11320 Saint Andrews Way Unit B3 Painesville, OH 44077

Quail Hollow NeighborhoodEstimated Value: $321,000 - $350,000

3

Beds

3

Baths

1,635

Sq Ft

$206/Sq Ft

Est. Value

About This Home

This home is located at 11320 Saint Andrews Way Unit B3, Painesville, OH 44077 and is currently estimated at $337,055, approximately $206 per square foot. 11320 Saint Andrews Way Unit B3 is a home located in Lake County with nearby schools including Henry F. Lamuth Middle School, Riverside Junior/Senior High School, and The Goddard School - Concord Township.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 3, 2006

Sold by

Sheets Lane H and Molder Esther S

Bought by

Sheets Lane H and Molder Esther S

Current Estimated Value

Purchase Details

Closed on

Apr 21, 2005

Sold by

Kovar Allen A and Kovar Mary Ann

Bought by

Sheets Lane H and Molder Esther S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$195,000

Interest Rate

5.37%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 17, 1996

Sold by

Rowley William W

Bought by

Kovar Allen A and Kovar Mary

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,500

Interest Rate

6.25%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sheets Lane H | -- | None Available | |

| Sheets Lane H | $250,000 | Continental Title | |

| Kovar Allen A | $212,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sheets Lane H | $195,000 | |

| Previous Owner | Kovar Allen A | $112,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | -- | $98,430 | $22,680 | $75,750 |

| 2023 | $7,594 | $78,630 | $18,900 | $59,730 |

| 2022 | $3,664 | $78,630 | $18,900 | $59,730 |

| 2021 | $3,679 | $78,630 | $18,900 | $59,730 |

| 2020 | $3,371 | $65,520 | $15,750 | $49,770 |

| 2019 | $3,367 | $65,520 | $15,750 | $49,770 |

| 2018 | $3,378 | $68,220 | $10,500 | $57,720 |

| 2017 | $3,727 | $68,220 | $10,500 | $57,720 |

| 2016 | $3,423 | $68,220 | $10,500 | $57,720 |

| 2015 | $3,205 | $68,220 | $10,500 | $57,720 |

| 2014 | $3,198 | $68,220 | $10,500 | $57,720 |

| 2013 | $3,198 | $68,220 | $10,500 | $57,720 |

Source: Public Records

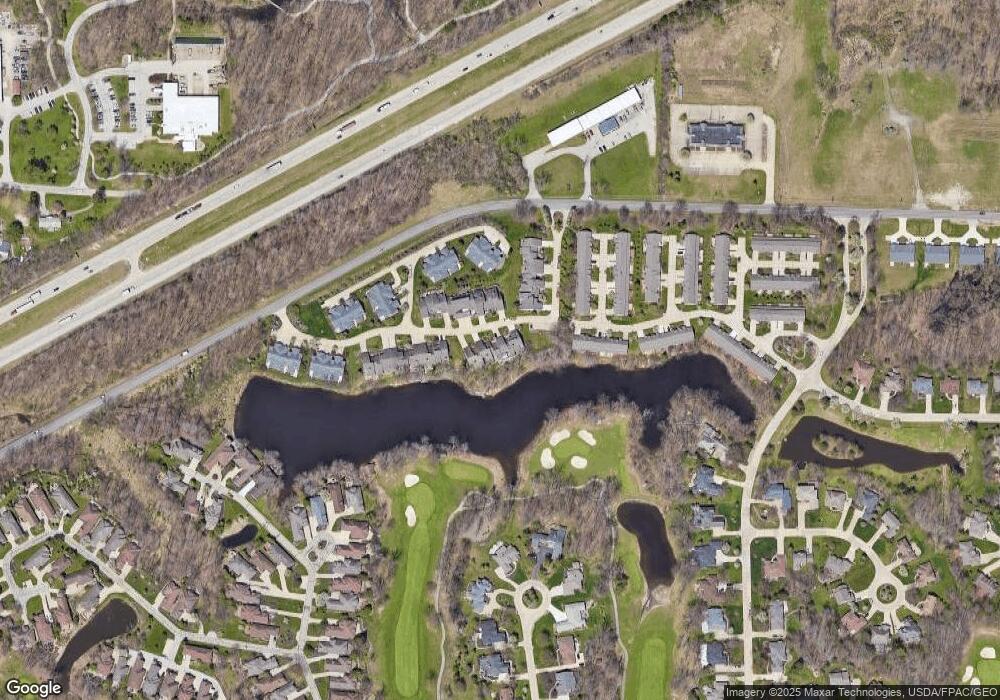

Map

Nearby Homes

- 7807 Hunting Lake Dr

- 7295 Players Club Dr

- 7280 Hunters Trail

- 11390 Labrador Ln

- 11383 Somerset Trail

- 7051 Bristlewood Dr Unit 6D

- 11231 Hampton Bay Ln Unit 74

- 11440 Somerset Trail

- 6980 Sturbridge Dr

- 7818 Hunting Lake Dr

- 11096 Quail Hollow Dr Unit 26

- 7347 Hillshire Dr

- 7204 S Excaliber Dr Unit 157-B

- 11307 S Forest Dr Unit 3

- 11310 S Forest Dr

- 7149 N Downing Place

- 11579 Olde Stone Ct

- 7248 S Jester Place Unit D

- 6871 Auburn Rd Unit 10

- 7159 N Kipling Place

- 11322 Saint Andrews Way Unit B4

- 11318 Saint Andrews Way Unit B2

- 11318 Saint Andrews Way Unit 2

- 11314 Saint Andrews Way

- 11325 Saint Andrews Way

- 11321 Saint Andrews Way

- 11329 Saint Andrews Way

- 11319 Saint Andrews Way

- 11306 Saint Andrews Way Unit D1

- 11315 Saint Andrews Way

- 11331 Saint Andrews Way Unit A4

- 11304 Saint Andrews Way Unit D2

- 11309 St Andrews Way

- 11309 Saint Andrews Way

- 11332 Pelican Cove Unit B-3

- 11332 Pelican Cove

- 11333 Saint Andrews Way

- 11305 Saint Andrews Way

- 11302 Saint Andrews Way Unit D3

- 11334 Glen Eagles Dr Unit C7