1140 Carbon Jct Unit 33 Durango, CO 81301

Estimated Value: $514,325 - $569,000

2

Beds

2

Baths

1,308

Sq Ft

$413/Sq Ft

Est. Value

About This Home

This home is located at 1140 Carbon Jct Unit 33, Durango, CO 81301 and is currently estimated at $539,831, approximately $412 per square foot. 1140 Carbon Jct Unit 33 is a home located in La Plata County with nearby schools including Park Elementary School, Escalante Middle School, and Durango High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 31, 2020

Sold by

Straubh Heidke Andrew and Heidke Heather

Bought by

Roark Regina

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$197,000

Outstanding Balance

$175,075

Interest Rate

3.1%

Mortgage Type

New Conventional

Estimated Equity

$364,756

Purchase Details

Closed on

Jun 1, 2018

Sold by

Wanatka Emil and Wanatka Susan A

Bought by

Straub Heidke Andrew and Heidke Heather

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$263,625

Interest Rate

4.5%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Roark Regina | $297,000 | Land Title Guarantee Co | |

| Straub Heidke Andrew | $277,500 | Colorado Title & Closing Ser |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Roark Regina | $197,000 | |

| Previous Owner | Straub Heidke Andrew | $263,625 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $966 | $32,240 | $5,600 | $26,640 |

| 2024 | $821 | $20,590 | $4,090 | $16,500 |

| 2023 | $821 | $23,500 | $4,670 | $18,830 |

| 2022 | $828 | $25,180 | $5,000 | $20,180 |

| 2021 | $832 | $21,110 | $4,120 | $16,990 |

| 2020 | $796 | $20,850 | $4,000 | $16,850 |

| 2019 | $761 | $20,850 | $4,000 | $16,850 |

| 2018 | $745 | $20,670 | $3,780 | $16,890 |

| 2017 | $729 | $20,670 | $3,780 | $16,890 |

| 2016 | $693 | $21,450 | $3,970 | $17,480 |

| 2015 | $584 | $21,450 | $3,970 | $17,480 |

| 2014 | $584 | $18,540 | $3,820 | $14,720 |

| 2013 | -- | $18,540 | $3,820 | $14,720 |

Source: Public Records

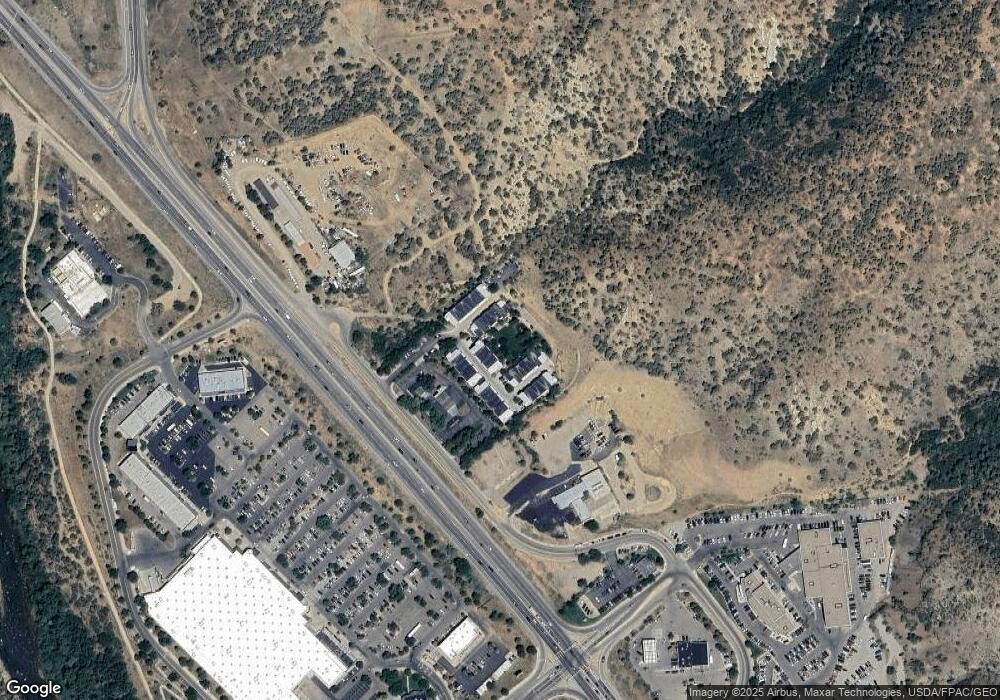

Map

Nearby Homes

- 1140 Carbon Jct Unit 42

- 1140 Carbon Jct Unit 24

- 1270 Escalante Dr

- 1295 Escalante Dr Unit 24

- 116 River Oaks Ct

- 26918 U S 160

- 555 Rivergate Ln Unit B1-119

- 555 Rivergate Ln Unit B1-227

- 10594 County Road 213

- 7149/7498 County Road 213

- 7149/7498 Cr 213

- 455 & 589 High Llama Ln

- TBD S Camino Del Rio

- TBD Airpark Dr

- 65 Airpark Dr

- 400 Ewing Mesa Dr

- 111 Cr 232

- 65 Design Center Rd

- 95 Design Center Rd

- 312 Davidson Creek Rd

- 1140 Carbon Jct Unit 49

- 1140 Carbon Jct Unit 48

- 1140 Carbon Jct Unit 47

- 1140 Carbon Jct Unit 46

- 1140 Carbon Jct Unit 45

- 1140 Carbon Jct Unit 44

- 1140 Carbon Jct Unit 43

- 1140 Carbon Jct Unit 41

- 1140 Carbon Jct Unit 40

- 1140 Carbon Jct Unit 39

- 1140 Carbon Jct Unit 38

- 1140 Carbon Jct Unit 37

- 1140 Carbon Jct Unit 36

- 1140 Carbon Jct Unit 35

- 1140 Carbon Jct Unit 34

- 1140 Carbon Jct Unit 32

- 1140 Carbon Jct Unit 31

- 1140 Carbon Jct Unit 30

- 1140 Carbon Jct Unit 29

- 1140 Carbon Jct Unit 28

Your Personal Tour Guide

Ask me questions while you tour the home.