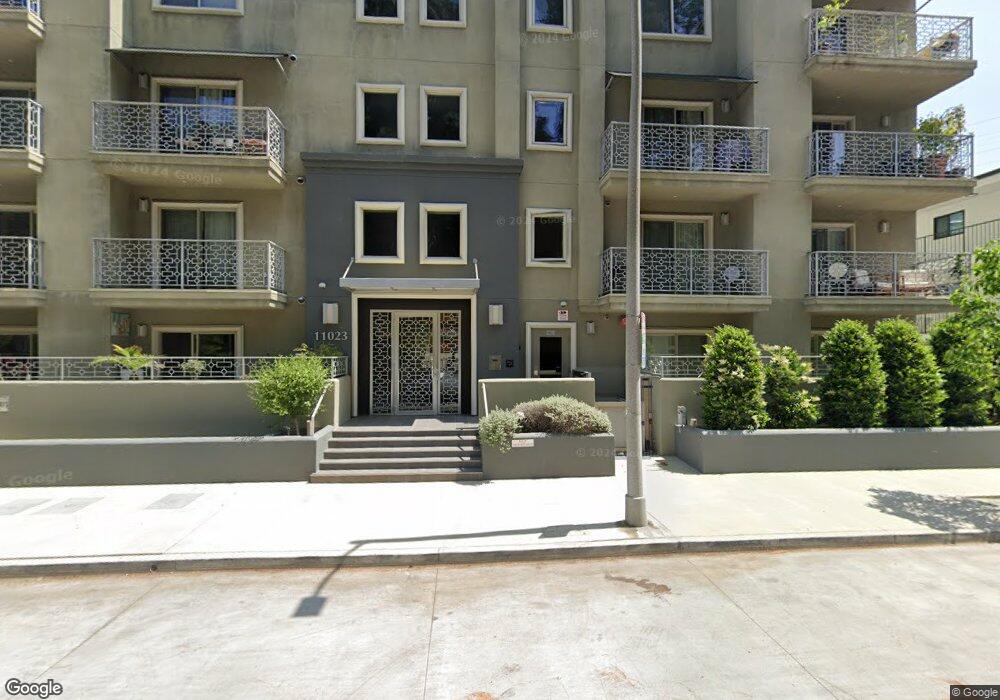

11023 Fruitland Dr Unit 401 Studio City, CA 91604

Estimated Value: $968,931 - $1,186,000

3

Beds

3

Baths

1,705

Sq Ft

$612/Sq Ft

Est. Value

About This Home

This home is located at 11023 Fruitland Dr Unit 401, Studio City, CA 91604 and is currently estimated at $1,042,983, approximately $611 per square foot. 11023 Fruitland Dr Unit 401 is a home located in Los Angeles County with nearby schools including Rio Vista Elementary, Walter Reed Middle, and North Hollywood Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 25, 2015

Sold by

Debruycker Pascal

Bought by

Debruycker Pascal

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$536,250

Outstanding Balance

$409,650

Interest Rate

3.61%

Mortgage Type

New Conventional

Estimated Equity

$633,333

Purchase Details

Closed on

Sep 25, 2013

Sold by

Debruycker Pascal

Bought by

Debruycker Pascal

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$560,000

Interest Rate

4.49%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 25, 2013

Sold by

Choi Jung Mi

Bought by

Debruycker Pascal

Purchase Details

Closed on

Oct 20, 2010

Sold by

The Citron Modern Living Llc

Bought by

Debruycker Pascal and Choi Jung Mi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$675,500

Interest Rate

4.37%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Debruycker Pascal | -- | Ticor Title Company | |

| Debruycker Pascal | -- | Arista National Title | |

| Debruycker Pascal | -- | None Available | |

| Debruycker Pascal | $700,000 | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Debruycker Pascal | $536,250 | |

| Closed | Debruycker Pascal | $560,000 | |

| Previous Owner | Debruycker Pascal | $675,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,740 | $896,809 | $653,393 | $243,416 |

| 2024 | $10,740 | $879,226 | $640,582 | $238,644 |

| 2023 | $10,529 | $861,987 | $628,022 | $233,965 |

| 2022 | $10,033 | $845,086 | $615,708 | $229,378 |

| 2021 | $9,907 | $828,517 | $603,636 | $224,881 |

| 2020 | $10,008 | $820,023 | $597,447 | $222,576 |

| 2019 | $9,606 | $803,945 | $585,733 | $218,212 |

| 2018 | $9,578 | $788,183 | $574,249 | $213,934 |

| 2016 | $9,151 | $757,579 | $551,951 | $205,628 |

| 2015 | $9,017 | $746,201 | $543,661 | $202,540 |

| 2014 | $8,961 | $731,585 | $533,012 | $198,573 |

Source: Public Records

Map

Nearby Homes

- 11023 Fruitland Dr Unit 304

- 3854 Vineland Ave

- 11145 Sunshine Terrace Unit 101

- 10926 Bluffside Dr Unit 3

- 11268 Sunshine Terrace

- 11265 Sunshine Terrace

- 3654 Wrightwood Dr

- 3620 Wrightwood Dr

- 3744 Vineland Ave

- 11316 Sunshine Terrace

- 4189 Vineland Ave Unit 108

- 3684 Willowcrest Ave

- 11230 Dilling St

- 3733 Willowcrest Ave

- 10940 Terryview Dr

- 11138 Aqua Vista St Unit 43

- 11138 Aqua Vista St Unit 63

- 11138 Aqua Vista St Unit 3

- 11138 Aqua Vista St Unit 49

- 11015 Aqua Vista St

- 11023 Fruitland Dr Unit 404

- 11023 Fruitland Dr Unit 403

- 11023 Fruitland Dr Unit 402

- 11023 Fruitland Dr Unit 305

- 11023 Fruitland Dr Unit 303

- 11023 Fruitland Dr Unit 302

- 11023 Fruitland Dr Unit 301

- 11023 Fruitland Dr Unit 204

- 11023 Fruitland Dr Unit 203

- 11023 Fruitland Dr Unit 202

- 11023 Fruitland Dr Unit 201

- 11023 Fruitland Dr Unit 105

- 11023 Fruitland Dr Unit 104

- 11023 Fruitland Dr Unit 103

- 11023 Fruitland Dr Unit 102

- 11023 Fruitland Dr Unit 101

- 11019 Fruitland Dr Unit 3

- 11019 Fruitland Dr

- 11019 Fruitland Dr

- 11019 Fruitland Dr Unit 2