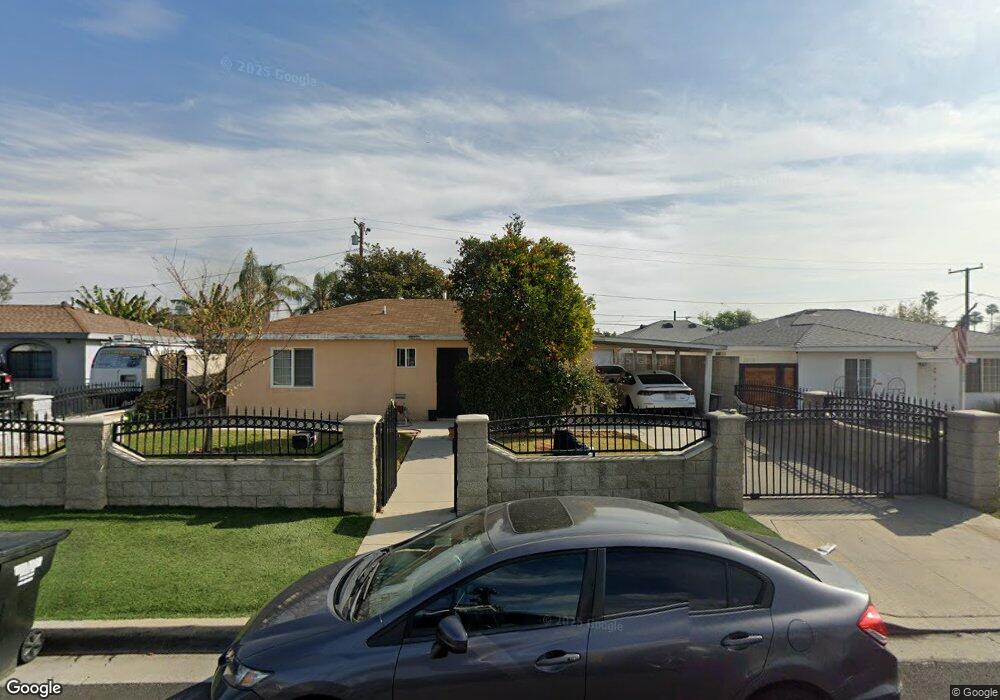

11402 Alclad Ave Whittier, CA 90605

South Whittier NeighborhoodEstimated Value: $638,000 - $713,000

3

Beds

1

Bath

840

Sq Ft

$813/Sq Ft

Est. Value

About This Home

This home is located at 11402 Alclad Ave, Whittier, CA 90605 and is currently estimated at $683,231, approximately $813 per square foot. 11402 Alclad Ave is a home located in Los Angeles County with nearby schools including California High School and St. Gregory The Great.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 6, 2015

Sold by

Jurado Esperanza

Bought by

Pryer Elvia J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Outstanding Balance

$92,179

Interest Rate

3.76%

Mortgage Type

New Conventional

Estimated Equity

$591,052

Purchase Details

Closed on

Aug 7, 2013

Sold by

Jurado Esperanza

Bought by

Pryer Elvia J and Thrope Meghan Deanne

Purchase Details

Closed on

Jul 1, 2008

Sold by

Jurado Esperanza

Bought by

Jurado Esperanza and Pryer Elvia J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Interest Rate

6.04%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 21, 1998

Sold by

Emc Mtg Corp

Bought by

Jurado Esperanza

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$107,120

Interest Rate

3.95%

Purchase Details

Closed on

Mar 12, 1998

Sold by

Barajas Raymundo

Bought by

Emc Mtg Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pryer Elvia J | -- | Chicago Title Company | |

| Pryer Elvia J | -- | Orange Coast Title Company O | |

| Jurado Esperanza | -- | Southland Title | |

| Jurado Esperanza | $134,000 | Lawyers Title | |

| Emc Mtg Corp | $113,742 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Pryer Elvia J | $120,000 | |

| Closed | Jurado Esperanza | $120,000 | |

| Closed | Jurado Esperanza | $107,120 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,144 | $409,996 | $288,135 | $121,861 |

| 2024 | $5,144 | $401,958 | $282,486 | $119,472 |

| 2023 | $4,985 | $394,078 | $276,948 | $117,130 |

| 2022 | $5,020 | $386,352 | $271,518 | $114,834 |

| 2021 | $4,919 | $378,778 | $266,195 | $112,583 |

| 2019 | $4,834 | $367,545 | $258,300 | $109,245 |

| 2018 | $4,650 | $360,339 | $253,236 | $107,103 |

| 2016 | $4,427 | $346,348 | $243,403 | $102,945 |

| 2015 | $4,088 | $321,293 | $229,495 | $91,798 |

| 2014 | $4,049 | $315,000 | $225,000 | $90,000 |

Source: Public Records

Map

Nearby Homes

- 11426 Newgate Ave

- 11329 Telechron Ave

- 11116 Leland Ave

- 13538 Lukay St

- 13481 Meyer Rd

- 13305 Meyer Rd Unit B

- 10849 Inez St

- 11531 Sunnybrook Ln

- 11118 Bunker Ln

- 11828 Louis Ave

- 13272 Beaty Ave

- 10745 Victoria Ave Unit 4

- 10745 Victoria Ave Unit 6

- 10745 Victoria Ave

- 13857 Leffingwell Rd

- 11518 Fidel Ave

- 11827 Loma Dr Unit 15

- 13513 Leffingwell Rd

- 11624 Starlight Ave

- 14034 Coteau Dr Unit 1103

- 11408 Alclad Ave

- 11330 Alclad Ave

- 11403 Newgate Ave

- 11414 Alclad Ave

- 11324 Alclad Ave

- 11409 Newgate Ave

- 11331 Newgate Ave Unit A

- 11331 Newgate Ave

- 11415 Newgate Ave

- 11403 Alclad Ave

- 11325 Newgate Ave

- 11409 Alclad Ave

- 11420 Alclad Ave

- 11318 Alclad Ave

- 11331 Alclad Ave

- 11419 Newgate Ave

- 11413 Alclad Ave

- 11325 Alclad Ave

- 11319 Newgate Ave

- 11419 Alclad Ave