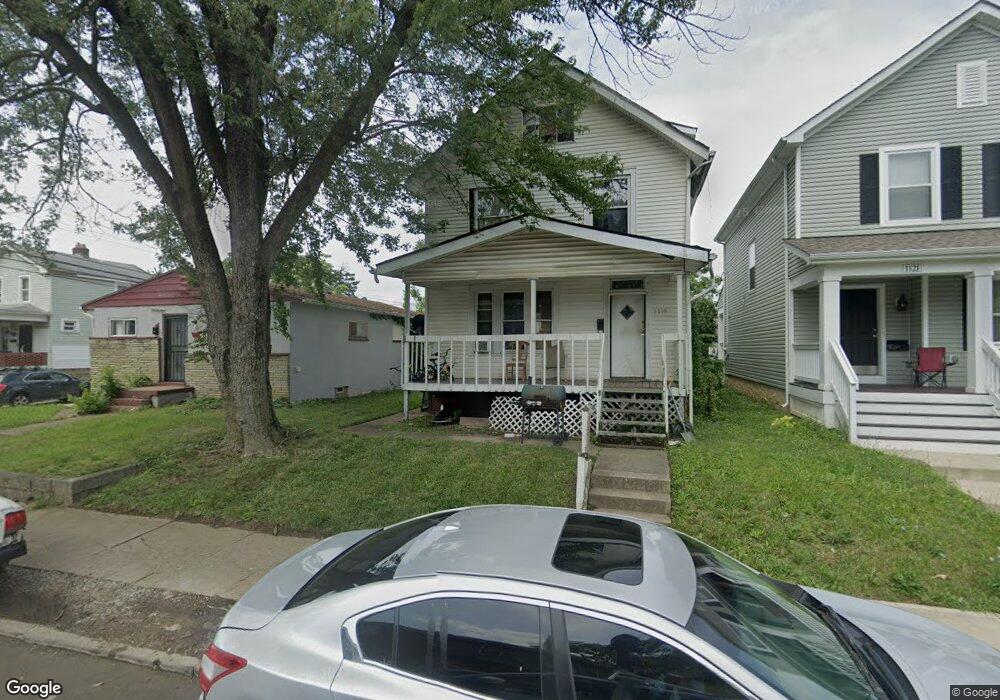

1119 Peters Ave Columbus, OH 43201

Milo-Grogan NeighborhoodEstimated Value: $106,000 - $186,000

4

Beds

1

Bath

1,291

Sq Ft

$118/Sq Ft

Est. Value

About This Home

This home is located at 1119 Peters Ave, Columbus, OH 43201 and is currently estimated at $152,598, approximately $118 per square foot. 1119 Peters Ave is a home located in Franklin County with nearby schools including Windsor Stem Acadmey, Linden-Mckinley Stem School On Arcadia, and Columbus Performance Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 23, 2016

Sold by

R & R Properties Group Of Ohio Llc

Bought by

Heard Ashley

Current Estimated Value

Purchase Details

Closed on

Jun 10, 2009

Sold by

Moequity Llc

Bought by

Ties Group Of Ohio Llc

Purchase Details

Closed on

Dec 24, 2007

Sold by

Crews Jevon M and Aames Home Loan

Bought by

Accredited Home Lenders Inc

Purchase Details

Closed on

May 20, 2005

Sold by

Tanner Gregory L

Bought by

Crews Jevon M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$57,000

Interest Rate

9.36%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jun 24, 1998

Sold by

Kirkish Douglas J

Bought by

Kirkish Douglas J and Kirkish Mary J

Purchase Details

Closed on

Dec 7, 1990

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Heard Ashley | $16,500 | Independence Title Services | |

| Ties Group Of Ohio Llc | $37,300 | Attorney | |

| Accredited Home Lenders Inc | $48,000 | None Available | |

| Crews Jevon M | $76,500 | Land Sel Ti | |

| Tanner Gregory L | $36,000 | Land Sel Ti | |

| Kirkish Douglas J | -- | -- | |

| Kirkish Douglas J | $1,900 | -- | |

| Kirkish Douglas J | $1,900 | -- | |

| Kirkish Douglas J | $1,900 | -- | |

| Kirkish Douglas J | $1,000 | -- | |

| Kirkish Douglas J | $1,000 | -- | |

| Kirkish Douglas J | $1,000 | -- | |

| Kirkish Douglas J | $1,000 | -- | |

| Kirkish Douglas J | $1,000 | -- | |

| Kirkish Douglas J | $1,000 | -- | |

| Kirkish Douglas J | $1,000 | -- | |

| Kirkish Douglas J | $1,000 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Crews Jevon M | $57,000 | |

| Closed | Crews Jevon M | $19,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,590 | $41,720 | $5,110 | $36,610 |

| 2023 | $1,938 | $41,720 | $5,110 | $36,610 |

| 2022 | $2,400 | $20,930 | $2,100 | $18,830 |

| 2021 | $1,107 | $20,930 | $2,100 | $18,830 |

| 2020 | $1,089 | $20,930 | $2,100 | $18,830 |

| 2019 | $1,115 | $18,380 | $1,820 | $16,560 |

| 2018 | $971 | $18,380 | $1,820 | $16,560 |

| 2017 | $1,013 | $18,380 | $1,820 | $16,560 |

| 2016 | $911 | $13,410 | $2,070 | $11,340 |

| 2015 | $829 | $13,410 | $2,070 | $11,340 |

| 2014 | $831 | $13,410 | $2,070 | $11,340 |

| 2013 | $456 | $14,910 | $2,310 | $12,600 |

Source: Public Records

Map

Nearby Homes

- 1082-1084 Peters Ave

- 940 Shoemaker Ave

- 940-942 Leona Ave

- 1186 Saint Clair Ave

- 927 Camden Ave

- 923 Camden Ave

- 911 Camden Ave

- 1025 Howard St

- 997-999 Gibbard Ave

- 796 Gibbard Ave

- 780-782 Gibbard Ave

- 779 Gibbard Ave

- 810-812 E 3rd Ave

- 773-775 E 3rd Ave

- 0 Leona Ave

- 790-792 E Starr Ave

- 841 Saint Clair Ave

- 0 E 4th Ave

- 276 E 4th Ave

- 1471 Jefferson Ave

- 1121 Peters Ave

- 1111 Peters Ave

- 1129 Peters Ave

- 1103 Peters Ave

- 1133 Peters Ave

- 1097-1099 Peters Ave

- 1097 Peters Ave Unit 99

- 1124 Lexington Ave

- 1120 Lexington Ave

- 1134 Lexington Ave

- 1137 Peters Ave Unit 139

- 1137-1139 Peters Ave

- 1138 Lexington Ave

- 190 Shoemaker Ave

- 1093 Peters Ave

- 1116 Peters Ave

- 1112 Lexington Ave

- 1120 Peters Ave

- 1112 Peters Ave

- 0 Peters Ave