115 Stornoway Dr E Unit 115 Columbus, OH 43213

Olde Orchard NeighborhoodEstimated Value: $147,000 - $170,000

2

Beds

2

Baths

1,320

Sq Ft

$118/Sq Ft

Est. Value

About This Home

This home is located at 115 Stornoway Dr E Unit 115, Columbus, OH 43213 and is currently estimated at $155,463, approximately $117 per square foot. 115 Stornoway Dr E Unit 115 is a home located in Franklin County with nearby schools including Olde Orchard Elementary School, Sherwood Middle School, and Walnut Ridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 20, 2011

Sold by

Shaw Christopher M and Shaw Alicia Nesline

Bought by

Hollanda Shaw Llc

Current Estimated Value

Purchase Details

Closed on

Jul 7, 2006

Sold by

Steele S and Schear Remington Trust

Bought by

Shaw Christopher M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$44,000

Interest Rate

6.73%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 23, 2006

Sold by

Hanley Kathleen A and Skeen Marian

Bought by

Steele S and The Schear Remington Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$44,000

Interest Rate

6.73%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 25, 1997

Sold by

Hanley Kathleen A Trustee

Bought by

Hanley Kathleen A and Skeen Marian

Purchase Details

Closed on

Jan 30, 1997

Sold by

Hunderliter Michael H

Bought by

Kathleen A Hanley Trustee

Purchase Details

Closed on

Nov 1, 1984

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hollanda Shaw Llc | $64,900 | Valmer | |

| Shaw Christopher M | $55,000 | Marketable | |

| Steele S | $30,500 | Avery Title | |

| Hanley Kathleen A | $44,000 | -- | |

| Kathleen A Hanley Trustee | $44,000 | -- | |

| -- | $47,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Shaw Christopher M | $44,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,137 | $46,630 | $9,980 | $36,650 |

| 2023 | $2,110 | $46,620 | $9,975 | $36,645 |

| 2022 | $1,168 | $21,980 | $3,640 | $18,340 |

| 2021 | $1,170 | $21,980 | $3,640 | $18,340 |

| 2020 | $1,172 | $21,980 | $3,640 | $18,340 |

| 2019 | $1,052 | $16,910 | $2,800 | $14,110 |

| 2018 | $1,095 | $16,910 | $2,800 | $14,110 |

| 2017 | $1,051 | $16,910 | $2,800 | $14,110 |

| 2016 | $1,251 | $18,420 | $2,770 | $15,650 |

| 2015 | $1,139 | $18,420 | $2,770 | $15,650 |

| 2014 | $1,142 | $18,420 | $2,770 | $15,650 |

| 2013 | $663 | $21,665 | $3,255 | $18,410 |

Source: Public Records

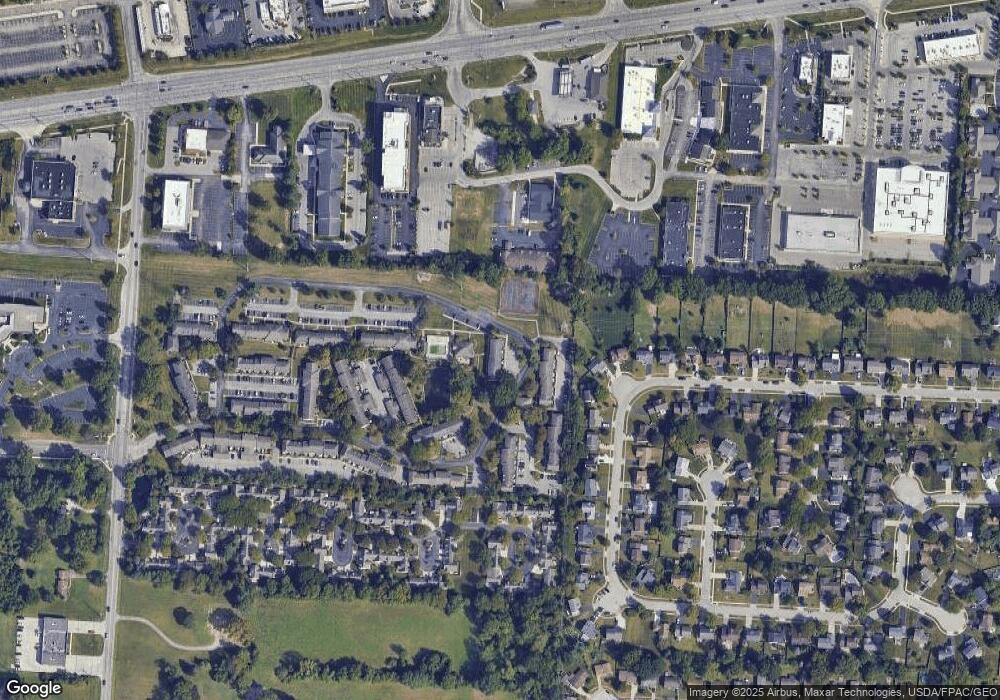

Map

Nearby Homes

- 117 Stornoway Dr E

- 6198 Stornoway Dr S Unit 6198

- 85 Stornoway Dr W Unit 85

- 142 Villamere Dr Unit 6

- 6560 Schenk Ave

- 6424 Plankton Dr

- 6392 Claypool Ct

- 541 Woodingham Place Unit 2-C

- 5850 Forestview Dr

- 6056 Naughten Pond Dr

- 6052 Naughten Pond Dr

- 6040 Naughten Pond Dr

- 6279 Braiden Ct Unit 10B

- 6033 McNaughten Grove Ln

- 6162 Stockton Trail Way

- 651 Cranfield Place

- 310 Trailblazer Ln

- 5613 Chowning Way Unit 6B

- 5719 Notre Dame Place Unit 11

- 5671 Bastille Place

- 113 Stornoway Dr E Unit 113

- 111 Stornoway Dr E

- 119 Stornoway Dr E

- 119 Stornoway Dr W Unit 119

- 121 Stornoway Dr E

- 116 Stornoway Dr E

- 120 Stornoway Dr E

- 132 Stornoway Dr E Unit B

- 132 Stornoway Dr E Unit 132A

- 132 Stornoway Dr E

- 132 Stornoway Dr S Unit A/B

- 132 Stornoway Dr E Unit A

- 124 Stornoway Dr E

- 126 Stornoway Dr E

- 134 Stornoway Dr E Unit B

- 134 Stornoway Dr E Unit 134A

- 134 Stornoway Dr E Unit A

- 128 Stornoway Dr E Unit 2

- 6230 Stornoway Dr S Unit 6230

- 6228 Stornoway Dr S Unit 6228