11395 Affinity Ct Unit 223 San Diego, CA 92131

Miramar Ranch North NeighborhoodEstimated Value: $672,532 - $723,000

3

Beds

2

Baths

1,248

Sq Ft

$564/Sq Ft

Est. Value

About This Home

This home is located at 11395 Affinity Ct Unit 223, San Diego, CA 92131 and is currently estimated at $703,883, approximately $564 per square foot. 11395 Affinity Ct Unit 223 is a home located in San Diego County with nearby schools including Miramar Ranch Elementary School, Thurgood Marshall Middle School, and Scripps Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 10, 2022

Sold by

Thorne John F

Bought by

John F Thorne Family Trust

Current Estimated Value

Purchase Details

Closed on

Jan 28, 2021

Sold by

Thorne John and Thorne John F

Bought by

Thorne John

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$333,000

Interest Rate

2.6%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 14, 2015

Sold by

Forrester John

Bought by

Thorne John F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$375,000

Interest Rate

3.63%

Mortgage Type

VA

Purchase Details

Closed on

Feb 19, 1998

Sold by

Forrester Marjorie E

Bought by

Forrester Marjorie E

Purchase Details

Closed on

Jul 1, 1992

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| John F Thorne Family Trust | -- | -- | |

| Thorne John | -- | First American Title Company | |

| Thorne John F | $375,000 | Corinthian Title Company | |

| Forrester Marjorie E | -- | -- | |

| -- | $152,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Thorne John | $333,000 | |

| Previous Owner | Thorne John F | $375,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,458 | $450,681 | $183,825 | $266,856 |

| 2024 | $5,458 | $441,845 | $180,221 | $261,624 |

| 2023 | $5,252 | $433,183 | $176,688 | $256,495 |

| 2022 | $5,111 | $424,690 | $173,224 | $251,466 |

| 2021 | $5,075 | $416,364 | $169,828 | $246,536 |

| 2020 | $5,012 | $412,096 | $168,087 | $244,009 |

| 2019 | $4,922 | $404,017 | $164,792 | $239,225 |

| 2018 | $4,600 | $396,096 | $161,561 | $234,535 |

| 2017 | $4,490 | $388,331 | $158,394 | $229,937 |

| 2016 | $4,417 | $380,718 | $155,289 | $225,429 |

| 2015 | $2,603 | $219,243 | $89,426 | $129,817 |

| 2014 | $2,480 | $214,950 | $87,675 | $127,275 |

Source: Public Records

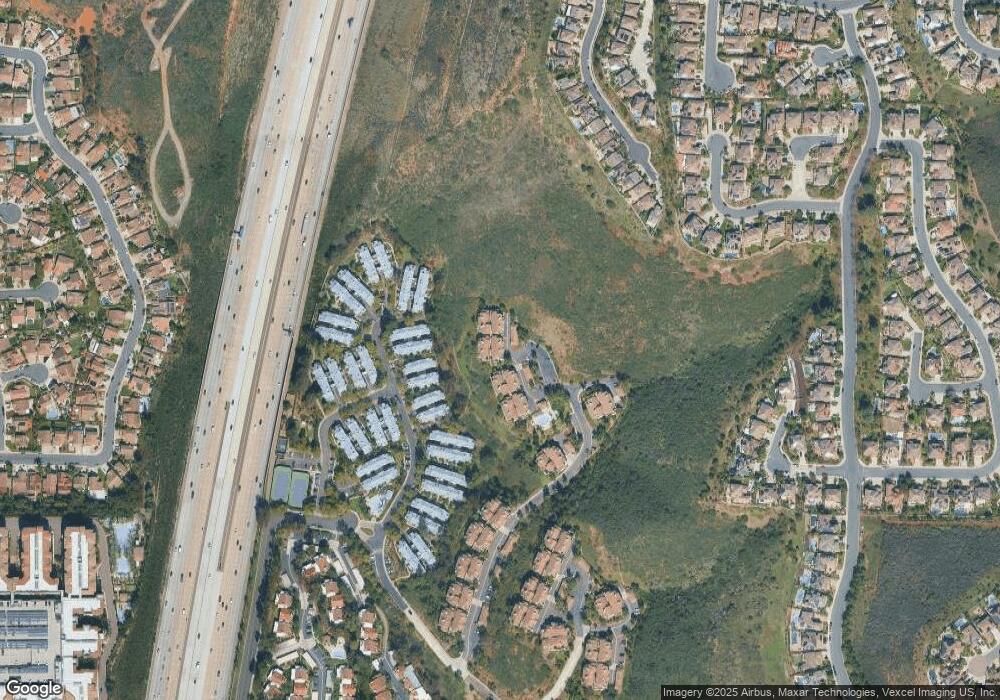

Map

Nearby Homes

- 9960 Scripps Vista Way Unit 116

- 11365 Affinity Ct Unit 192

- 11482 Cortina Place

- 11265 Affinity Ct Unit 103

- 11215 Affinity Ct Unit 80

- 11325 Affinity Ct Unit 151

- 11235 Affinity Ct Unit 68

- 11175 Affinity Ct Unit 45

- 9909 Scripps Westview Way Unit 212

- 11115 Affinity Ct Unit 1

- 9899 Scripps Westview Way Unit 243

- 9899 Scripps Westview Way Unit 244

- 9939 Erma Rd Unit 101

- 9929 Erma Rd Unit 102

- 11856 Miro Cir

- 9471 Compass Point Dr S

- 11629 Swan Lake Dr Unit 4

- 11825 Miro Cir

- 11091 Ice Skate Place Unit 20

- 11061 Scripps Ranch Blvd

- 11405 Affinity Ct

- 11405 Affinity Ct Unit 231

- 11405 Affinity Ct Unit 234

- 11395 Affinity Ct Unit 230

- 11405 Affinity Ct Unit 239

- 11405 Affinity Ct Unit 238

- 11405 Affinity Ct Unit 237

- 11405 Affinity Ct Unit 236

- 11405 Affinity Ct Unit 235

- 11405 Affinity Ct Unit 233

- 11405 Affinity Ct Unit 232

- 11395 Affinity Ct Unit 229

- 11395 Affinity Ct Unit 228

- 11395 Affinity Ct Unit 227

- 11395 Affinity Ct Unit 226

- 11395 Affinity Ct Unit 225

- 11395 Affinity Ct Unit 224

- 11395 Affinity Ct Unit 222

- 11395 Affinity Ct Unit 221

- 11385 Affinity Ct Unit 215