11561 Lower Azusa Rd Unit D El Monte, CA 91732

Norwood Cherrylee NeighborhoodEstimated Value: $590,000 - $611,468

3

Beds

3

Baths

1,219

Sq Ft

$494/Sq Ft

Est. Value

About This Home

This home is located at 11561 Lower Azusa Rd Unit D, El Monte, CA 91732 and is currently estimated at $602,617, approximately $494 per square foot. 11561 Lower Azusa Rd Unit D is a home located in Los Angeles County with nearby schools including Rio Hondo School, Arroyo High School, and Shield of Faith Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 21, 2003

Sold by

Ayala Oralia S

Bought by

Ayala Martha J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$162,400

Outstanding Balance

$74,588

Interest Rate

5.98%

Mortgage Type

Stand Alone First

Estimated Equity

$528,029

Purchase Details

Closed on

Feb 14, 1998

Sold by

Huizar Sandra

Bought by

Ayala Albert S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,160

Interest Rate

7.07%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ayala Martha J | $203,000 | -- | |

| Ayala Martha J | $203,000 | Diversified Title & Escrow S | |

| Ayala Albert S | $108,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ayala Martha J | $162,400 | |

| Closed | Ayala Martha J | $162,400 | |

| Previous Owner | Ayala Albert S | $110,160 | |

| Closed | Ayala Martha J | $30,450 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,111 | $288,606 | $160,654 | $127,952 |

| 2024 | $4,111 | $282,948 | $157,504 | $125,444 |

| 2023 | $4,029 | $277,401 | $154,416 | $122,985 |

| 2022 | $3,881 | $271,963 | $151,389 | $120,574 |

| 2021 | $3,928 | $266,631 | $148,421 | $118,210 |

| 2019 | $4,005 | $258,724 | $144,020 | $114,704 |

| 2018 | $3,932 | $253,652 | $141,197 | $112,455 |

| 2016 | $3,770 | $243,804 | $135,715 | $108,089 |

| 2015 | $3,727 | $240,143 | $133,677 | $106,466 |

| 2014 | $3,585 | $235,440 | $131,059 | $104,381 |

Source: Public Records

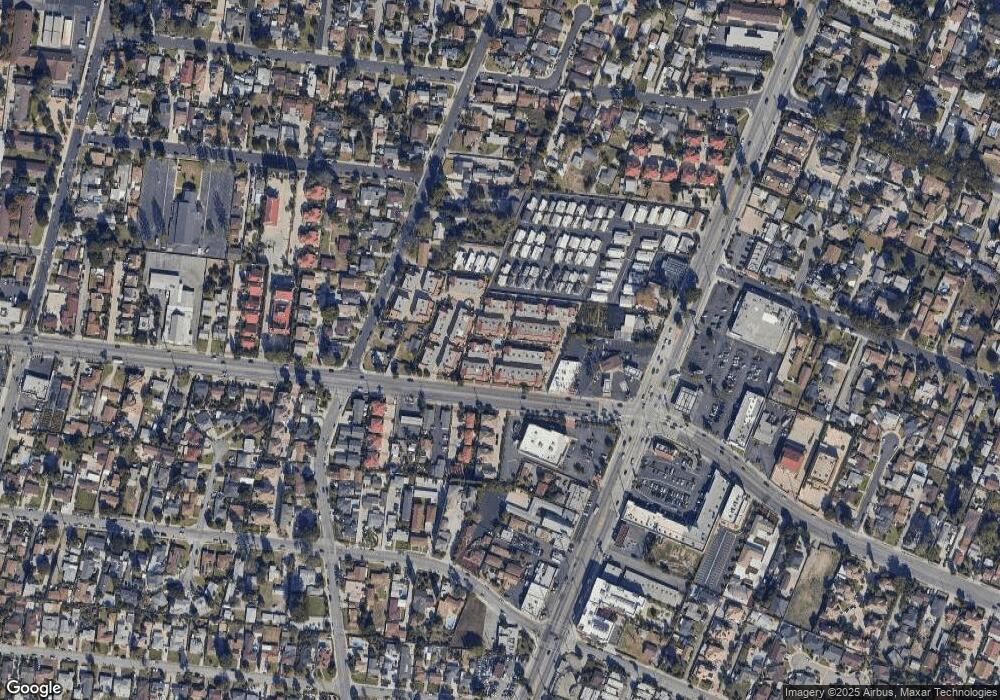

Map

Nearby Homes

- 11530 Hallwood Dr

- 4849 Peck Rd Unit 36

- 4849 Peck Rd Unit 67

- 4849 Peck Rd Unit 48

- 11654 Roseglen St

- 11639 Hallwood Dr

- 11328 Elmcrest St

- 4501 Peck Rd Unit 43

- 11215 Mulhall St

- 5320 Peck Rd Unit 49

- 11946 Fairview St

- 11396 Mcgirk Ave

- 5343 Peck Rd Unit D

- 11211 Mcgirk Ave

- 5082 La Madera Ave

- 11414 Lambert Ave

- 4346 Cypress Ave

- 11452 Lambert Ave

- 4454 Cogswell Rd

- 12132 Roseglen St

- 11531 Lower Azusa Rd

- 11565 Lower Azusa Rd Unit D

- 11565 Lower Azusa Rd Unit C

- 11565 Lower Azusa Rd Unit B

- 11565 Lower Azusa Rd Unit A

- 11539 Lower Azusa Rd Unit A

- 11553 Lower Azusa Rd Unit G

- 11553 Lower Azusa Rd Unit F

- 11553 Lower Azusa Rd Unit E

- 11553 Lower Azusa Rd Unit D

- 11553 Lower Azusa Rd Unit C

- 11553 Lower Azusa Rd Unit B

- 11553 Lower Azusa Rd Unit A

- 11535 Lower Azusa Rd Unit C

- 11535 Lower Azusa Rd Unit B

- 11535 Lower Azusa Rd Unit A

- 11547 Lower Azusa Rd Unit G

- 11547 Lower Azusa Rd Unit F

- 11547 Lower Azusa Rd Unit E

- 11547 Lower Azusa Rd Unit D