11303 S 100 W Unit 1 La Fontaine, IN 46940

Estimated Value: $384,000 - $508,775

3

Beds

4

Baths

2,789

Sq Ft

$155/Sq Ft

Est. Value

About This Home

This home is located at 11303 S 100 W Unit 1, La Fontaine, IN 46940 and is currently estimated at $431,258, approximately $154 per square foot. 11303 S 100 W Unit 1 is a home located in Wabash County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 25, 2022

Sold by

Whiteman Shane M and Whiteman Jessie M

Bought by

Kenneth W & Antonita N Miller Joint Revocable

Current Estimated Value

Purchase Details

Closed on

Apr 24, 2017

Sold by

Dyson Roger E

Bought by

Whiteman Shane M and Whiteman Jessie M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,600

Interest Rate

3.75%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Apr 21, 2017

Sold by

Bowling Pamela J and Dyson Pamela J

Bought by

Dyson Roger E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,600

Interest Rate

3.75%

Mortgage Type

Adjustable Rate Mortgage/ARM

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kenneth W & Antonita N Miller Joint Revocable | $50,000 | None Listed On Document | |

| Whiteman Shane M | -- | None Available | |

| Dyson Roger E | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Whiteman Shane M | $224,600 | |

| Previous Owner | Dyson Roger E | $224,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,528 | $379,300 | $25,800 | $353,500 |

| 2023 | $2,190 | $360,000 | $24,500 | $335,500 |

| 2022 | $1,793 | $340,000 | $30,800 | $309,200 |

| 2021 | $1,775 | $301,500 | $26,000 | $275,500 |

| 2020 | $1,693 | $300,400 | $26,000 | $274,400 |

| 2019 | $1,485 | $277,500 | $28,400 | $249,100 |

| 2018 | $1,426 | $269,400 | $28,800 | $240,600 |

| 2017 | $1,356 | $269,600 | $30,800 | $238,800 |

| 2016 | $1,147 | $284,200 | $42,900 | $241,300 |

| 2014 | $979 | $280,800 | $42,900 | $237,900 |

| 2013 | $853 | $275,400 | $42,900 | $232,500 |

Source: Public Records

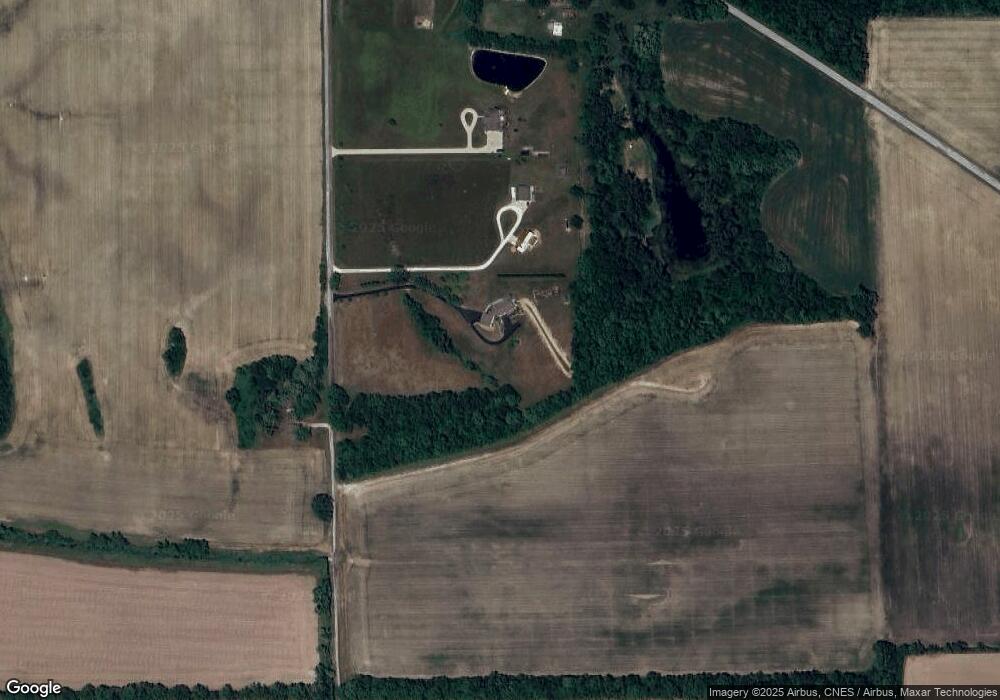

Map

Nearby Homes

- 15 S Second St

- 100 N Delaware Ln

- 852 W 850 S

- 3576 W 505 N

- 3 Mason St

- 109 E Grant St

- 403 E Kendall St

- 3192 E 800 S Unit 2

- 7754 S America Rd

- 5430 W Delphi Pike

- 5292 W Delphi Pike

- 318 Gayle Dr

- 7649 E 850 S

- 9620 W Delphi Pike

- 4493 N Wabash Rd

- 611 Allen Dr

- 119 Short St

- 106 W Water St

- 514 Allen Dr

- 218 Greenberry St

- 11321 S 100 W

- 859 W Old Slocum Trail Unit 1

- 11356 S 100 W

- 538 W Old Slocum Trail

- 1063 W Old Slocum Trail

- 1271 W Old Slocum Trail

- 1329 W Old Slocum Trail

- 11779 S 100 W

- 1259 W Old Slocum Trail

- 1402 W Old Slocum Trail

- 1402 W Old Slocum Trail

- 1521 W Old Slocum Trail

- 11790 S 100 W

- 11880 S 100 W

- 1665 W Old Slocum Trail

- 11245 S State Road 13

- 38 W Old Slocum Trail

- 1370 W 1200 S

- 1763 W Old Slocum Trail

- 1763 W Old Slocum Trail