11322 Red Cedar Ln San Diego, CA 92131

Scripps Ranch NeighborhoodEstimated Value: $1,248,480 - $1,411,000

4

Beds

2

Baths

1,672

Sq Ft

$789/Sq Ft

Est. Value

About This Home

This home is located at 11322 Red Cedar Ln, San Diego, CA 92131 and is currently estimated at $1,319,620, approximately $789 per square foot. 11322 Red Cedar Ln is a home located in San Diego County with nearby schools including Jerabek Elementary School, Thurgood Marshall Middle School, and Scripps Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 13, 2020

Sold by

Mills Margie Richardson and Mills David Gene

Bought by

Mills Margie Richardson and Mills David Gene

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$281,000

Outstanding Balance

$249,267

Interest Rate

3%

Mortgage Type

New Conventional

Estimated Equity

$1,070,353

Purchase Details

Closed on

Sep 20, 2002

Sold by

Mills David G and Mills Margie Richardson

Bought by

Mills David and Mills Margie R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$208,000

Interest Rate

6.24%

Purchase Details

Closed on

Jul 29, 1987

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mills Margie Richardson | -- | Wfg Title Company Of Ca | |

| Mills David | -- | Fidelity National Title Co | |

| -- | $155,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mills Margie Richardson | $281,000 | |

| Closed | Mills David | $208,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,741 | $296,648 | $88,241 | $208,407 |

| 2024 | $3,741 | $290,832 | $86,511 | $204,321 |

| 2023 | $3,651 | $285,130 | $84,815 | $200,315 |

| 2022 | $3,544 | $279,540 | $83,152 | $196,388 |

| 2021 | $3,508 | $274,060 | $81,522 | $192,538 |

| 2020 | $7,571 | $271,251 | $80,687 | $190,564 |

| 2019 | $7,507 | $265,933 | $79,105 | $186,828 |

| 2018 | $7,286 | $260,719 | $77,554 | $183,165 |

| 2017 | $80 | $255,608 | $76,034 | $179,574 |

| 2016 | $7,135 | $250,597 | $74,544 | $176,053 |

| 2015 | $3,006 | $246,834 | $73,425 | $173,409 |

| 2014 | $2,959 | $242,000 | $71,987 | $170,013 |

Source: Public Records

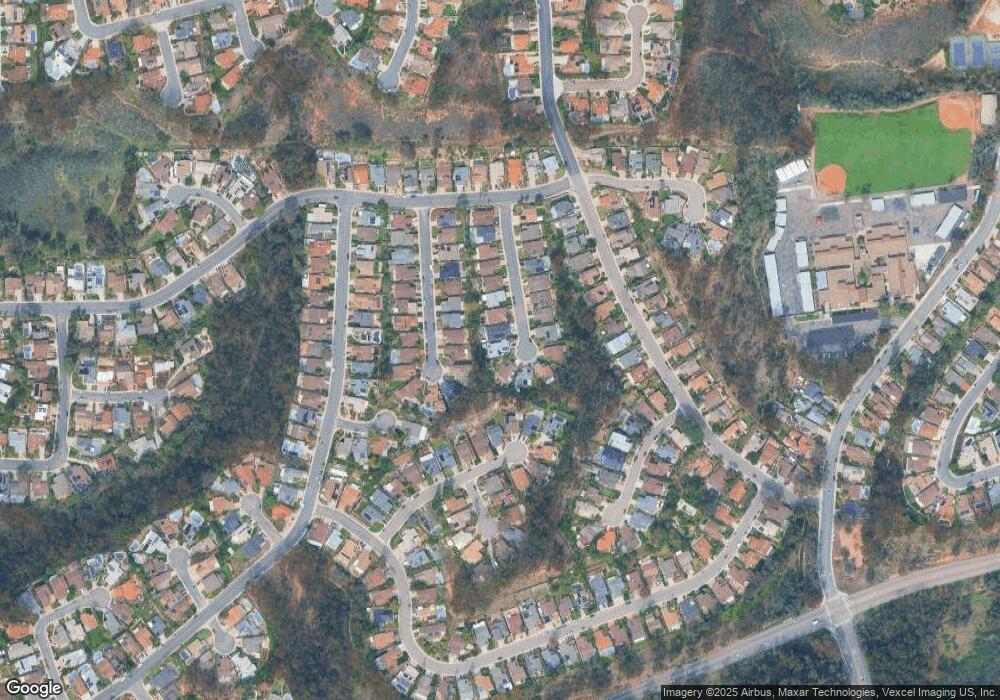

Map

Nearby Homes

- 9950 Dichondra Place

- 10415 Mesa Madera Dr

- 11646 La Colina Rd

- 10405 White Birch Dr

- 10473 Crosscreek Terrace

- 10535 Arbor Park Place

- 10466 Ridgewater Ln

- 10265 Aviary Dr

- 10616 Falcon Rim Point

- 11787 La Colina Rd

- 10831 Ironwood Rd

- 10304 Spruce Grove Ave

- 10545 Caminito Memosac

- 10594 Rookwood Dr

- 10565 Caminito Basswood

- 12026 Medoc Ln

- 10497 Caminito Mayten

- 10447 Caminito Banyon

- 10280 Caminito Rio Branco

- 10374 Caminito Banyon Unit U140

- 11330 Red Cedar Ln

- 11314 Red Cedar Ln

- 11338 Red Cedar Ln

- 11329 Red Cedar Way

- 11317 Red Cedar Way

- 11337 Red Cedar Way

- 11306 Red Cedar Ln

- 11345 Red Cedar Way

- 11346 Red Cedar Ln

- 11309 Red Cedar Way

- 11323 Red Cedar Ln

- 11353 Red Cedar Way

- 11331 Red Cedar Ln

- 11307 Red Cedar Ln

- 11354 Red Cedar Ln

- 11324 Vista la Cuesta Dr

- 11318 Vista la Cuesta Dr

- 11315 Red Cedar Ln

- 11339 Red Cedar Ln

- 11361 Red Cedar Way