11335 W San Raphael Driveway San Diego, CA 92130

Carmel Valley NeighborhoodEstimated Value: $1,772,000 - $1,834,000

3

Beds

3

Baths

2,327

Sq Ft

$775/Sq Ft

Est. Value

About This Home

This home is located at 11335 W San Raphael Driveway, San Diego, CA 92130 and is currently estimated at $1,803,496, approximately $775 per square foot. 11335 W San Raphael Driveway is a home located in San Diego County with nearby schools including Ocean Air Elementary School, Carmel Valley Middle School, and Torrey Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 15, 2014

Sold by

Tsay Jia Yeong and Tsay Tung Ying

Bought by

Tsay Tung Ying

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Outstanding Balance

$121,286

Interest Rate

3.23%

Mortgage Type

New Conventional

Estimated Equity

$1,682,210

Purchase Details

Closed on

Apr 28, 2009

Sold by

Jackson Loraine

Bought by

Tsay Tung Ying

Purchase Details

Closed on

Jun 9, 2005

Sold by

Jackson Loraine

Bought by

Jackson Loraine

Purchase Details

Closed on

Feb 22, 2000

Sold by

Western Pacific Housing Sorrento Llc

Bought by

Jackson Loraine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$292,500

Interest Rate

8.27%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tsay Tung Ying | -- | Ticor Title | |

| Tsay Jia Yeong | -- | Ticor Title | |

| Tsay Tung Ying | $720,000 | Chicago Title Company | |

| Jackson Loraine | -- | -- | |

| Jackson Loraine | $392,500 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Tsay Jia Yeong | $400,000 | |

| Previous Owner | Jackson Loraine | $292,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,857 | $927,175 | $356,613 | $570,562 |

| 2024 | $10,857 | $908,996 | $349,621 | $559,375 |

| 2023 | $10,791 | $891,173 | $342,766 | $548,407 |

| 2022 | $10,629 | $873,700 | $336,046 | $537,654 |

| 2021 | $10,279 | $856,569 | $329,457 | $527,112 |

| 2020 | $10,354 | $847,787 | $326,079 | $521,708 |

| 2019 | $10,175 | $831,165 | $319,686 | $511,479 |

| 2018 | $9,745 | $814,868 | $313,418 | $501,450 |

| 2017 | $9,584 | $798,891 | $307,273 | $491,618 |

| 2016 | $9,311 | $783,228 | $301,249 | $481,979 |

| 2015 | $9,189 | $771,464 | $296,724 | $474,740 |

| 2014 | $9,025 | $756,353 | $290,912 | $465,441 |

Source: Public Records

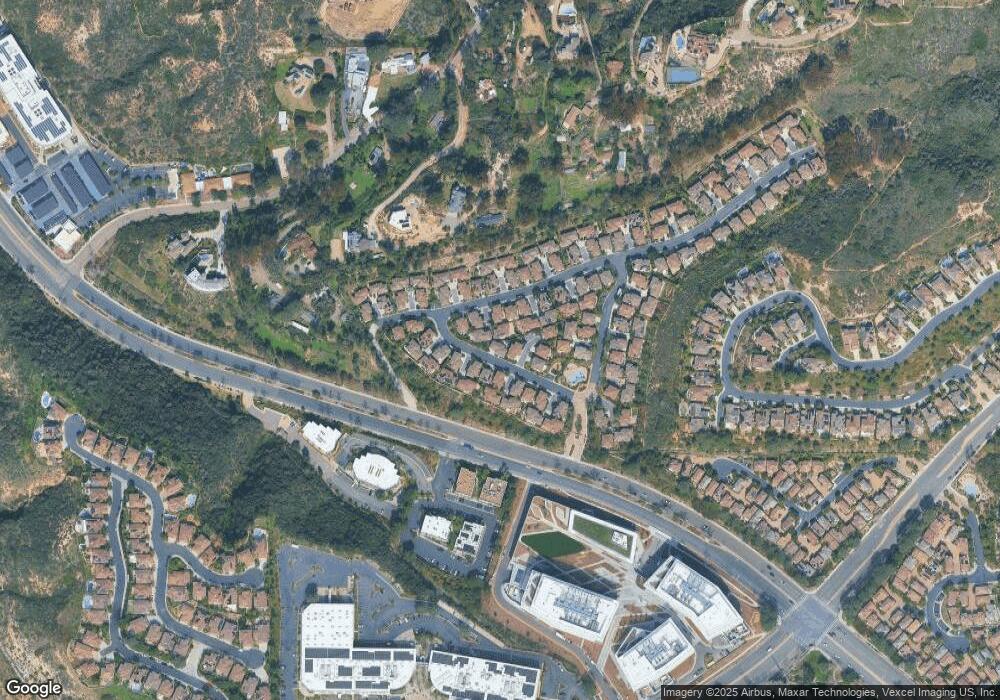

Map

Nearby Homes

- 3738 Ruette San Raphael

- 3854-56 Via Del Mar

- 3767 Torrey View Ct

- 4 Via Del Mar

- 3 Via Del Mar

- 11325 Carmel Creek Rd

- 3811 Via Del Mar

- 4289 Calle Isabelino

- 11649 Thistle Hill Place

- 12999 Caminito Pointe Del Mar

- 3714 Carmel View Rd

- 12233 Caminito Del Mar Sands

- 3672 Caminito Carmel Landing

- 3602 Caminito Carmel Landing Unit 125

- 3975 San Gregorio Way

- 12165 Caminito Mira Del Mar

- 10495 Abalone Landing Terrace

- 13147 Portofino Dr

- 12213 Carmel Vista Rd Unit 234

- 13027 Via Latina

- 11338 E San Raphael Driveway

- 11331 W San Raphael Driveway

- 11344 E San Raphael Driveway

- 11342 E San Raphael Driveway

- 11334 E San Raphael Driveway

- 11330 E San Raphael Driveway

- 11327 W San Raphael Driveway Unit 104

- 11323 W San Raphael Driveway

- 11342 E San Raphael

- 11319 W San Raphael Driveway

- 3775 Ruette San Raphael

- 3771 Ruette San Raphael Unit 120

- 3783 Ruette San Raphael

- 11353 E San Raphael

- 11325 E San Raphael

- 11322 W San Raphael

- 11326 W San Raphael Driveway

- 11318 W San Raphael Driveway Unit 5

- 11314 W San Raphael Driveway

- 11310 W San Raphael Driveway Unit 3