Estimated Value: $396,000 - $422,000

--

Bed

2

Baths

1,247

Sq Ft

$325/Sq Ft

Est. Value

About This Home

This home is located at 11069 E Kilarea Ave Unit 171, Mesa, AZ 85209 and is currently estimated at $405,579, approximately $325 per square foot. 11069 E Kilarea Ave Unit 171 is a home located in Maricopa County with nearby schools including Augusta Ranch Elementary School, Desert Ridge Jr. High School, and Desert Ridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 28, 2025

Sold by

Stein Roger A and Stein Marcia A

Bought by

Rms Trust and Stein

Current Estimated Value

Purchase Details

Closed on

May 2, 2005

Sold by

Brock Shirley Ann

Bought by

Livin Stein Marcia A

Purchase Details

Closed on

Jan 13, 2005

Sold by

Walrath Faith Kay

Bought by

Information Technology Paradigms Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$191,000

Interest Rate

5.67%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 6, 2004

Sold by

Transnation Title Insurance Co

Bought by

Walrath Faith Kay

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,662

Interest Rate

5.82%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rms Trust | -- | None Listed On Document | |

| Stein Roger A | -- | None Listed On Document | |

| Livin Stein Marcia A | $244,900 | Transnation Title | |

| Information Technology Paradigms Inc | $180,946 | -- | |

| Brock Shirley Ann | $239,000 | Transnation Title | |

| Walrath Faith Kay | $180,946 | Transnation Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Brock Shirley Ann | $191,000 | |

| Previous Owner | Walrath Faith Kay | $126,662 | |

| Closed | Walrath Faith Kay | $36,189 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,984 | $26,786 | -- | -- |

| 2024 | $1,925 | $25,511 | -- | -- |

| 2023 | $1,925 | $26,370 | $5,270 | $21,100 |

| 2022 | $1,878 | $25,760 | $5,150 | $20,610 |

| 2021 | $2,034 | $24,270 | $4,850 | $19,420 |

| 2020 | $1,999 | $21,650 | $4,330 | $17,320 |

| 2019 | $1,852 | $20,520 | $4,100 | $16,420 |

| 2018 | $1,763 | $19,660 | $3,930 | $15,730 |

| 2017 | $1,708 | $18,130 | $3,620 | $14,510 |

| 2016 | $1,796 | $17,750 | $3,550 | $14,200 |

| 2015 | $1,655 | $17,360 | $3,470 | $13,890 |

Source: Public Records

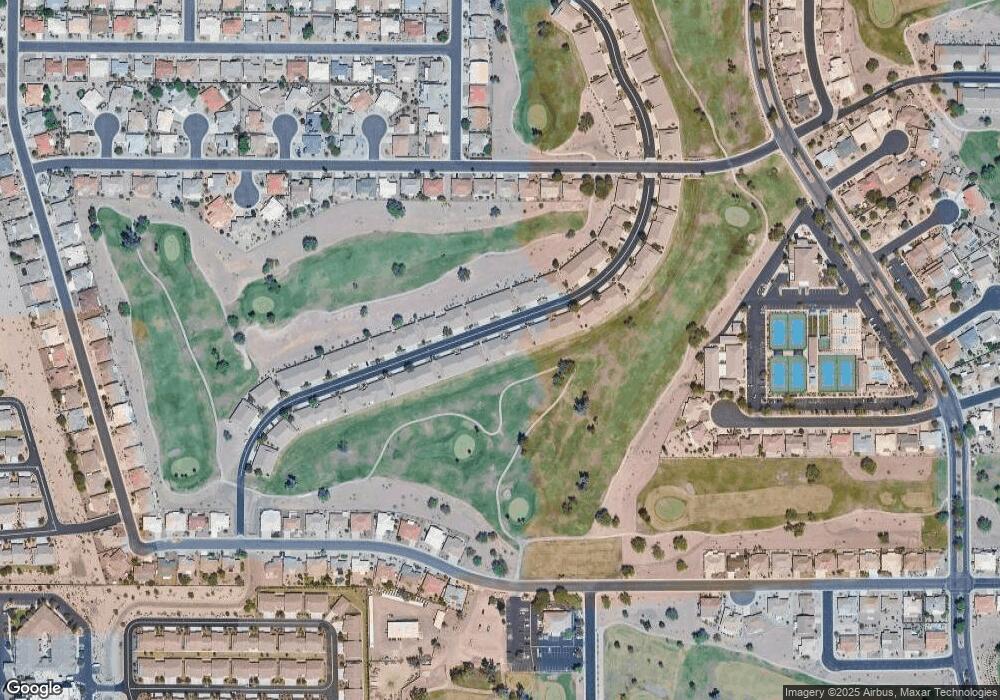

Map

Nearby Homes

- 11069 E Kilarea Ave Unit 111

- 11069 E Kilarea Ave Unit 186

- 11069 E Kilarea Ave Unit 198

- 11069 E Kilarea Ave Unit 128

- 11069 E Kilarea Ave Unit 194

- 11069 E Kilarea Ave Unit 114

- 11205 E Laguna Azul Cir

- 11068 E Kilarea Ave Unit 143

- 2153 S Cherrywood Cir

- 11259 E Laguna Azul Cir

- 11303 E Laguna Azul Cir

- 11259 E Medina Ave

- 10964 E Keats Ave

- 11360 E Keats Ave Unit 92

- 11360 E Keats Ave Unit 20

- 11360 E Keats Ave Unit 51

- 11360 E Keats Ave Unit 4

- 11360 E Keats Ave Unit 72

- 11360 E Keats Ave Unit 70

- 10865 E Keats Ave

- 11069 E Kilarea Ave Unit 133

- 11069 E Kilarea Ave Unit 203

- 11069 E Kilarea Ave Unit 188

- 11069 E Kilarea Ave Unit 170

- 11069 E Kilarea Ave Unit 176

- 11069 E Kilarea Ave Unit 136

- 11069 E Kilarea Ave Unit 135

- 11069 E Kilarea Ave Unit 134

- 11069 E Kilarea Ave Unit 129

- 11069 E Kilarea Ave Unit 109

- 11069 E Kilarea Ave Unit 106

- 11069 E Kilarea Ave Unit 166

- 11069 E Kilarea Ave Unit 184

- 11069 E Kilarea Ave Unit 201

- 11069 E Kilarea Ave Unit 139

- 11069 E Kilarea Ave Unit 118

- 11069 E Kilarea Ave Unit 156

- 11069 E Kilarea Ave Unit 152

- 11069 E Kilarea Ave Unit 183

- 11069 E Kilarea Ave Unit 182