

- 4140 Cachalote St

- 145 Apache

- 106 Pawnee Ln Unit B

- 1111 Mohawk Unit A

- 192 Cherokee Unit 91

- 1168 Aztec Unit 141

- 104 Pawnee Ln Unit 16

- 1131 Mohawk

- 182 Comanche

- 1130 Mohawk

- 1173 Aztec Unit 146

- 177 Comanche

- 1133 Mohawk Unit 1133

- 1124 Mohawk Unit 123

- 145 Apache Unit 145

- 1124 Mohawk Unit 124

- 1124 Mohawk

- 100 Pawnee Ln Unit B

- 100 Pawnee Ln Unit A

- 1126 Mohawk