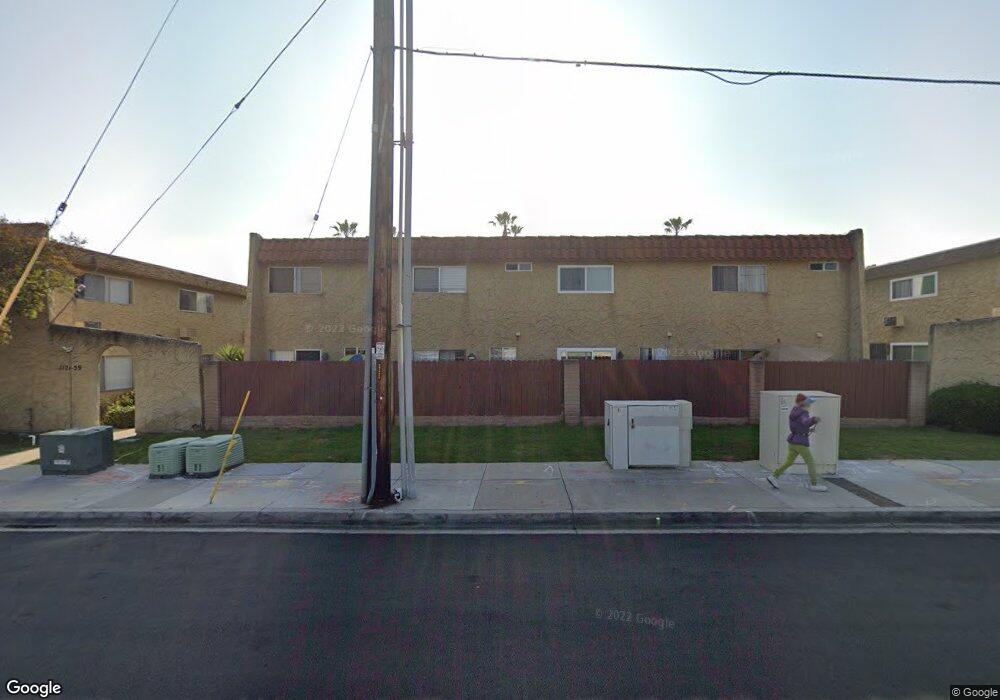

1129 Emerald Ave Unit 5 El Cajon, CA 92020

Estimated Value: $401,000 - $458,000

2

Beds

2

Baths

1,024

Sq Ft

$425/Sq Ft

Est. Value

About This Home

This home is located at 1129 Emerald Ave Unit 5, El Cajon, CA 92020 and is currently estimated at $435,689, approximately $425 per square foot. 1129 Emerald Ave Unit 5 is a home located in San Diego County with nearby schools including Chase Avenue Elementary School, Cajon Valley Middle School, and Bostonia Global High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 14, 2015

Sold by

Young Daryl and Young Carmen

Bought by

Frangool Dina

Current Estimated Value

Purchase Details

Closed on

Jan 14, 2004

Sold by

Baugh Wesley Allen and Baugh Helen

Bought by

Young Daryl and Young Carmen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$151,200

Interest Rate

6.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 11, 1995

Sold by

J Sheldon White Inc and Baugh Wesley Allen

Bought by

Baugh Wesley Allen and Pacific Coast Funding

Purchase Details

Closed on

Mar 25, 1992

Purchase Details

Closed on

Feb 12, 1992

Purchase Details

Closed on

Nov 12, 1986

Purchase Details

Closed on

Sep 5, 1986

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Frangool Dina | $174,000 | Title365 | |

| Young Daryl | $189,000 | Fidelity National Title Co | |

| Baugh Wesley Allen | $59,503 | Orange Coast Title Company | |

| -- | $63,600 | -- | |

| -- | $58,000 | -- | |

| -- | $68,000 | -- | |

| -- | $59,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Young Daryl | $151,200 | |

| Closed | Young Daryl | $37,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,133 | $209,109 | $107,169 | $101,940 |

| 2024 | $3,133 | $205,010 | $105,068 | $99,942 |

| 2023 | $3,373 | $200,991 | $103,008 | $97,983 |

| 2022 | $2,404 | $197,051 | $100,989 | $96,062 |

| 2021 | $2,371 | $193,188 | $99,009 | $94,179 |

| 2020 | $2,346 | $191,208 | $97,994 | $93,214 |

| 2019 | $2,317 | $187,460 | $96,073 | $91,387 |

| 2018 | $2,279 | $183,786 | $94,190 | $89,596 |

| 2017 | $30 | $180,184 | $92,344 | $87,840 |

| 2016 | $2,161 | $176,652 | $90,534 | $86,118 |

| 2015 | $1,895 | $160,000 | $82,000 | $78,000 |

| 2014 | -- | $139,000 | $72,000 | $67,000 |

Source: Public Records

Map

Nearby Homes

- 730 W Chase Ave

- 1000 Estes St Unit 44

- 1000 Estes St Unit 11

- 1440 S Orange Ave Unit 64

- 1440 S Orange Ave Unit 92

- 1440 S Orange Ave Unit 27

- 1440 S Orange Ave Unit 71

- 1440 S Orange Ave Unit 99

- 1440 S Orange Ave

- 908 S Sunshine Ave Unit 18

- 1490 S Orange Ave Unit 117

- 868 Pearl Place

- 1521 Kimberly Woods Dr

- 1198 Benjamin Place

- 649 W Washington Ave

- 1288 Avocado Ave

- 1006 Avocado Ave

- 652 S Orange Ave

- 449 Avenida Abajo

- 10310 Fuerte Dr

- 1145 Emerald Ave

- 1151 Emerald Ave

- 1149 Emerald Ave

- 1137 Emerald Ave

- 1131 Emerald Ave

- 1125 Emerald Ave

- 1123 Emerald Ave Unit LU2

- 1121 Emerald Ave

- 1153 Emerald Ave Unit LU8

- 1139 Emerald Ave

- 1147 Emerald Ave

- 1143 Emerald Ave

- 1135 Emerald Ave

- 1133 Emerald Ave

- 1127 Emerald Ave

- 1159 Emerald Ave

- 1155 Emerald Ave

- 565 W Chase Ave

- 1120 Emerald Ave

- 1130 Emerald Ave