114 State St West Union, IA 52175

Estimated Value: $138,000 - $177,113

2

Beds

1

Bath

1,168

Sq Ft

$135/Sq Ft

Est. Value

About This Home

This home is located at 114 State St, West Union, IA 52175 and is currently estimated at $157,778, approximately $135 per square foot. 114 State St is a home located in Fayette County with nearby schools including North Fayette Valley Middle School and North Fayette Valley H. School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 8, 2018

Sold by

Schott Wyatt

Bought by

Rose Karen A

Current Estimated Value

Purchase Details

Closed on

Nov 5, 2012

Sold by

Martin Reid T and Martin Sandra M

Bought by

Rose Karen A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$64,000

Interest Rate

3.32%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 18, 2011

Sold by

The Estate Of Ivanelle L Ganske

Bought by

Martin Reid T and Martin Sandra M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,020

Interest Rate

4.12%

Mortgage Type

Future Advance Clause Open End Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rose Karen A | -- | -- | |

| Rose Karen A | $80,000 | None Available | |

| Martin Reid T | $38,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rose Karen A | $64,000 | |

| Previous Owner | Martin Reid T | $40,020 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,094 | $175,750 | $18,180 | $157,570 |

| 2024 | $2,094 | $154,610 | $18,180 | $136,430 |

| 2023 | $2,182 | $154,610 | $18,180 | $136,430 |

| 2022 | $2,104 | $122,350 | $15,150 | $107,200 |

| 2021 | $2,104 | $122,350 | $15,150 | $107,200 |

| 2020 | $2,092 | $118,400 | $9,090 | $109,310 |

| 2019 | $1,826 | $106,300 | $0 | $0 |

| 2018 | $1,788 | $106,300 | $0 | $0 |

| 2017 | $1,826 | $98,630 | $0 | $0 |

| 2016 | $1,776 | $98,630 | $0 | $0 |

| 2015 | $1,776 | $0 | $0 | $0 |

| 2014 | $1,166 | $0 | $0 | $0 |

Source: Public Records

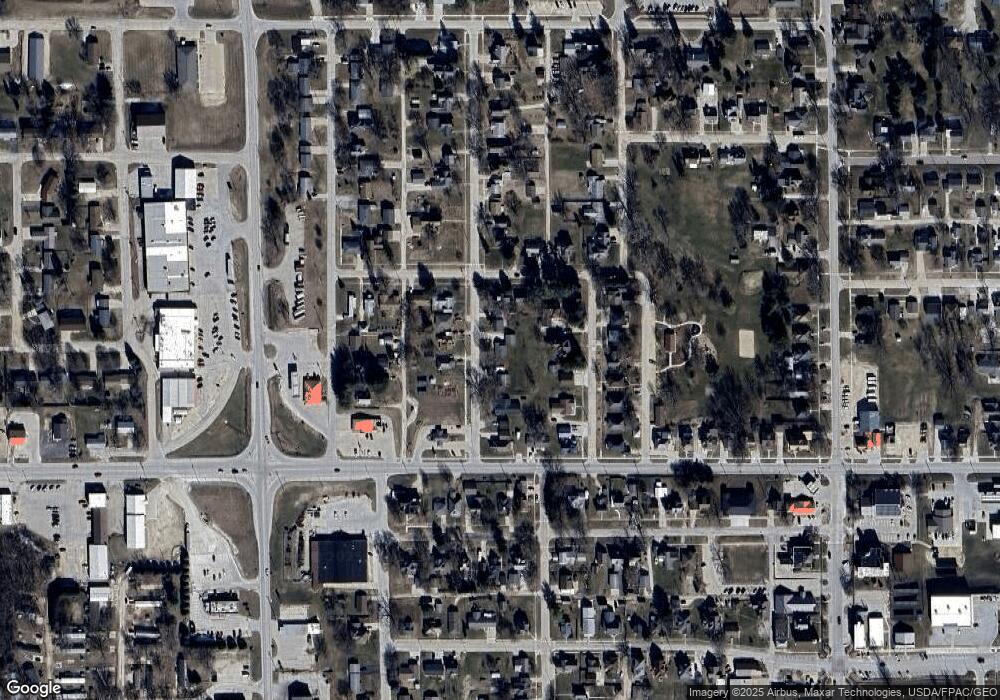

Map

Nearby Homes

- 106 Jones St

- 206 W Maple St

- 119 N Wells St

- 504 W Bradford St

- 304 Auburn St

- 601 Russell Ave

- 701 Northwestern Ave

- 313 W Elm St

- 110 Lilac Ave

- 310 W Plum St

- 306 W Plum St

- 217 S Walnut St

- 326 E Elm St

- TBD Lots 5&6 St

- 107 Union Ridge Dr

- 10290 Echo Valley Lot 2 Rd

- 705 Iowa 150

- 15453 200th St

- 14973 Nature Rd

- 28882 Pine St