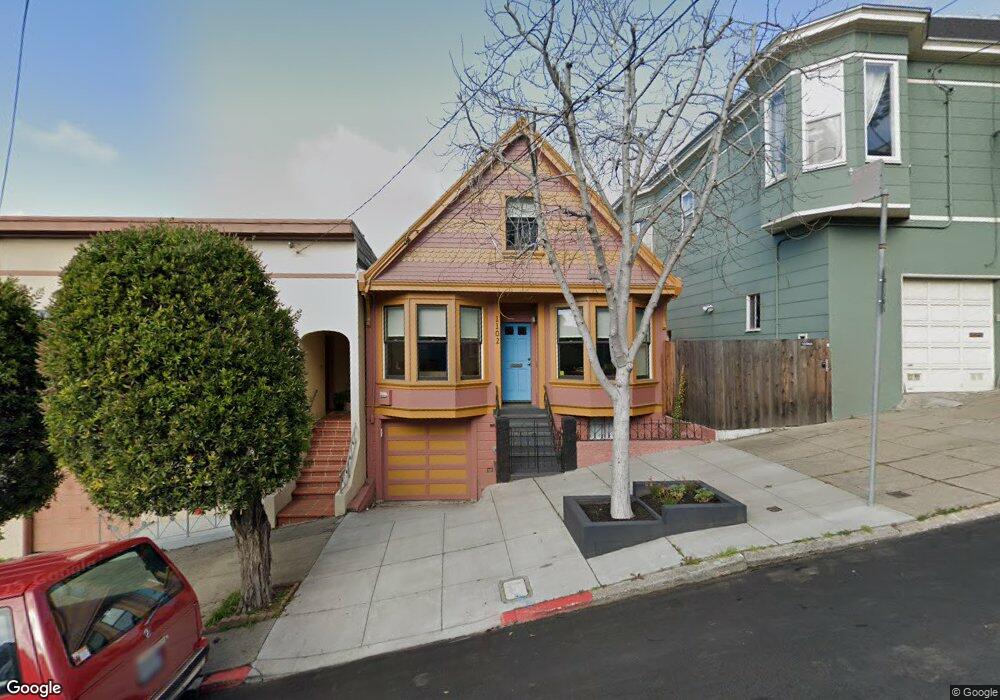

1102 De Haro St San Francisco, CA 94107

Potrero NeighborhoodEstimated Value: $1,093,000 - $1,620,000

2

Beds

2

Baths

838

Sq Ft

$1,570/Sq Ft

Est. Value

About This Home

This home is located at 1102 De Haro St, San Francisco, CA 94107 and is currently estimated at $1,315,303, approximately $1,569 per square foot. 1102 De Haro St is a home located in San Francisco County with nearby schools including Thomas Starr King Elementary School, Aptos Middle School, and The New School of San Francisco.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 11, 2016

Sold by

Hirsch Elizabeth L and Hetherington James F

Bought by

Hirsch Elizabeth L and Hetherington James F

Current Estimated Value

Purchase Details

Closed on

Nov 19, 2010

Sold by

Hirsch Elizabeth L and Hetherington James F

Bought by

Hirsch Elizabeth L and Hetherington James F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$352,000

Outstanding Balance

$120,551

Interest Rate

4.17%

Mortgage Type

New Conventional

Estimated Equity

$1,194,752

Purchase Details

Closed on

Dec 14, 2004

Sold by

Hirsch Elizabeth Lorna and Hetherington James F

Bought by

Hirsch Elizabeth L and Hetherington James F

Purchase Details

Closed on

Nov 10, 1995

Sold by

Warner Susan K and Warner Howard M

Bought by

Hetherington James F and Hirsch Elizabeth Lorna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,000

Interest Rate

8%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hirsch Elizabeth L | -- | None Available | |

| Hirsch Elizabeth L | -- | Fidelity National Title Co | |

| Hirsch Elizabeth L | -- | -- | |

| Hetherington James F | $320,000 | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hirsch Elizabeth L | $352,000 | |

| Closed | Hetherington James F | $256,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,071 | $554,135 | $315,627 | $238,508 |

| 2024 | $7,071 | $543,271 | $309,439 | $233,832 |

| 2023 | $6,956 | $532,620 | $303,372 | $229,248 |

| 2022 | $6,893 | $522,178 | $297,424 | $224,754 |

| 2021 | $6,767 | $511,941 | $291,593 | $220,348 |

| 2020 | $6,863 | $506,694 | $288,604 | $218,090 |

| 2019 | $6,583 | $496,761 | $282,946 | $213,815 |

| 2018 | $6,363 | $487,023 | $277,399 | $209,624 |

| 2017 | $5,989 | $477,475 | $271,960 | $205,515 |

| 2016 | $5,872 | $468,114 | $266,628 | $201,486 |

| 2015 | $5,798 | $461,083 | $262,623 | $198,460 |

| 2014 | $5,647 | $452,053 | $257,479 | $194,574 |

Source: Public Records

Map

Nearby Homes

- 2225 23rd St Unit 214

- 1225 Rhode Island St

- 2023 22nd St

- 1002 Rhode Island St Unit 1

- 2119 22nd St

- 2250 24th St Unit 127

- 1040 Wisconsin St

- 1336-1338 Rhode Island St

- 1145 Wisconsin St

- 1206-1208 Utah St

- 2603 23rd St

- 1812 20th St

- 19 Blair Terrace

- 666 Carolina St Unit 666

- 573 Connecticut St

- 561 Connecticut St

- 631 Carolina St

- 2758 23rd St

- 2758-2760 23rd St

- 700 De Haro St

- 1106 De Haro St

- 1094 De Haro St

- 1112 De Haro St

- 1088 De Haro St

- 1118 De Haro St

- 1082 De Haro St

- 1084 De Haro St

- 1101 Rhode Island St

- 1124 De Haro St

- 1076 De Haro St

- 1115 Rhode Island St

- 1029 Rhode Island St

- 1095 Rhode Island St Unit A

- 1095 Rhode Island St

- 1093 Rhode Island St

- 1130 De Haro St Unit 1132

- 1119 Rhode Island St

- 1027 Rhode Island St

- 1132 De Haro St

- 1070 De Haro St