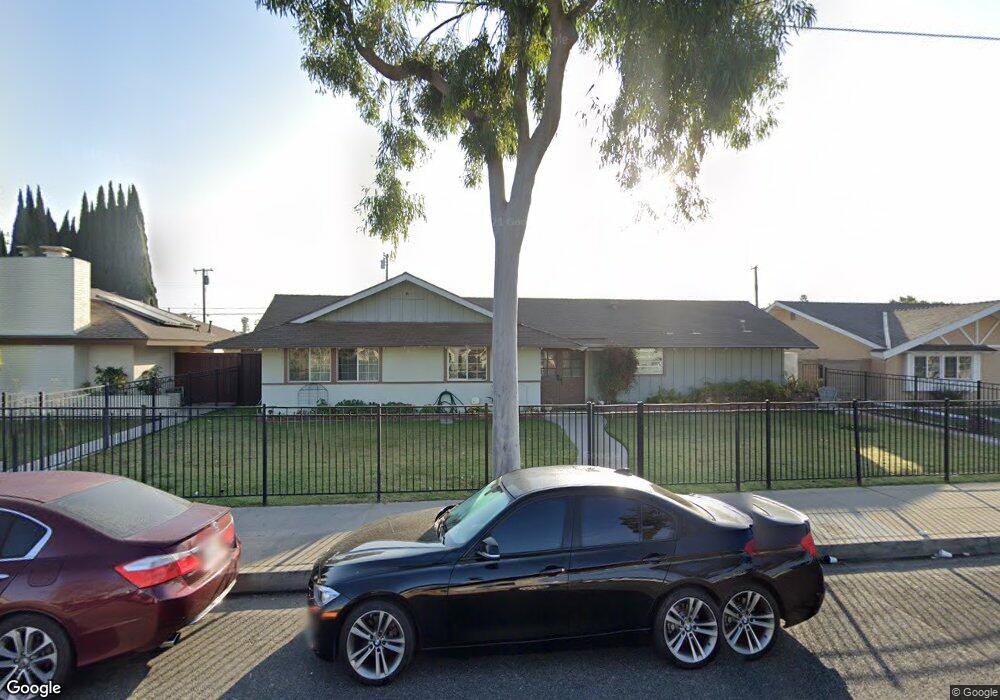

11132 Gilbert St Garden Grove, CA 92841

Estimated Value: $1,048,000 - $1,307,000

4

Beds

2

Baths

1,878

Sq Ft

$621/Sq Ft

Est. Value

About This Home

This home is located at 11132 Gilbert St, Garden Grove, CA 92841 and is currently estimated at $1,166,572, approximately $621 per square foot. 11132 Gilbert St is a home located in Orange County with nearby schools including Gilbert Elementary School, Lake Intermediate School, and Rancho Alamitos High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 16, 2004

Sold by

Kahadawaarachchi Umendra

Bought by

Moses Roland and Kahadawaarachchi Umendra

Current Estimated Value

Purchase Details

Closed on

Mar 5, 2004

Sold by

Moses Roland

Bought by

Kahadawaarachchi Umendra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Outstanding Balance

$187,989

Interest Rate

5.75%

Mortgage Type

New Conventional

Estimated Equity

$978,583

Purchase Details

Closed on

Feb 18, 2003

Sold by

Pehr Charles

Bought by

Moses Roland and Kahadawaarachchi Umendra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Interest Rate

5.82%

Purchase Details

Closed on

Feb 4, 1994

Sold by

Pehr Herbert and Pehr Alice M

Bought by

Pehr Herbert and Pehr Alice M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Moses Roland | -- | -- | |

| Kahadawaarachchi Umendra | -- | Commonwealth Land Title | |

| Moses Roland | $375,000 | Chicago Title Co | |

| Pehr Herbert | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kahadawaarachchi Umendra | $400,000 | |

| Closed | Moses Roland | $300,000 | |

| Closed | Moses Roland | $37,450 | |

| Closed | Kahadawaarachchi Umendra | $50,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,641 | $543,116 | $421,506 | $121,610 |

| 2024 | $6,641 | $532,467 | $413,241 | $119,226 |

| 2023 | $6,517 | $522,027 | $405,138 | $116,889 |

| 2022 | $6,421 | $511,792 | $397,194 | $114,598 |

| 2021 | $6,358 | $501,757 | $389,406 | $112,351 |

| 2020 | $6,286 | $496,613 | $385,414 | $111,199 |

| 2019 | $6,131 | $486,876 | $377,857 | $109,019 |

| 2018 | $6,031 | $477,330 | $370,448 | $106,882 |

| 2017 | $5,948 | $467,971 | $363,184 | $104,787 |

| 2016 | $5,652 | $458,796 | $356,063 | $102,733 |

| 2015 | $5,582 | $451,905 | $350,715 | $101,190 |

| 2014 | $5,391 | $443,053 | $343,845 | $99,208 |

Source: Public Records

Map

Nearby Homes

- 9552 Dewey Dr

- 9592 Katella Ave

- 9762 Gamble Ave

- 11432 Pollard Dr

- 9262 Joyzelle Dr

- 9751 Oma Place

- 11172 Homeway Dr

- 11421 Barclay Dr

- 9881 Aldgate Ave

- 90093 Stacie Ln

- 1765 S Biscayne Ct

- 11222 Magnolia St

- 8971 Poinsettia Ln

- 9041 Stacie Ln Unit 12

- 9155 Pacific Ave Unit 265

- 9901 Royal Palm Blvd

- 10112 Becca Dr

- 9272 Cerritos Ave

- 9041 Shelley Dr

- 1737 S Garden Dr

- 11122 Gilbert St

- 11142 Gilbert St

- 11131 Endry St

- 11152 Gilbert St

- 11112 Gilbert St

- 11141 Endry St

- 11161 Gilbert St

- 11151 Endry St

- 11151 Gilbert St

- 11162 Gilbert St

- 11165 Gilbert St

- 11102 Gilbert St

- 11128 Endry St

- 11111 Gilbert St

- 11161 Endry St

- 11171 Gilbert St

- 11182 Gilbert St

- 11092 Gilbert St

- 11091 Gilbert St

- 11171 Endry St