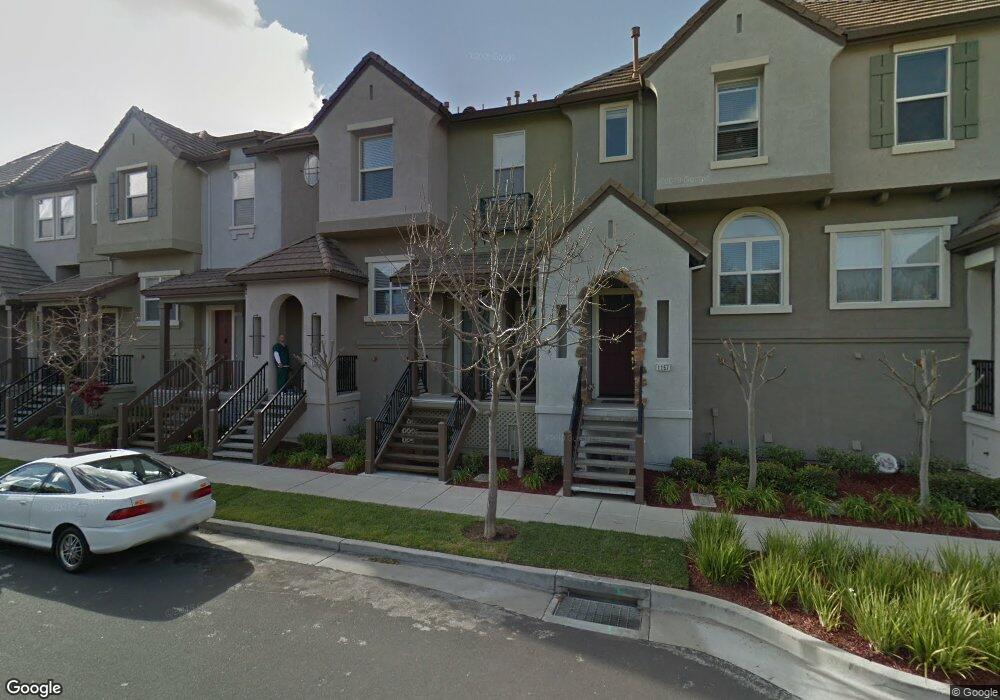

1155 Yates Way Unit U5913 San Mateo, CA 94403

Hillsdale NeighborhoodEstimated Value: $1,158,000 - $1,562,000

3

Beds

3

Baths

1,312

Sq Ft

$962/Sq Ft

Est. Value

About This Home

This home is located at 1155 Yates Way Unit U5913, San Mateo, CA 94403 and is currently estimated at $1,262,673, approximately $962 per square foot. 1155 Yates Way Unit U5913 is a home located in San Mateo County with nearby schools including George Hall Elementary School, Abbott Middle School, and Hillsdale High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 19, 2008

Sold by

Buenaventura Gil

Bought by

Buenaventura Gil and Buenaventura Jane C

Current Estimated Value

Purchase Details

Closed on

Apr 9, 2004

Sold by

Munjal Deepak

Bought by

Buenaventura Gil

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$430,500

Outstanding Balance

$201,315

Interest Rate

5.57%

Mortgage Type

Stand Alone First

Estimated Equity

$1,061,358

Purchase Details

Closed on

Sep 9, 2003

Sold by

Buenaventura Jane C

Bought by

Buenaventura Gil

Purchase Details

Closed on

Mar 7, 2002

Sold by

Pang Elton and Huang Sophie Fei Sung

Bought by

Munjal Deepak and Munjal Ena

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Buenaventura Gil | -- | None Available | |

| Buenaventura Gil | $615,000 | Chicago Title Co | |

| Buenaventura Gil | -- | Chicago Title Co | |

| Munjal Deepak | $525,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Buenaventura Gil | $430,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,410 | $874,381 | $262,309 | $612,072 |

| 2023 | $11,410 | $840,429 | $252,124 | $588,305 |

| 2022 | $10,762 | $823,951 | $247,181 | $576,770 |

| 2021 | $10,535 | $807,796 | $242,335 | $565,461 |

| 2020 | $10,079 | $799,514 | $239,851 | $559,663 |

| 2019 | $9,700 | $783,839 | $235,149 | $548,690 |

| 2018 | $9,174 | $768,471 | $230,539 | $537,932 |

| 2017 | $8,925 | $753,404 | $226,019 | $527,385 |

| 2016 | $8,586 | $738,633 | $221,588 | $517,045 |

| 2015 | $8,637 | $727,539 | $218,260 | $509,279 |

| 2014 | $8,500 | $713,288 | $213,985 | $499,303 |

Source: Public Records

Map

Nearby Homes

- 2876 Saratoga Dr

- 2736 Foster St

- 133 Waters Park Cir

- 2835 Alvarado Ave

- 475 Landeros Dr

- 406 E 28th Ave

- 2868 Baze Rd

- 1573 Marina Ct Unit A

- 367 Derby Ave

- 1640 Marina Ct Unit F

- 413 Franklin Pkwy

- 3015 Los Prados St Unit 114

- 3001 Los Prados St Unit 104

- 3513 Casanova Dr

- 1928 Vista Cay

- 740 Promontory Point Ln Unit 3109

- 3045 Los Prados St Unit 218

- 706 Celestial Ln

- 1542 Vista Del Sol

- 739 Aries Ln

- 1145 Yates Way Unit U5908

- 1137 Yates Way

- 1151 Yates Way Unit U5911

- 1149 Yates Way

- 1147 Yates Way Unit U5909

- 1143 Yates Way Unit U5907

- 1135 Yates Way Unit U5903

- 1157 Yates Way

- 1141 Yates Way Unit U5906

- 1139 Yates Way Unit U5905

- 1133 Yates Way

- 1131 Yates Way Unit U5901

- 1159 Yates Way Unit U5915

- 1153 Yates Way Unit U5912

- 1140 Wayne Way

- 1136 Wayne Way

- 1144 Wayne Way

- 1132 Wayne Way

- 1148 Wayne Way

- 1128 Wayne Way