11207 Kings Crest Ct Unit 32 Fredericksburg, VA 22407

Estimated Value: $330,000 - $371,000

3

Beds

3

Baths

1,264

Sq Ft

$277/Sq Ft

Est. Value

About This Home

This home is located at 11207 Kings Crest Ct Unit 32, Fredericksburg, VA 22407 and is currently estimated at $349,625, approximately $276 per square foot. 11207 Kings Crest Ct Unit 32 is a home located in Spotsylvania County with nearby schools including Battlefield Elementary School, Battlefield Middle School, and Chancellor High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 6, 2018

Sold by

Moore Ii Steven Chad

Bought by

Brown-Robinson Felecia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$206,196

Outstanding Balance

$179,073

Interest Rate

4.5%

Mortgage Type

FHA

Estimated Equity

$170,552

Purchase Details

Closed on

Jun 3, 2009

Sold by

Gameli Edem

Bought by

Moore Ii Steven

Purchase Details

Closed on

Oct 24, 2005

Sold by

Stark Michael W

Bought by

Gameli Edem K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,000

Interest Rate

5.72%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 31, 2003

Sold by

Amos Linda

Bought by

Stark Michael

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$162,352

Interest Rate

5.91%

Mortgage Type

FHA

Purchase Details

Closed on

Dec 3, 2002

Sold by

Buonassissi Joseph V

Bought by

Amos Linda C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brown-Robinson Felecia | $210,000 | Champion Title & Stlmnts Inc | |

| Moore Ii Steven | $132,500 | -- | |

| Gameli Edem K | $275,000 | -- | |

| Stark Michael | $164,900 | -- | |

| Amos Linda C | $120,100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Brown-Robinson Felecia | $206,196 | |

| Previous Owner | Gameli Edem K | $220,000 | |

| Previous Owner | Stark Michael | $162,352 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,058 | $280,200 | $100,000 | $180,200 |

| 2024 | $2,058 | $280,200 | $100,000 | $180,200 |

| 2023 | $1,546 | $200,300 | $70,000 | $130,300 |

| 2022 | $1,478 | $200,300 | $70,000 | $130,300 |

| 2021 | $1,605 | $198,300 | $50,000 | $148,300 |

| 2020 | $1,605 | $198,300 | $50,000 | $148,300 |

| 2019 | $1,424 | $168,000 | $40,000 | $128,000 |

| 2018 | $1,399 | $168,000 | $40,000 | $128,000 |

| 2017 | $1,320 | $155,300 | $30,000 | $125,300 |

| 2016 | $1,320 | $155,300 | $30,000 | $125,300 |

| 2015 | $976 | $123,300 | $27,000 | $96,300 |

| 2014 | $976 | $123,300 | $27,000 | $96,300 |

Source: Public Records

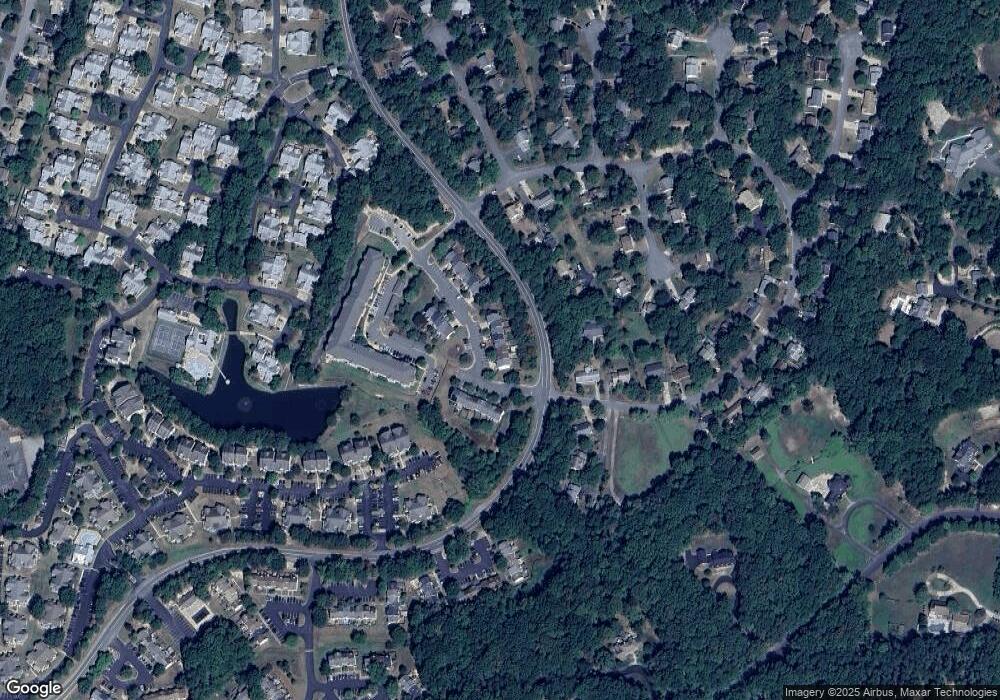

Map

Nearby Homes

- 11209 Kings Crest Ct

- 11606 Savannah Dr

- 11170 Hamlet Ct

- 11310 Crown Ct

- 11471 Charleston Ct

- 11343 Savannah Dr

- 32 Carriage Hill Ln

- 11206 Old Leavells Rd

- 5903 Griffith Way

- 19 Twin Springs Dr

- 5508 Redgum Ln

- 7009 Lombard Ln

- 11520 Bluestem Way

- Oostende Plan at Hazel Run Glen

- Malmo Plan at Hazel Run Glen

- Stavanger III Plan at Hazel Run Glen

- Canterbury Plan at Hazel Run Glen

- Macon II Plan at Hazel Run Glen

- 0001 Ivy Bush Ln

- 0002 Ivy Bush Ln

- 11205 Kings Crest Ct

- 11203 Kings Crest Ct

- 11211 Kings Crest Ct

- 11213 Kings Crest Ct Unit 1

- 11213 Kings Crest Ct

- 11201 Kings Crest Ct

- 11215 Kings Crest Ct

- 11301 Kings Crest Ct

- 11300 Kings Crest Ct

- 11302 Kings Crest Ct

- 11303 Kings Crest Ct

- 11304 Kings Crest Ct

- 5708 Falls Way Ct

- 5710 Falls Way Ct

- 5706 Falls Way Ct

- 5712 Falls Way Ct

- 5704 Falls Way Ct

- 11306 Kings Crest Ct

- 11305 Kings Crest Ct

- 5714 Falls Way Ct