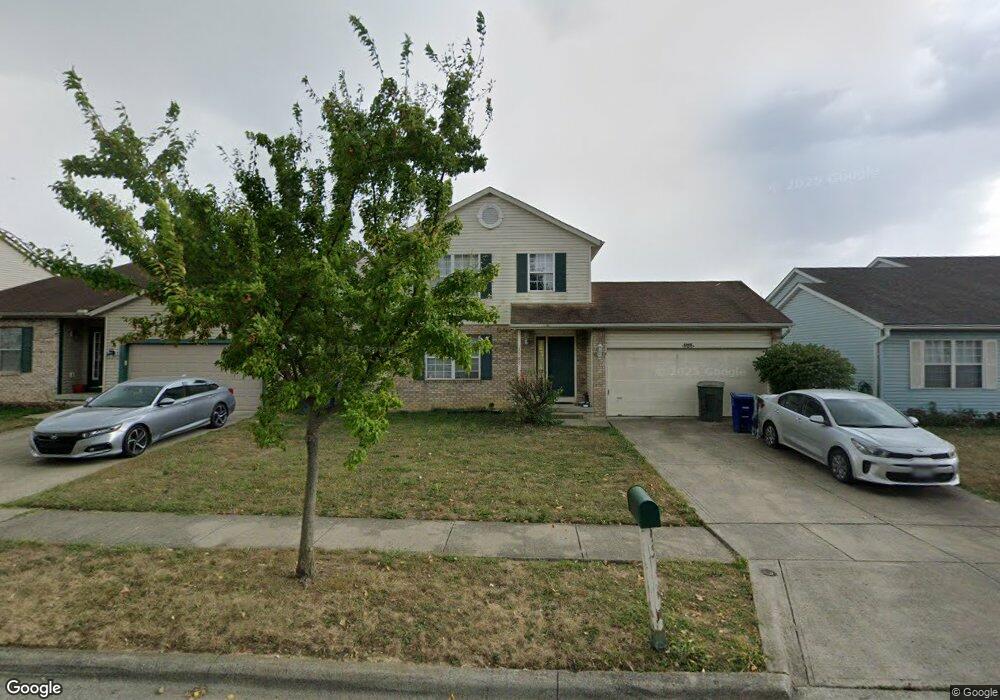

1105 Viewpointe Dr Columbus, OH 43207

Obetz-Lockbourne NeighborhoodEstimated Value: $247,000 - $318,000

3

Beds

3

Baths

1,408

Sq Ft

$198/Sq Ft

Est. Value

About This Home

This home is located at 1105 Viewpointe Dr, Columbus, OH 43207 and is currently estimated at $278,850, approximately $198 per square foot. 1105 Viewpointe Dr is a home located in Franklin County with nearby schools including Hamilton Elementary School, Hamilton Intermediate School, and Hamilton Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 25, 2005

Sold by

Griffiths Susan E and The Susan E Griffiths Revocabl

Bought by

Griffiths Susan E

Current Estimated Value

Purchase Details

Closed on

Apr 28, 2005

Sold by

Griffiths Susan B and Griffiths Susan E

Bought by

Griffiths Susan E and The Susan E Griffiths Revocabl

Purchase Details

Closed on

Apr 2, 1997

Sold by

Deluxe Homes Of Ohio Inc

Bought by

Griffiths Susan B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$107,771

Outstanding Balance

$11,302

Interest Rate

8.05%

Mortgage Type

FHA

Estimated Equity

$267,548

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Griffiths Susan E | -- | -- | |

| Griffiths Susan E | -- | -- | |

| Griffiths Susan E | -- | -- | |

| Griffiths Susan B | $109,400 | Chicago Title West |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Griffiths Susan B | $107,771 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,246 | $84,210 | $22,680 | $61,530 |

| 2024 | $3,246 | $84,210 | $22,680 | $61,530 |

| 2023 | $3,193 | $84,210 | $22,680 | $61,530 |

| 2022 | $1,917 | $45,930 | $8,580 | $37,350 |

| 2021 | $1,949 | $45,930 | $8,580 | $37,350 |

| 2020 | $1,993 | $45,930 | $8,580 | $37,350 |

| 2019 | $1,826 | $38,400 | $7,140 | $31,260 |

| 2018 | $1,871 | $38,400 | $7,140 | $31,260 |

| 2017 | $1,851 | $38,400 | $7,140 | $31,260 |

| 2016 | $1,855 | $36,050 | $6,370 | $29,680 |

| 2015 | $1,928 | $36,050 | $6,370 | $29,680 |

| 2014 | $1,885 | $36,050 | $6,370 | $29,680 |

| 2013 | $967 | $37,975 | $6,720 | $31,255 |

Source: Public Records

Map

Nearby Homes

- 1062 Viewpointe Dr

- 1122 Viewpointe Dr

- 1101 Meadow Ln

- 4451 1/2 Lockbourne Rd Unit R

- 1187 Rendezvous Ln

- 950 Radbourne Dr

- 904 Kyle Ave

- 4455 Catamaran Dr

- 4412 Catamaran Dr

- 4069 Jessamine Place

- 812 Breathitt Ave

- 796 Redford Ave

- 757 Ivorton Rd S

- 3785 S Ohio Ave

- 4410 Holstein Dr

- 1132 Ayrshire Dr

- 4241 Gelbray Ct

- 1559 Obetz Ave

- 4436 Wesley Trail

- 3531 Lockbourne Rd

- 1099 Viewpointe Dr

- 1117 Viewpointe Dr

- 1093 Viewpointe Dr

- 1106 Rendezvous Ln

- 1112 Rendezvous Ln

- 1100 Rendezvous Ln

- 1123 Viewpointe Dr

- 1087 Viewpointe Dr

- 1118 Rendezvous Ln

- 1094 Rendezvous Ln

- 1104 Viewpointe Dr

- 1098 Viewpointe Dr

- 1124 Rendezvous Ln

- 1110 Viewpointe Dr

- 1092 Viewpointe Dr

- 1129 Viewpointe Dr

- 1081 Viewpointe Dr

- 1116 Viewpointe Dr

- 1088 Rendezvous Ln

- 1130 Rendezvous Ln

Your Personal Tour Guide

Ask me questions while you tour the home.